FX Daily Strategy: Asia, January 23rd

GBP softer after public sector borrowing numbers

CAD could be at risk if market starts to take tariff threat seriously

AUD continues to represent long term value

EUR and JPY both look too weak despite challenges

Norges Bank may try to sound dovish but is likely to leave rates unchanged

Still scope for NOK recovery

Risk appetite to remain strong as long as US jobless claims remain subdued

Market on watch for BoJ leaks. JPY has modest upside scope on the expected 25bp hike

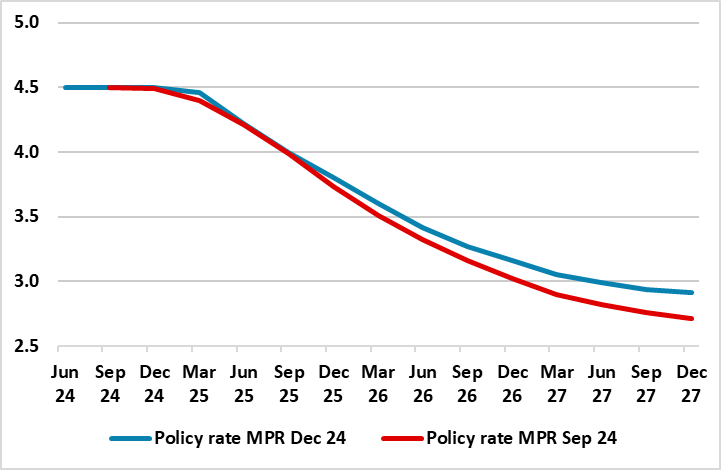

Existing Policy Outlook to be Kept Intact?

Existing Policy Outlook to be Kept Intact?

Source: Norges Bank December Monetary Policy Report

Thursday looks like another relatively quiet day, but there is the Norges Bank meeting in the European morning. Norges Bank is expected to keep rates on hold, having flagged a move as being more likely at the meeting due in March. Weaker price pressures (especially excluding what are pro-cyclical rises in rents) and the recent repricing of policy ahead and inter-related rise in bond yields may nevertheless convince them that they need to send a more dovish signal. The Board may therefore be more vocal about the scale and timing of easing ahead being largely unchanged from the projections made last month, albeit having to resort to rhetoric as new forecasts will not be published until March.

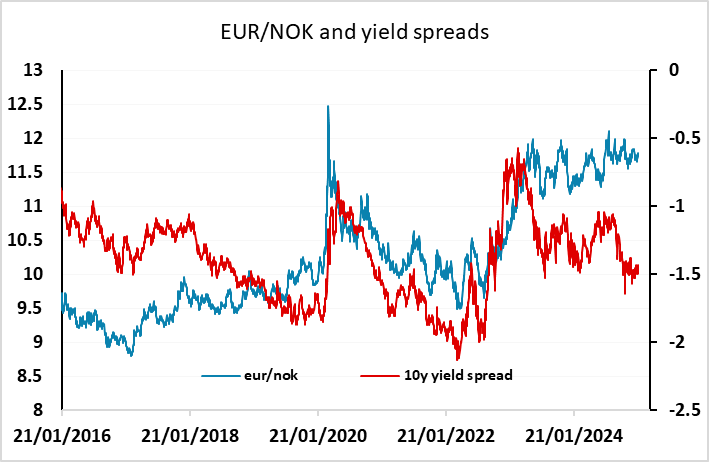

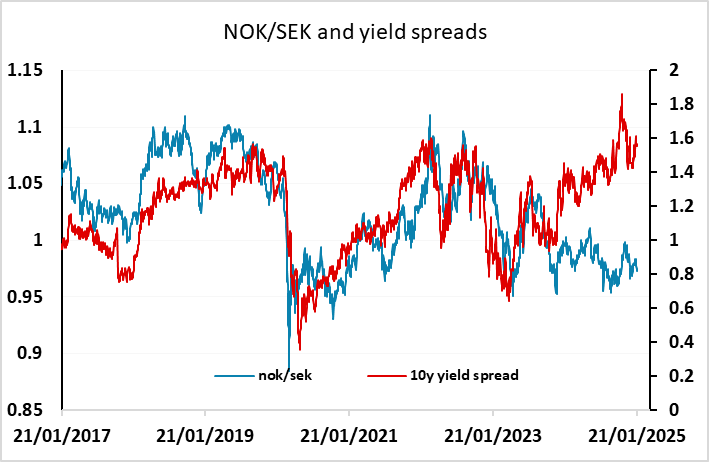

The possibility of some more dovish rhetoric isn’t particularly positive for the NOK, which continues to dramatically underperform yield spreads both against the EUR and the SEK. But EUR/NOK remains only a couple of % away from the August high which was also the all time high, pandemic excluded. In a generally risk positive environment, the NOK ought to have potential to recover from here, with both EUR/NOK and NOK/SEK looking attractive for NOK bulls.

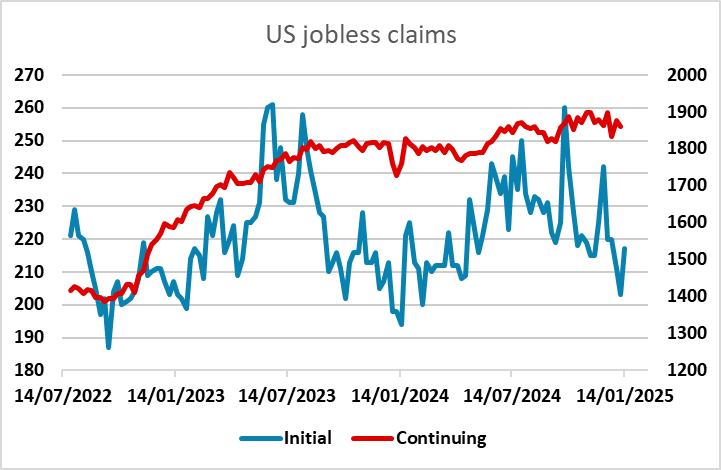

Otherwise, the US jobless claims numbers are probably the main focus datawise, with Canadian retail sales unlikely to be market moving. There is still no evidence of any rising trend in initial claims, although continuing claims have risen in the last couple of years and are holding at higher levels. Until we see some evidence of a trend increase in initial claims, the market is likely to remain comfortable that the US labour market is in a healthy state, and consequently sustain the positive risk tone that supports the current high equity market valuations. From an FX perspective, the riskier currencies should continue to do well as long as the US labor market remains healthy.

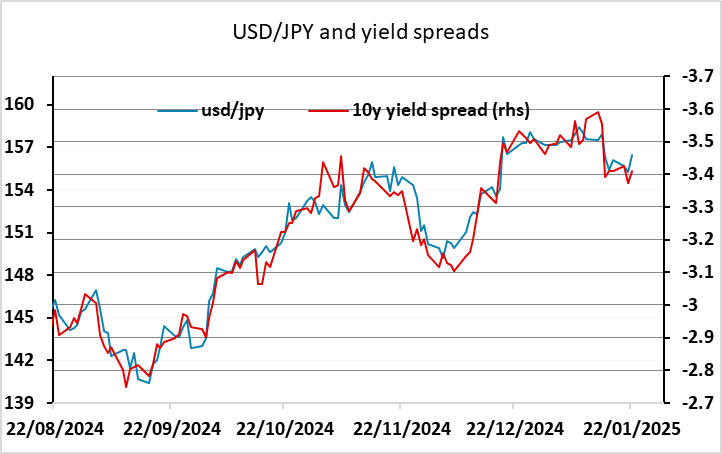

Late on Thursday there is Japanese national CPI data, but this has been well trailed by the Tokyo CPI data already released, and is unlikely to have any influence of the BoJ interest rate decision on Friday. But the market will be on watch for any late leaks from the BoJ ahead of Friday’s rate decision. The JPY has underperformed this week as riskier currencies have rallied, but USD/JPY now looks a little too low given current yield spreads, and there should be scope for the JPY to rise if the BoJ delivers a 25bp rate hike. This is now 88% priced in, so the JPY could be expected to decline on anything less than a 25bp rate hike.