FX Daily Strategy: Asia, February 5th

Trade Balance May Support the Aussie

ECB steady policy in H1 2026

Clues From February 5 for BoE

The December Australian trade balance will be released on Wednesday. Following a contraction in export in November, we are expecting a rebound and stronger growth in import. Domestic deamand has been solid for Australia and the RBA believe it will gain further momentum. It will be critical to see strong import numbers for RBA's forecast to come true. Still, the Aussie will remain supported bby the hawkish take from the RBA.

On the chart, the pair bounces from the above the .6900 support to regain the .7000 level has seen gains to resistance at the .7050 congestion. Would take break here to expose the .7094 high to retest but mixed daily studies suggest this likely to cap for now and extend consolidation below this. Break, if seen, will resume the April gains and see room for extension to strong resistance at .7158/.7210, 2023 year high and 61.8% Fibonacci level. Meanwhile, support starts at .6942 and extend to the .6900 congestion, expected to underpin.

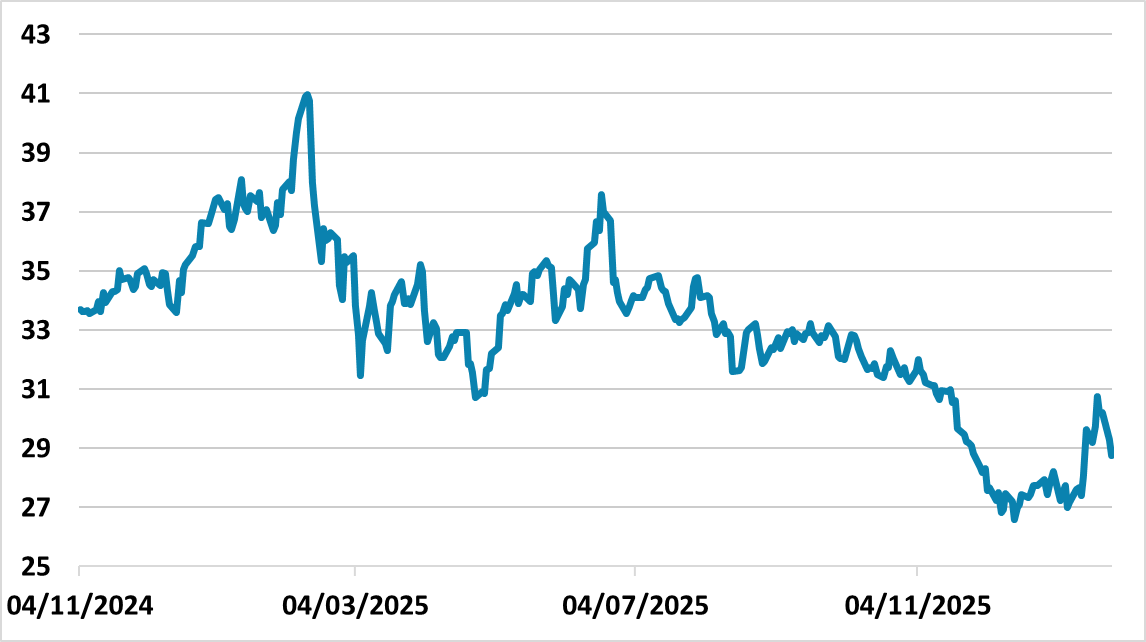

Figure: December 2026 TTF Gas Prices (EURs)

Most on the ECB council appear to be comfortable with steady policy in H1 2026, after a cumulative 200bps of cuts. This will likely be the overall message from the February 5 ECB meeting. This will paper over differences for 2027 among ECB council members. However, we agree with the doves concerns. We remain of the view that financial conditions and lending rates are worse than the current ECB depo rate level suggest and means that 2026 EZ growth does not really pick-up. Combined with a mild undershoot in inflation, this can build the case for the ECB to deliver two 25bps cuts in June and September 2026.

While an unchanged policy rate is expected on February 5 from the ECB, the communications will be watched closely for forward guidance. Key points to make are.

· ECB Steady, but Council Splits. Similar communications to the December meeting will likely be evident, with the ECB consensus towards keeping rates unchanged in the coming meetings after 200bps of easing. However, the December ECB minutes show a clear division between doves and hawks. The doves are concerned about the economic recovery, but also that slowing wage inflation could mean an undershoot of inflation. This could mean further rate cuts are needed. The hawks take a more upbeat view of the GDP trajectory, but are also concerned that recent wage compensation data means that inflation could now be slow to fall. For the hawks this could mean that tightening is required into 2027. ECB president Lagarde will likely diplomatically want to avoid showing these differences and will likely try to navigate the Q/A, without providing much clarity.

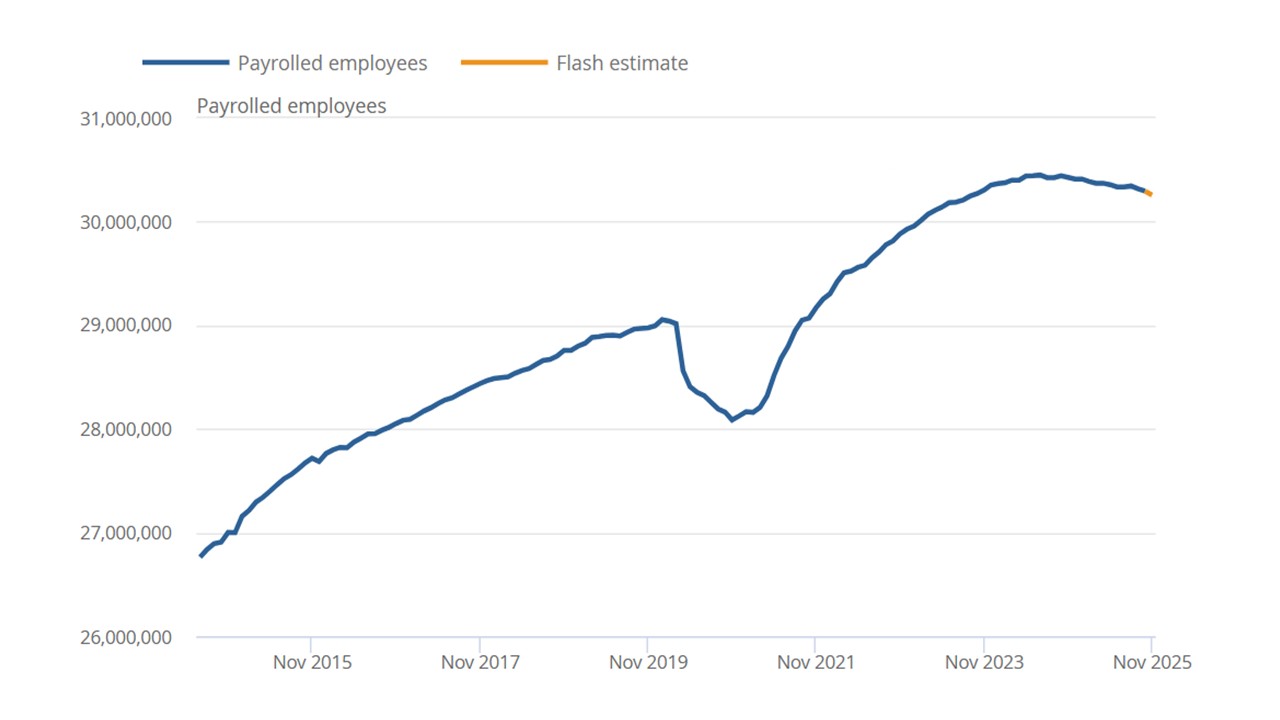

Figure: Payrolled employees (SA)

The February 5 MPC meeting is widely expected to see unchanged rates, but will add to guidance on future rate prospects. Statements since the December MPC meeting suggest no major change of view and the key guidance will remain that some potential exists for lower policy rates but at a slower pace than 2025. The CPI forecasts will be watched closely, but we do not see radical change. Some have noted the jump in UK and global gas prices, but this is mainly spot and end 2026 and 2027 are less impacted. We see the four hawks eventually softening their view and the five cutters becoming more worried, which will combine to deliver three 25bps cut from the BOE this year. The April 30 meeting is key as the monetary policy report is also delivered and we favor a move by then – March would require a run of weak real sector data and lower CPI. The April 30 meeting will also be close to the drop in headline CPI in April as base effects drop out. Timing does depend on when the hawks become more forward looking and change view, which could be gradual or abrupt. However, we are confident that this will happen and deliver three 25bps cuts in 2026.