FX Daily Strategy: Asia, Oct 1

US government shutdown could be USD negative

JPY has most scope to benefit

EUR unlikely to move on CPI data

GBP vulnerable

US government shutdown looks set to start on October 1

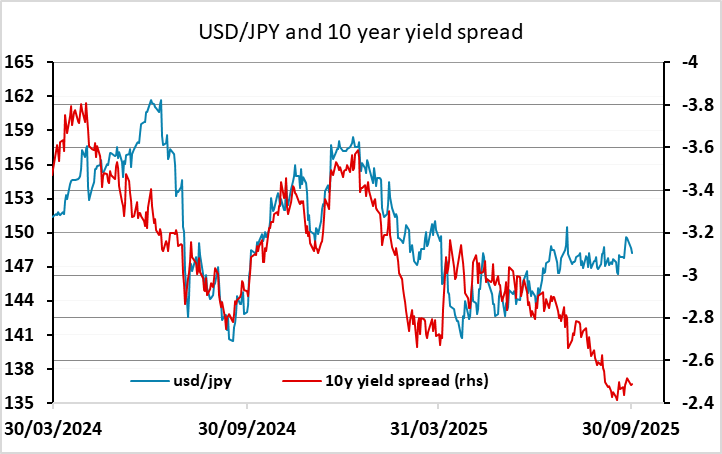

Typically, shutdown is seen as negative for USD/JPY

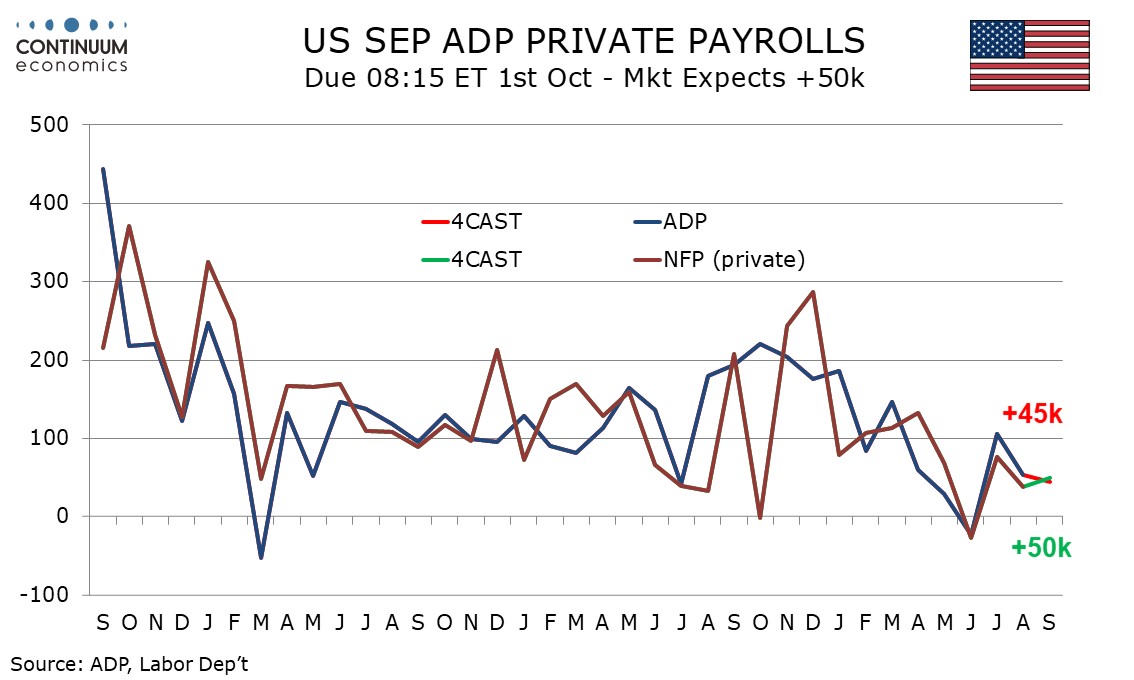

ADP data to take on higher profile if official employment data not being released due to shutdown

EUR/JPY also looks vulnerable if risk sentiment weakens

At the time of writing, it looked increasingly likely that the US government will shutdown on Wednesday. The Republican-controlled Senate is expected to vote on a temporary spending bill that has failed once already, with no sign that a second vote will bring success. Once a shutdown starts, the standoff could last for a few weeks, but probably not as far as the next FOMC meeting on October 29, though that cannot be ruled out. As long as the government remains shut, the Fed and financial markets will have to deal with the absence of key economic data. The last government shutdown was during Trump's first term, spanning 34 days from December 22 2018 to January 25 2019. The equity market did decline ahead of the shutdown, but recovered in January while the government was shut, and USD/JPY fell sharply at the end of 2018 in sympathy before recovering. We have seen some modest JPY strength in the last couple of days in anticipation of the shutdown, but we would expect to see some more USD/JPY and equity market weakness if the shutdown goes ahead.

If there is a shutdown, Wednesday’s ADP employment data will be of greater interest than usual, as the official employment data won’t be released on Friday. We expect a rise of 45k in August’s ADP estimate for private sector employment growth. This would match our forecast for overall non-farm payrolls but underperform our 50k forecast for private payrolls, correcting from three straight modest outperformances. Both ADP and non-farm payrolls are now showing only a marginally increasing trend, though the picture is one of limited hiring and limited layoffs, rather than an economy entering recession. Initial claims have recently moved marginally higher but continued claims have fallen. Our forecast is marginally below the consensus of 52k, and as such is unlikely to have much impact. But in the event of a shutdown estimates suggest the economy loses 0.2% of annualised GDP a week, and this could be too low should Trump carry out a threat to permanently layoff government employees rather than the usual temporary furloughs in the event of a shutdown. So stronger data may be required to prevent a weaker USD.

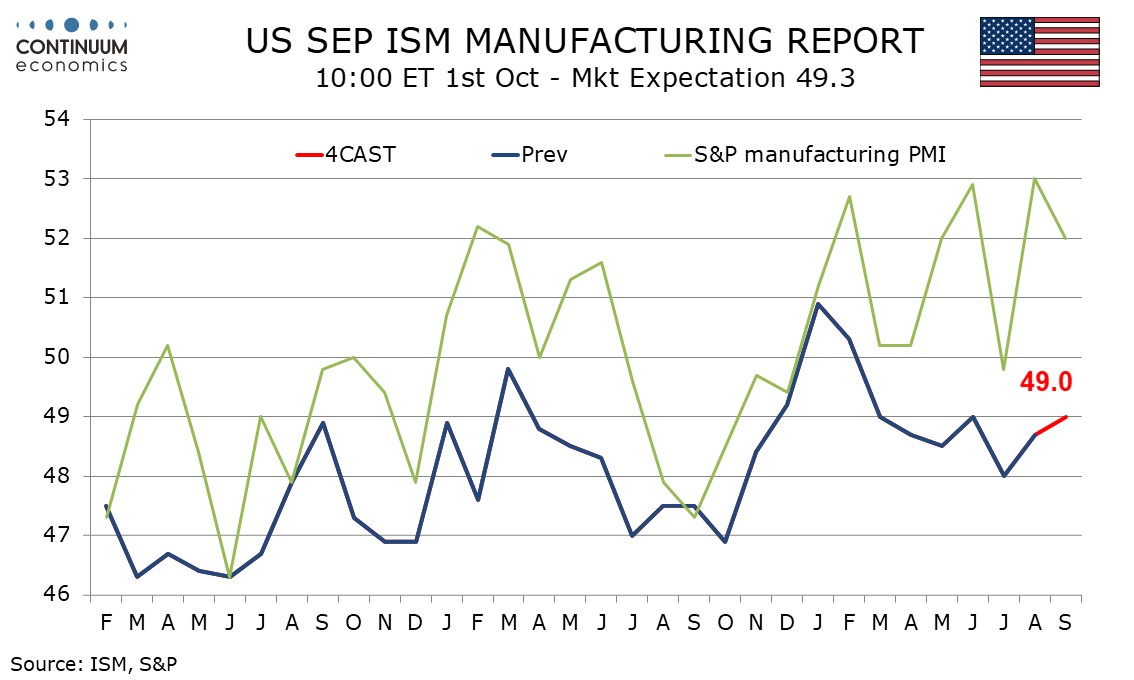

There are also final S&P manufacturing PMIs, and the ISM manufacturing PMI in the US. We expect September’s ISM manufacturing index to 49.0, returning to June’s level after rising to 48.7 in August from 48.0 in July. The index has not been above neutral since February. The correlation of the ISM with the S&P PMI has broken down in the last few months (it was never very strong on the services side). Our forecast is in line with consensus, and unlikely to trigger much reaction in a market more focused on shutdowns and tariffs.

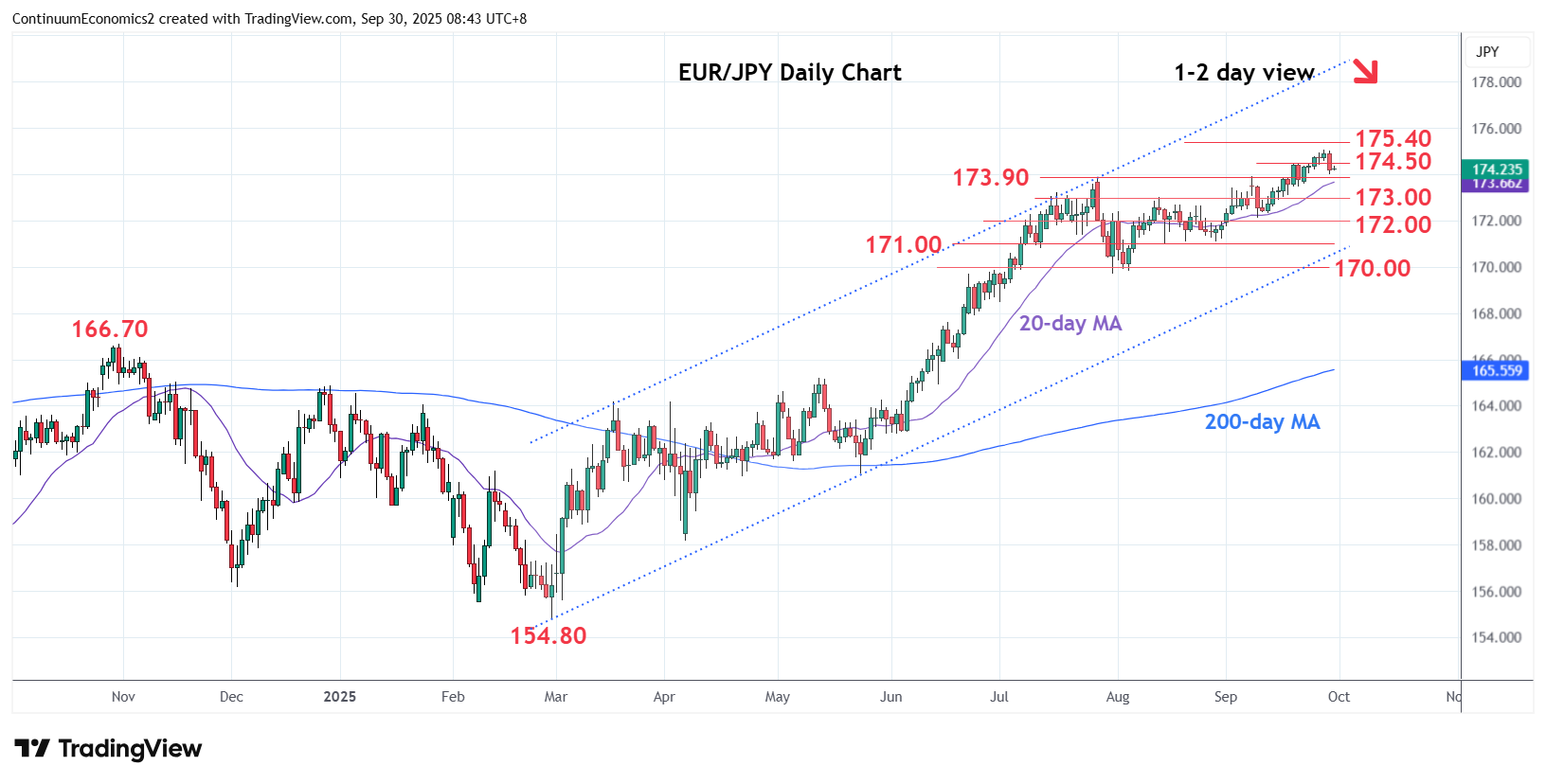

There isn’t a great deal on the calendar outside the US. Although there is the Japanese Tankan survey which used to be a significant focus, it doesn’t attract much attention nowadays. There is also Eurozone CPI, but this won’t contain any surprises with the main national data already released this week. But EUR/JPY may be a focus if the market takes on a more risk negative tone due to a US government shutdown. We have already seen a dip and a suggestion that the uptrend that has been in place since February may be coming under threat. Certainly, there should be scope for a significant correction lower as recent gains have run ahead of the usual correlation with risk premia.