FX Daily Strategy: Europe, November 13th

US CPI the focus but limited scope for reaction

USD still gripped by post-election bullishness

EUR/USD still has downside risks

USD/JPY upside more constrained

JPY weakness supported by low equity risk premia, but can they last?

US CPI the focus but limited scope for reaction

USD still gripped by post-election bullishness

EUR/USD still has downside risks

USD/JPY upside more constrained

JPY weakness supported by low equity risk premia, but can they last?

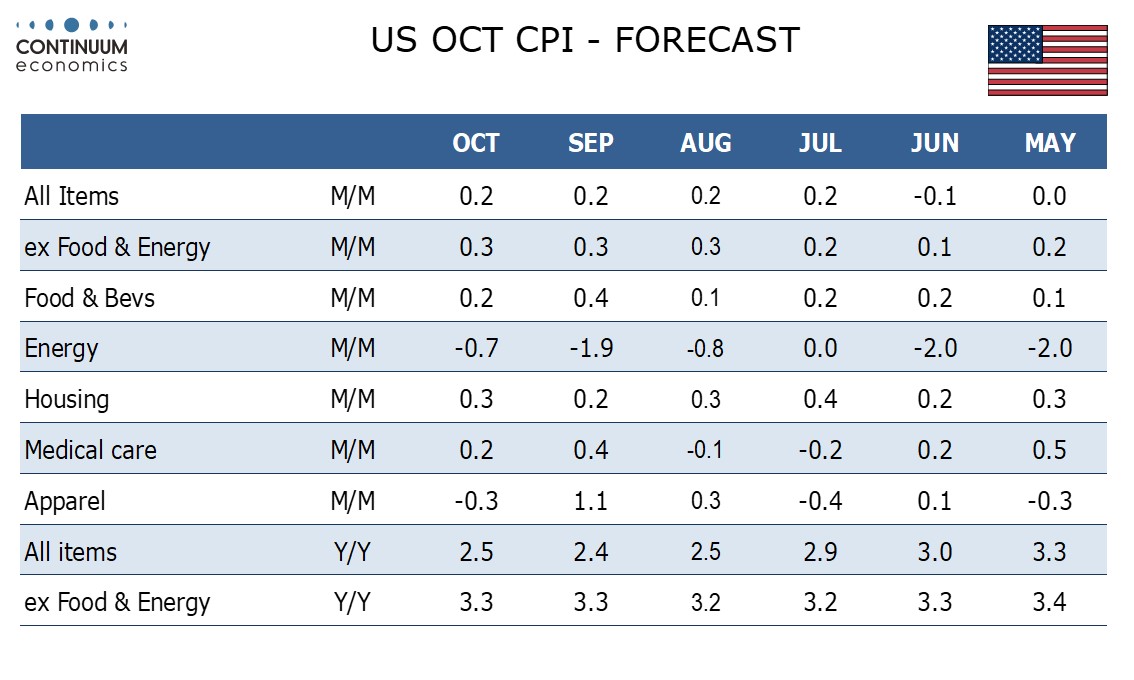

US CPI is the main data for Wednesday. The markets are currently tending to focus on what the Trump administration is going to do more than the current economic conditions, so the reaction to the CPI data may be relatively muted. In any case, our forecasts are in line with market consensus. We expect October’s CPI to increase by 0.3% overall for a fourth straight month with a third straight 0.3% increase ex food and energy. Before rounding we expect a 0.20% rise overall, slightly stronger than the three preceding outcomes, with a 0.28% rise ex food and energy. The latter will be softer than September’s 0.31% but matching August’s 0.28%.

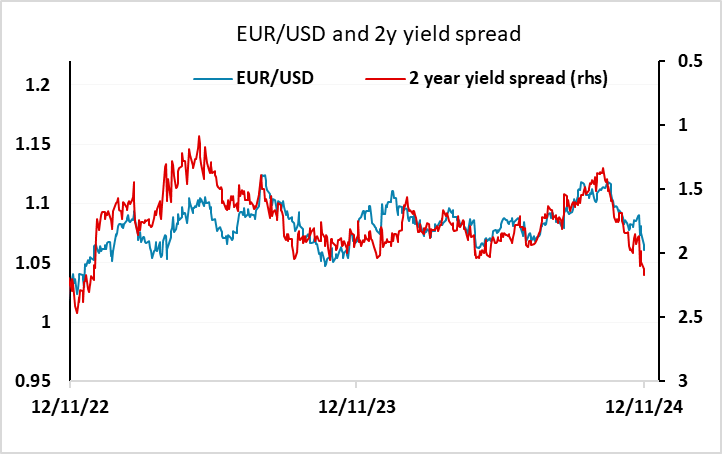

The USD’s underlying tone remains very positive, as the market continues to reduce expectations of Fed easing, pushing up US yields. While yields elsewhere are also rising in sympathy, yield spreads are moving steadily in the USD’s favour. EUR/USD still looks vulnerable, despite the April low of 1.0601 providing some initial support. Yield spreads already suggest scope to 1.05, and we would expect some stop loss selling on a break below 1.06. It is still possible for the market to price out the expectation of a December Fed rate cut, which is currently priced as an 85% chance, so as long as the US data remains firm we wouldn’t oppose USD strength. After the Trump victory in 2016, USD strength persisted until late December on the back of rising yields.

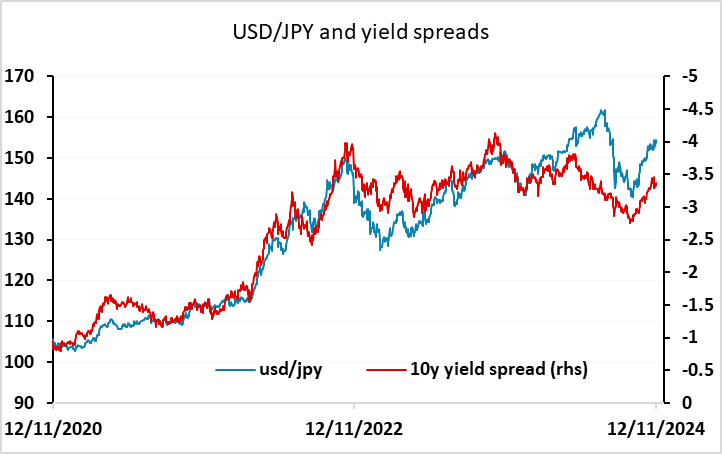

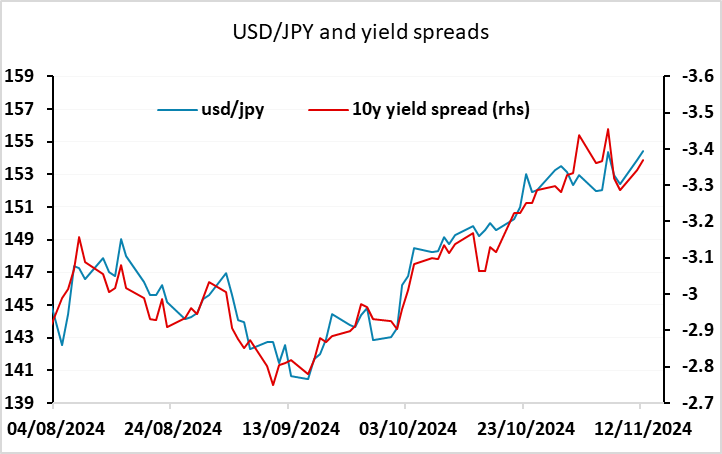

The support at 1.06 in EUR/USD may have encouraged speculators to switch to USD/JPY on Tuesday, which broke up to its highest since late July. There is a retracement target at 156.60/70, and this may be achievable, but USD/JPY bulls have to be cautious about potential action from the Japanese authorities to halt JPY weakness. Typically, however, Japanese authorities are wary of acting against a market that is being solidly driven by widening yield spreads, so we wouldn’t expect any immediate intervention. Even though USD/JPY still looks high relative to the yield spread correlation in the last few years, it is broadly matching the move in yield spreads in the last few months.

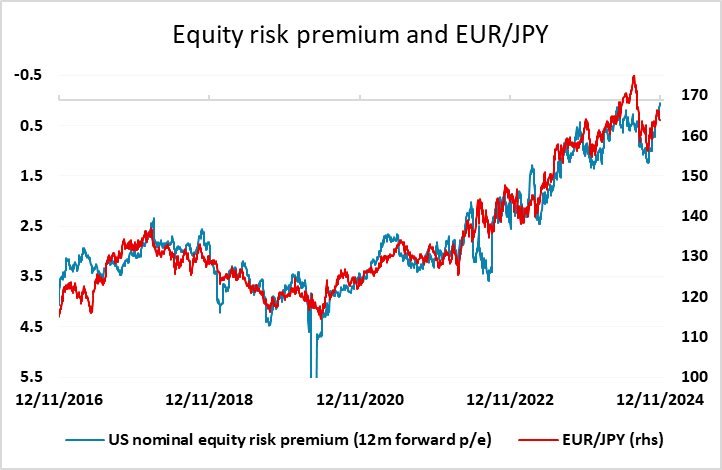

Also, the rise in US yields has mean a further decline in equity risk premia to a new low for this cycle (in nominal terms). This is generally negative for the JPY, and EUR/JPY in particular has tracked this closely in recent years. But it must be asked whether such a low risk premium is sustainable. In The end, the US economy may be solid, but at full employment earnings are unlikely to grow particularly fast, and the low level of risk premium implies very rapid earnings growth. While the equity markets have risen on the back of tax cut expectations since the election, there are also likely to be tariff increases which are going to be contractionary. We would therefore be wary of JPY weakness in the longer run.