USD. JPY, EUR flows: JPY soft after election, USD firm

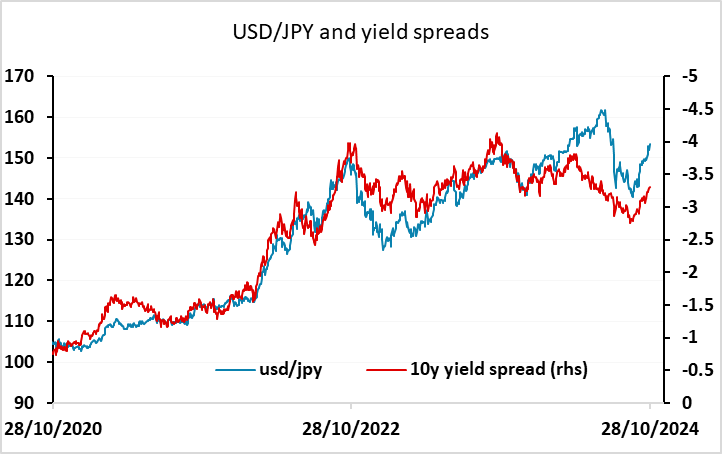

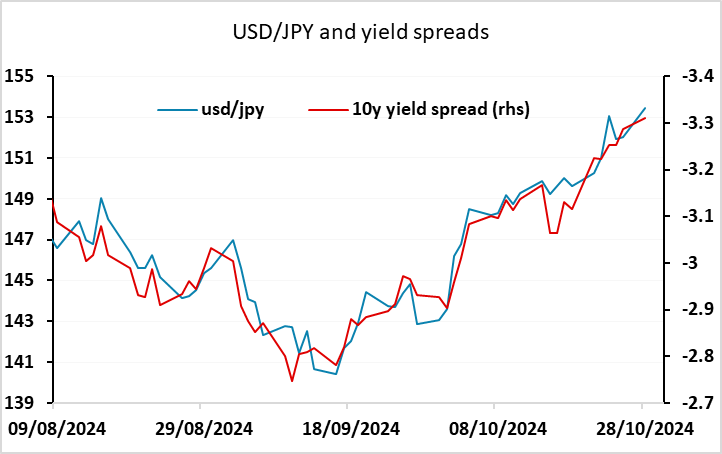

USD/JPY continues to gain as ruling coalition loses majority at weekend election, while USD continues to benefit from rising yields.

JPY weakness is the main news overnight, with the JPY undermined by the Japanese election at the weekend which left the ruling coalition short of a parliamentary majority. This is seen as being likely to restrict the BoJ’s willingness to raise rates, and undermined JPY sentiment. We are less sure that this is true – after all, there has been considerable instability in Japanese politics in recent years, but the BoJ has nevertheless raised rates under Ueda and the BoJ does have independence. Even so, from a sentiment perspective the development is JPY negative, but this view could be vulnerable to the BoJ statement at the Thursday meeting.

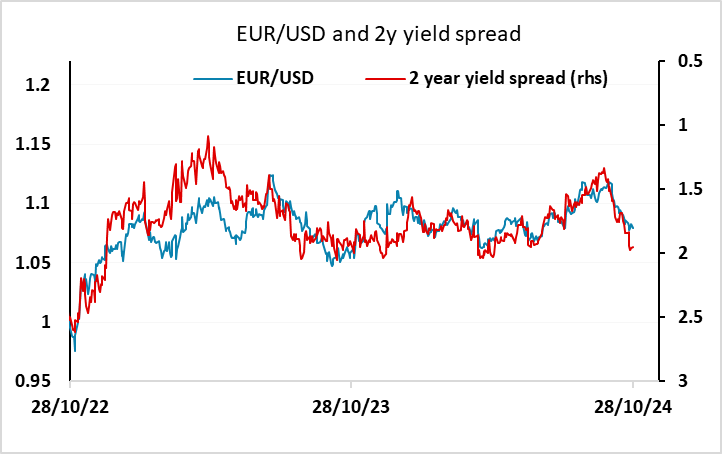

As well as Japanese politics, there has been a further increase in US yields over the weekend, with 2 year yields up to their highest since early August and 10 year yields at their highest since late July. This has helped the USD across the board, even though European yields and Japanese yields have also risen. The driver for higher yields looks to be the increasing expectation of a Trump victory and fiscal policies that will restrict the Fed’s ability to ease policy. However, this story could be vulnerable to the employment report on Friday.

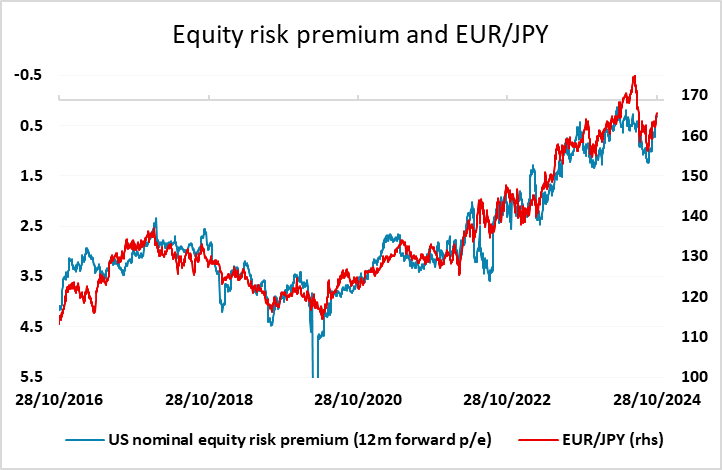

USD/JPY has overshot the rise in the yield spread from the perspective of the longer term correlation, but remains broadly in line with the correlation we have seen in the last few months. EUR/USD does however look vulnerable with the widening of the 2 year spread, although EUR/JPY remains well supported by the resilience of the equity market in spite of rising US yields and the implied decline in equity risk premia.