USD, JPY, EUR flows: JPY gains as equities correct lower

Equity dip triggers JPY gains, AUD losses

A corrective move lower in equities overnight has helped a JPY recovery and weighted on the riskier currencies overnight. While the slightly weaker than expected US ISM manufacturing data yesterday provided a mild negative impulse, most of the equity decline came mid-to-late Asian session, without an obvious trigger, and looks to be more technically driven. S&P 500 futures have now closed the gap opened last week on the post-US/China trade deal rally, but are now closing in on the early October highs, which may provide some support.

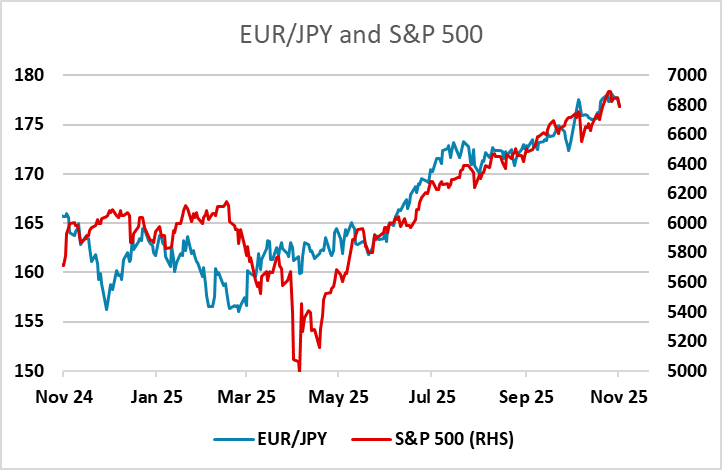

The net USD impact of the equity dip is slightly negative. The JPY is clearly higher, but the EUR and CHF have also edged up slightly, while the AUD is lower and the CAD and GBP are little changed. EUR/JPY has followed the equity move lower, in line with the recent correlation, but the comments from Japanese PM Takaichi, who said that Japan has not yet achieved “sustainable, wage-driven inflation” will limit market expectations of BoJ tightening and may restrict the scope for near term JPY strength. There isn’t a lot else on today’s calendar, so the FX market will continue to watch equities.