U.S. Initial Claims slip back, record Trade Deficit, Productivity and Costs revisions welcome

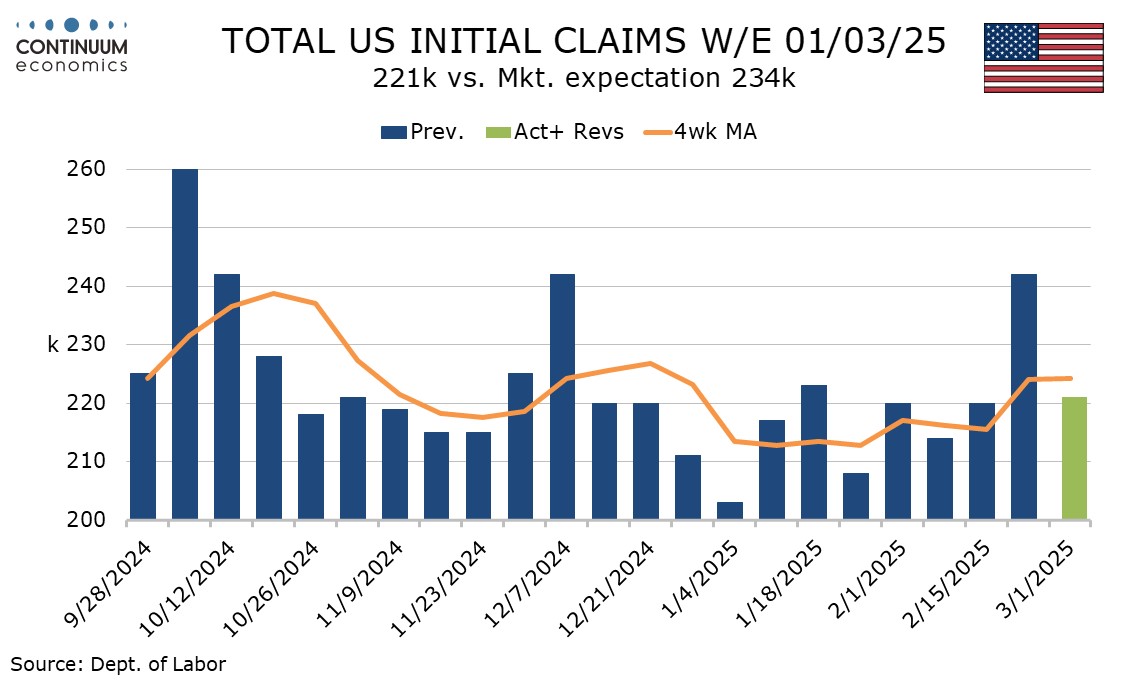

Initial claims at 221k from 242k are lower than expected and suggest last week’s high figure was impacted more by some mix of bad weather and seasonal adjustment problems due to the President’s Day holiday than DOGE layoffs.

While there is no doubt that large numbers of government workers are losing their jobs, initial claims are still consistent with strong payroll growth, particularly given that the payroll survey week came two weeks ago, before last week’s sharp spike.

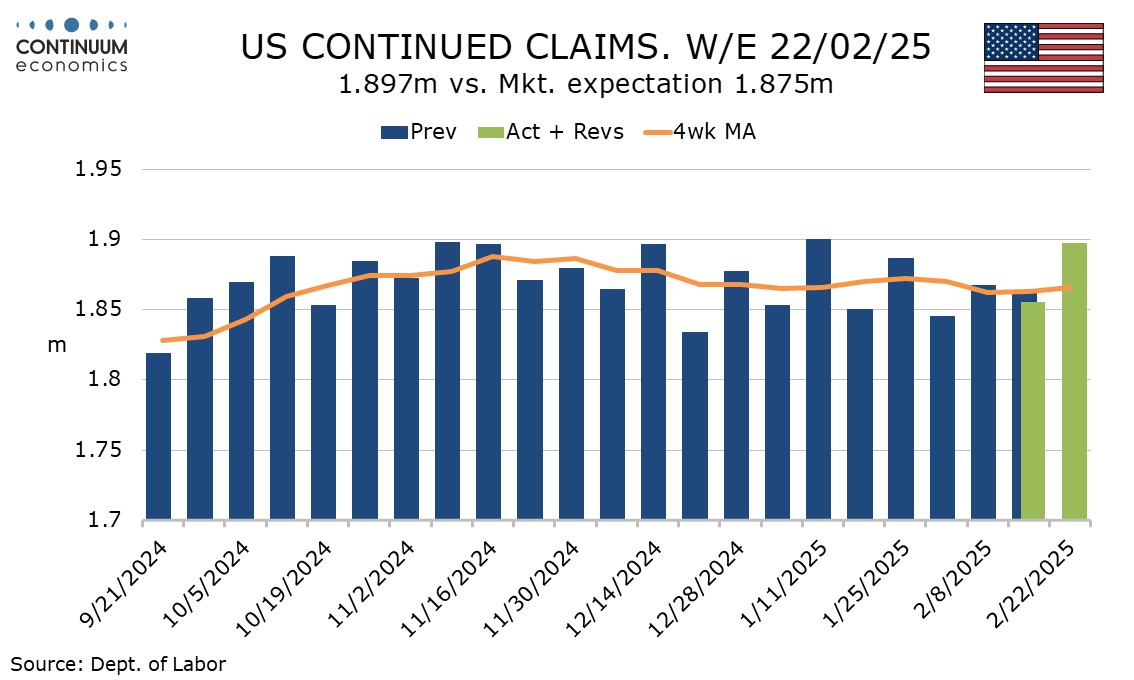

Continued claims, which cover the week before initial claims, rose to 1.897m from 1.855m, though the series was higher as recently as January 11 and the 4-week average is not showing much movement.

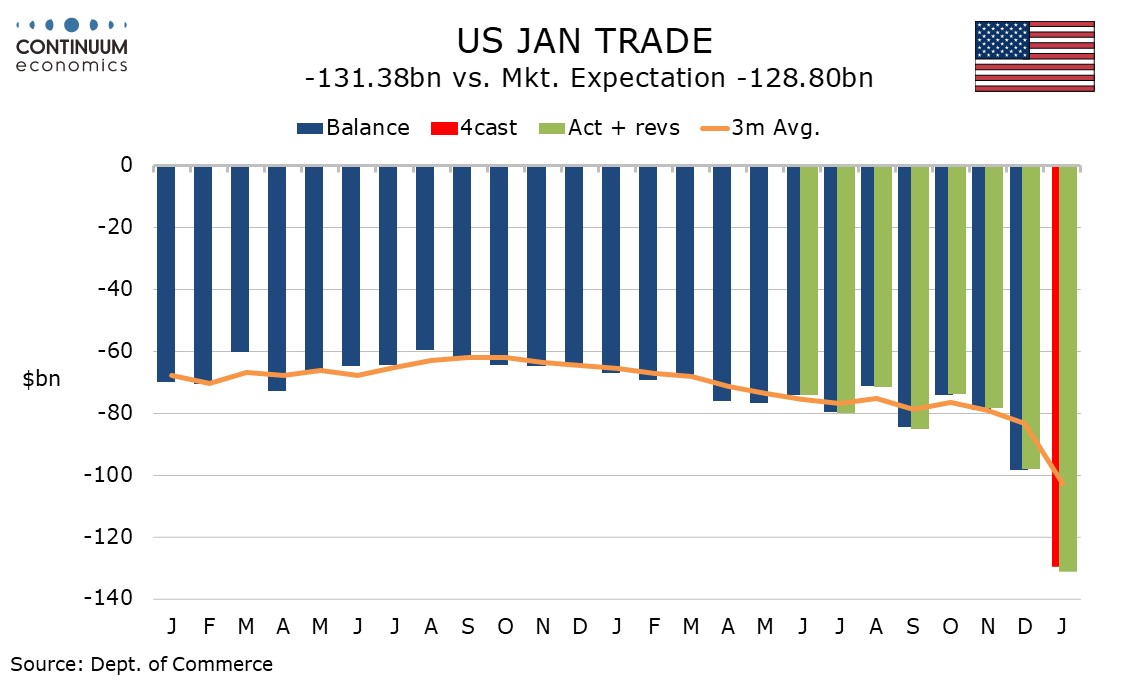

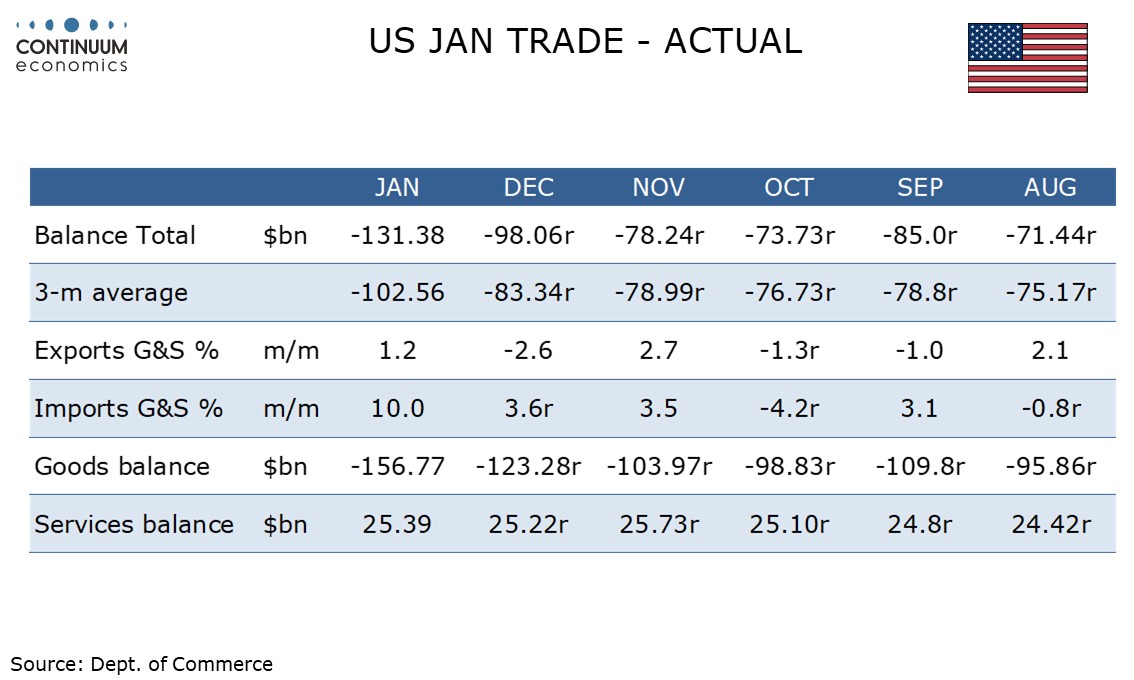

In other data, January’s record trade deficit of $131.4bn was even higher than expected, led by a surge in imports to beat threatened tariffs as advance goods data had implied.

Goods imports with a 12.3% rise were even stronger than the 11.9% seen in advance data while goods exports rise by only 1.6% versus 2.0% in the advance data, disappointing after a 4.3% December decline. Services saw both exports and imports up by 0.6%.

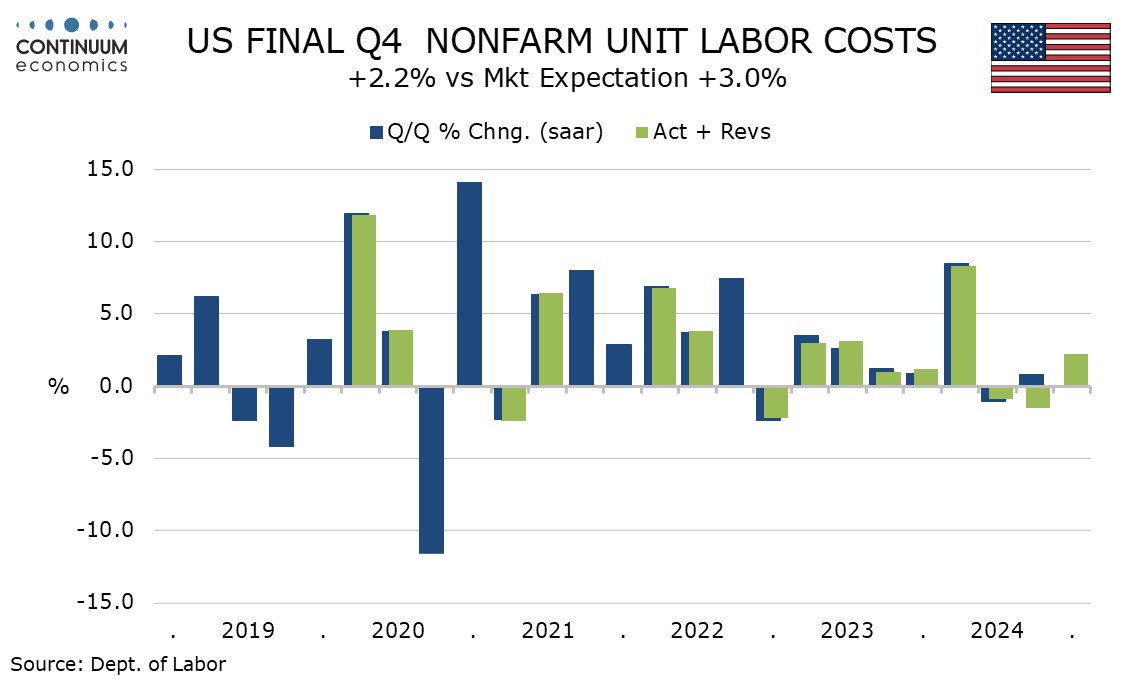

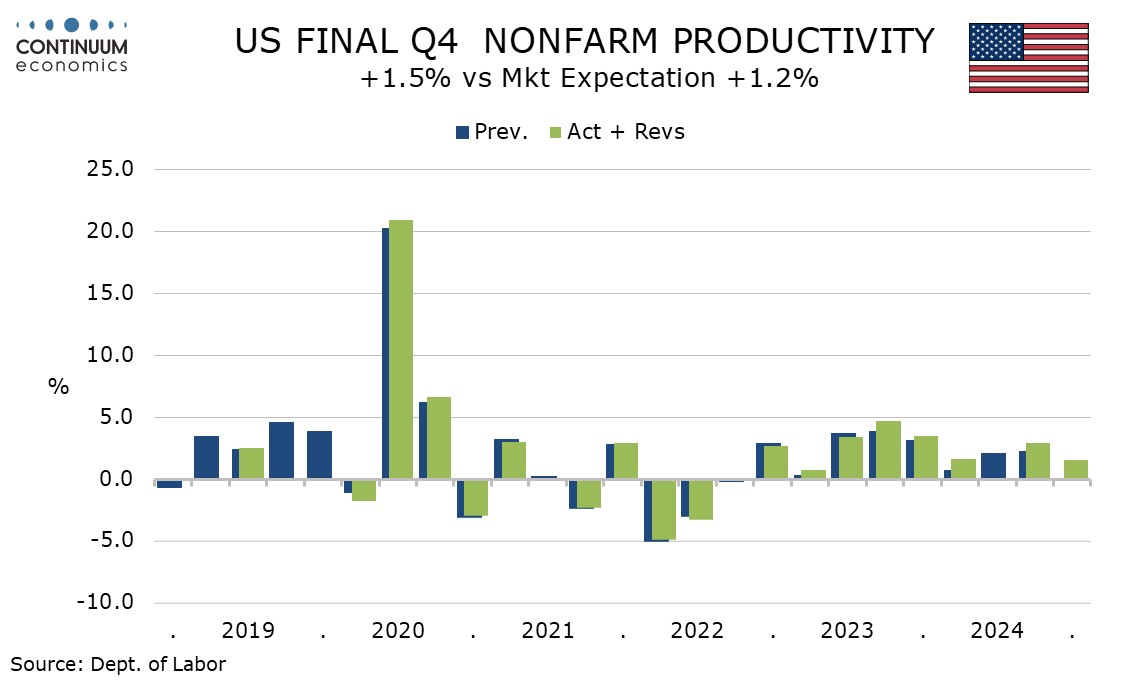

Q4 non-farm productivity was revised up to 1.5% from 1.2% with non-farm business output revised up to 2.4% from 2.3% and hours worked revised down to 0.8% from 1.0%.

Unit labor costs were revised down to 2.2% from 3.0% in part of the productivity revision and also as hourly compensation was revised down to 3.8% from 4.2%. However, with non-labor payments revised to 1.3% from 0.2% the overall deflator was revised up to a still moderate 1.8% from 1.7%.