FX Daily Strategy: APAC, December 11th

US CPI key for the next Fed decision

Slight downside USD bias if data is as expected

JPY looks to have the most potential to rally

CAD focus on the BoC but limited upside scope

US CPI key for the next Fed decision

Slight downside USD bias if data is as expected

JPY looks to have the most potential to rally

CAD focus on the BoC but limited upside scope

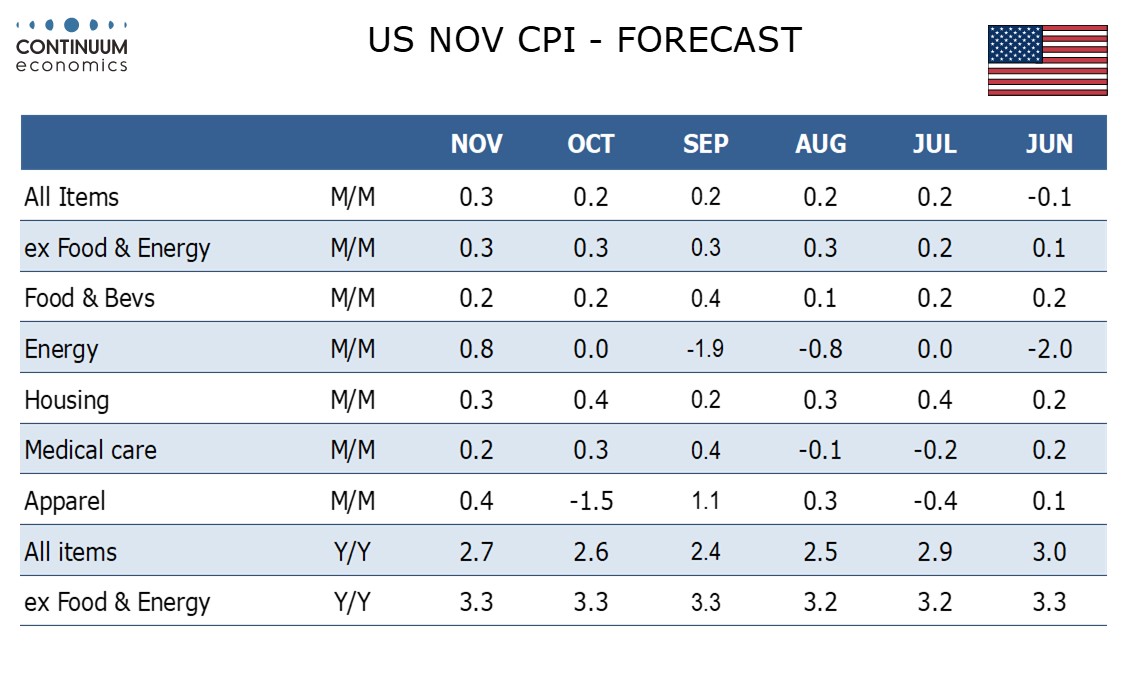

Wednesday sees the key release of US November CPI and the BoC monetary policy decision. As it stands, the market is pricing a 25bp Fed rate cut on December 18 as an 82% chance. This is the last significant data before then. We expect November’s CPI to increase by 0.3% overall, in line with the market consensus, after four straight gains of 0.2%, while the ex food and energy rate increases by 0.3% for a fourth straight month. Such an outcome would support concerns that progress in reducing inflation is stalling, but would probably not be enough to prevent a Fed rate cut. If the Fed are to leave rates unchanged, we will likely have to see CPI come in above expectations at 0.4% for the core.

However, the USD risks are nevertheless broadly balanced. Fed comments this week, even from the usually dovish Goolsbee, suggested that we will only get one cut in the next two meetings, but this is essentially priced into the market, with 27bps of cuts priced by January. If we see a cut this month, the market will still price in a higher chance if a January cut. While the statement may suggest a slow pace of easing, the Fed can’t indicate no change in January is close to certain when they are still on a medium term easing trajectory. If we don’t see a cut front end yields will rise, but a January cut will still likely be seen as better than a 50/50 chance. Under the most likely scenario the USD may therefore move a little lower.

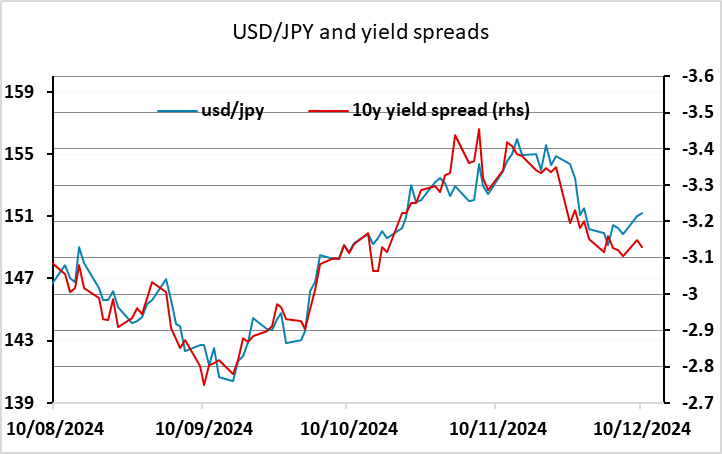

The JPY continues to look like the currency with then most potential for gains, having underperformed yield spreads in the last few days. Spreads are still suggestive of a USD/JPY level sub-150, and if CPI comes in in line with expectations, we would expect USD/JPY to retreat.

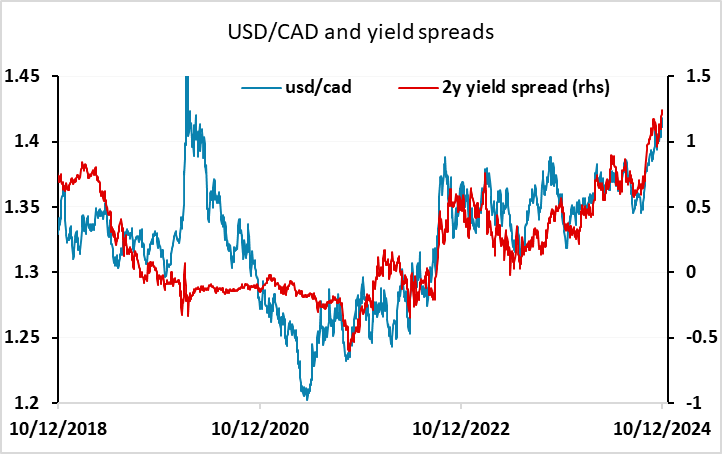

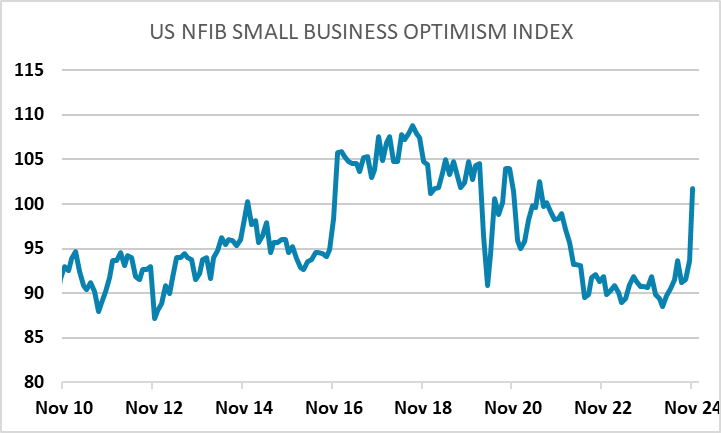

The BoC is priced as 90% certain to produce a 50bp rate cut, so it would be quite a major surprise if they were only to move 25bps. Tuesday saw USD/CAD hit its highest since June 2021, with the USD getting something of a boost from the very strong NFIB survey of small businesses. However, it is a little early to assume that this is going to prove an accurate assessment of business prospects, as it seems very likely to have been affected by the election. USD/CAD remains broadly in line with yield spread moves, so we wouldn’t expect a major move lower from here unless US CPI comes in well below expectations.