FX Daily Strategy: Europe, September 17th

Focus remains on FOMC

USD remains under pressure as market moves towards pricing a 50bp cut

Retail sales unlikely to change the direction of travel

USD/CAD unlikely to react much to Canadian CPI

Focus remains on FOMC

USD remains under pressure as market moves towards pricing a 50bp cut

Retail sales unlikely to change the direction of travel

USD/CAD unlikely to react much to Canadian CPI

The focus is very much on the central bank meetings this week, particularly the FOMC on Wednesday. As it stands, the market is pricing a 50bp rate cut as a 65% chance against 35% for a 25bp cut. A week ago a 50bp cut was priced as less than a 20% chance. The shift all seems to be based on the press reports last week which indicated that the decision was a close call after the market had reduced the chances of a 50bp cut to less than 20% after the stronger than expected CPI data.

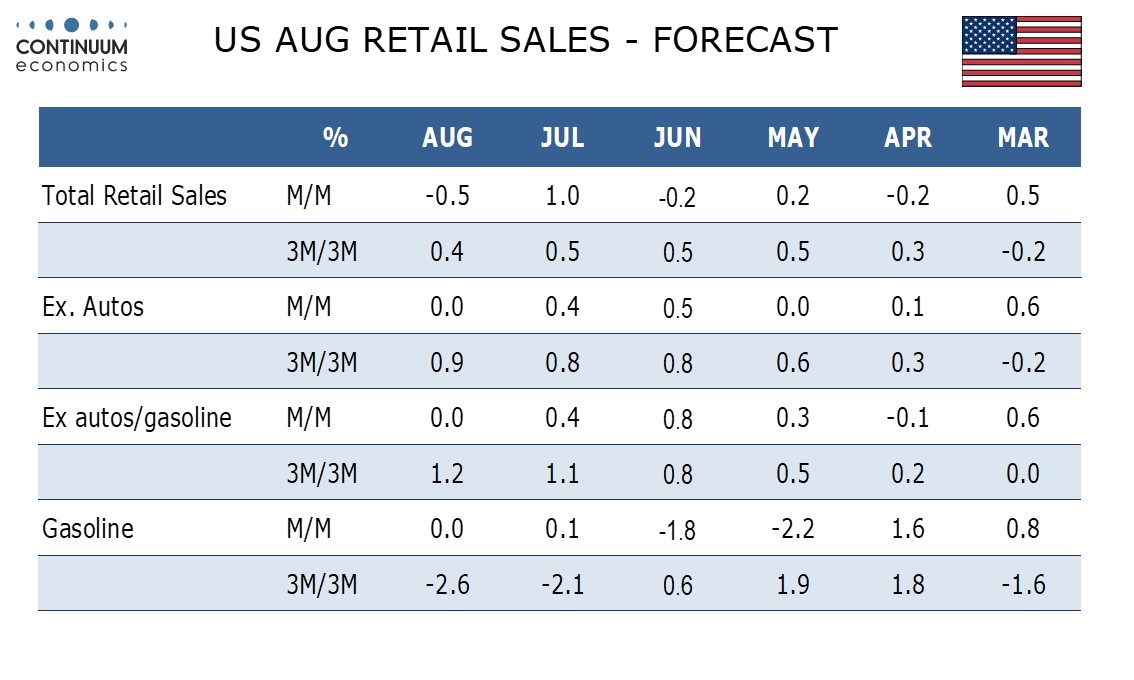

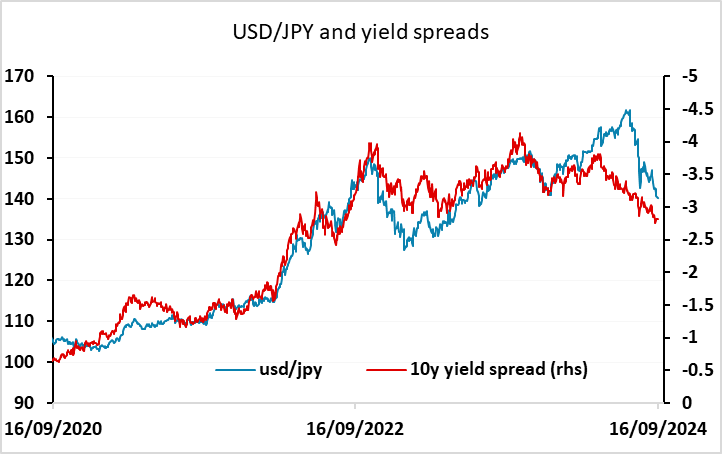

This being the case, we doubt that the market expectation will shift much on the back of the US August retail sales data released on Tuesday. While this is the main data of the day, it is unlikely to give any strong insight into whether the US economy is slowing significantly. Even though we are looking for weaker numbers than the consensus at -0.5% headline and flat core, this would still maintain the steady quarterly pace of growth of around 0.5% headline, 0.8% core seen in the last two months. But our expectation of a softer than consensus number should nevertheless sustain the USD negative tone seen in the last week. Monday saw the USD fall mostly against the riskier currencies but there is still potential for USD losses across the board, and if we see yields continuing to decline without any notable positive impact on equities, this should normally benefit the JPY on the crosses as well.

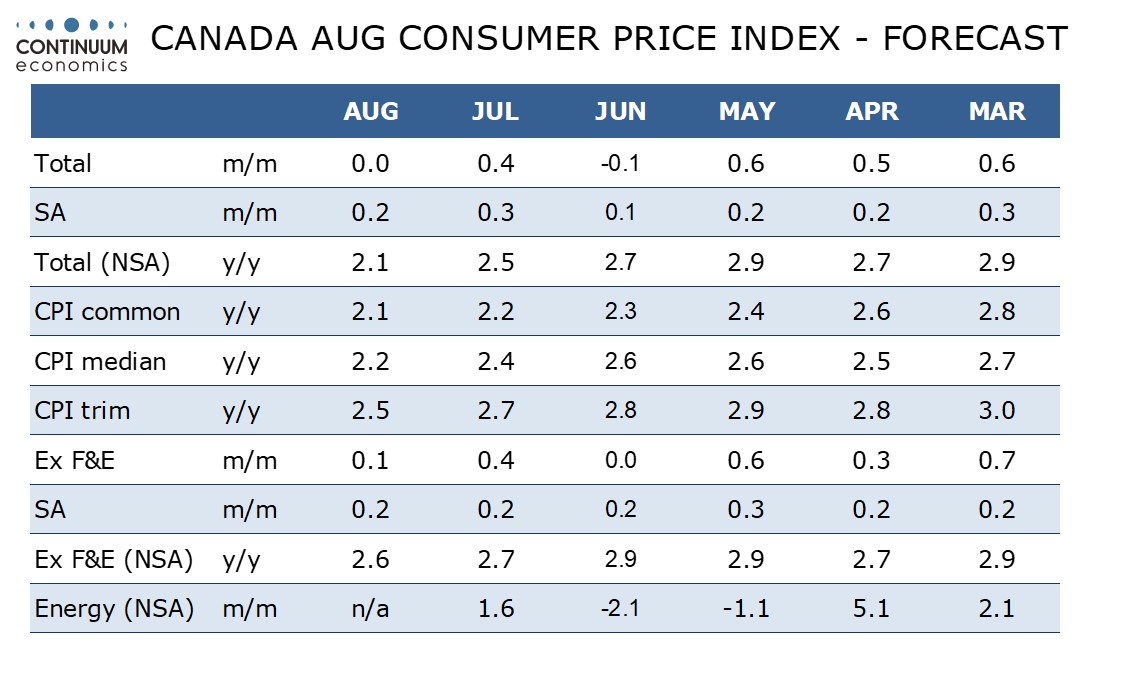

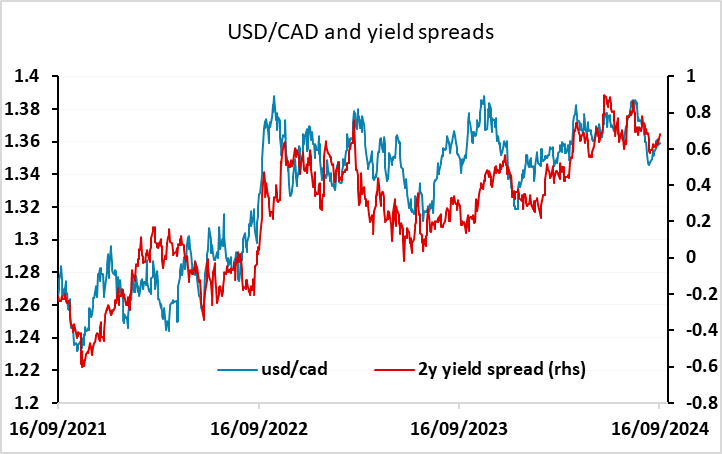

There is also August Canadian data due. We expect this to slip to 2.1% yr/yr from 2.5% as year ago strength drops out, reaching its lowest level since February 2021. While progress on the Bank of Canada’s core rates will be a little less sharp, we expect the rates to continue moving lower. However, our forecasts are in line with consensus, so we wouldn’t expect much CAD reaction. USD/CAD has been moving fairly closely with front end yield spreads in recent weeks, so if anything we see a slight bias to the downside due to potential extension of the recent declines in US yields.

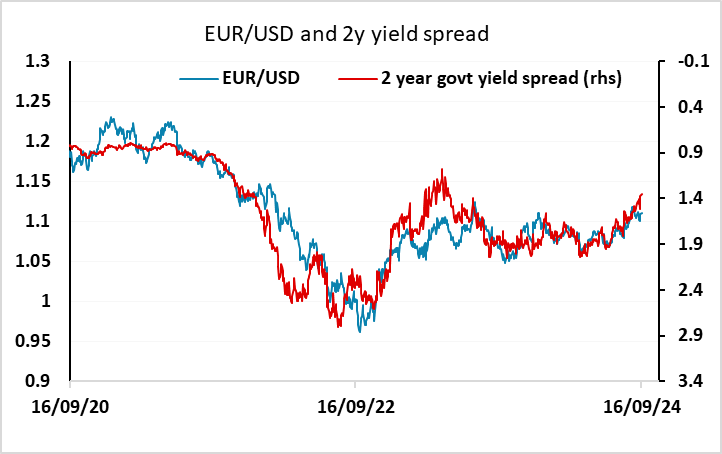

In Europe there isn’t a great deal on the calendar, with the German ZEW survey unlikely to trigger too much reaction. This in any case tends not to be much of a leading indicator and often reflects moves in equity markets rather than economic developments. But we would note that there may be more concern about a slowing economy at the ECB than was obvious after the decision last week, as the forecasts they updated showed significant downgrades in domestic demand growth. While yield spreads suggests there may be some more short term upside scope for EUR/USD, there may be more downside risk to European yields than is currently priced in, and the EUR may therefore be vulnerable if we see a move to 1.12 or above, especially if the Fed only delivers a 25bp cut.