FX Daily Strategy: N America, Sep 25th

US GDP data could take the edge off USD strength

USD gains not driven by higher US yields

JPY weakness remains a major feature

SNB could protest CHF strength

US GDP data could take the edge off USD strength

USD gains not driven by higher US yields

JPY weakness remains a major feature

SNB could protest CHF strength

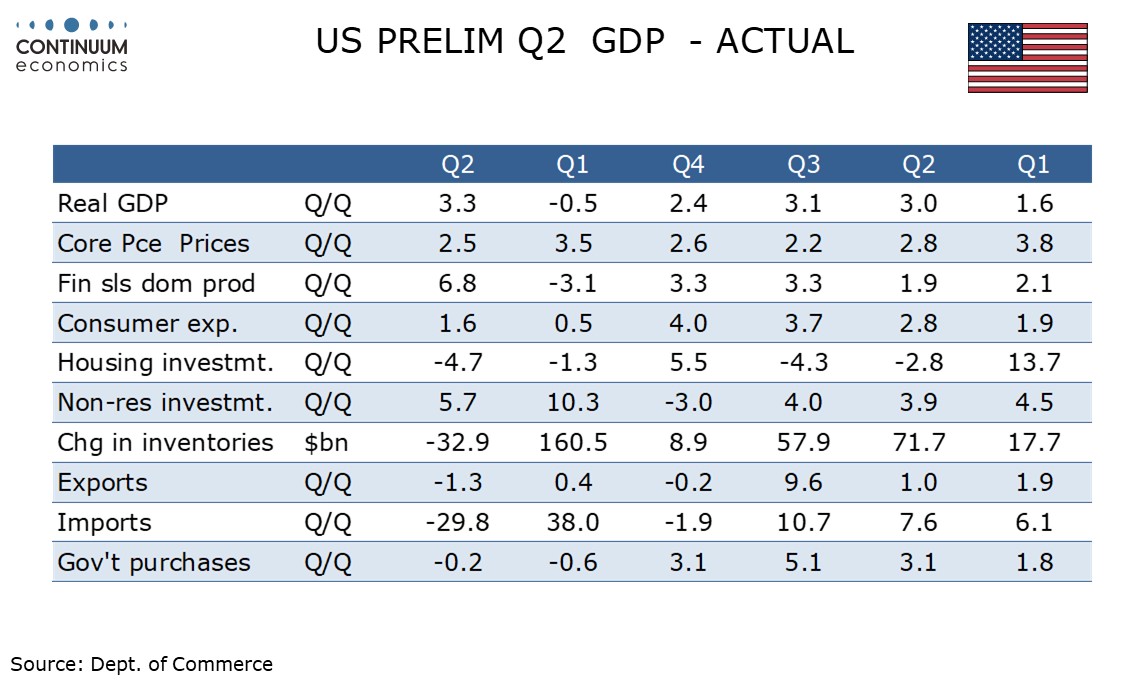

The main focus on Thursday should be the final estimate of the Q2 GDP data. We do not expect any significant revision in the third (final) estimate of Q2 GDP from the second (preliminary) estimate of 3.3%. However the data will include historical revisions, and here risk is on the downside, particularly for 2024. Employment was revised significantly lower, by 911k or 0.6%, in the preliminary estimate for the March 2025 non-farm payroll benchmark and that suggests downward revisions to personal income in the four quarters to Q1 2025. The Fed will also be watching the price indices for historical revisions, though we do not expect any substantial revisions here. Core PCE prices rose by 2.5% annualized in the preliminary Q2 data.

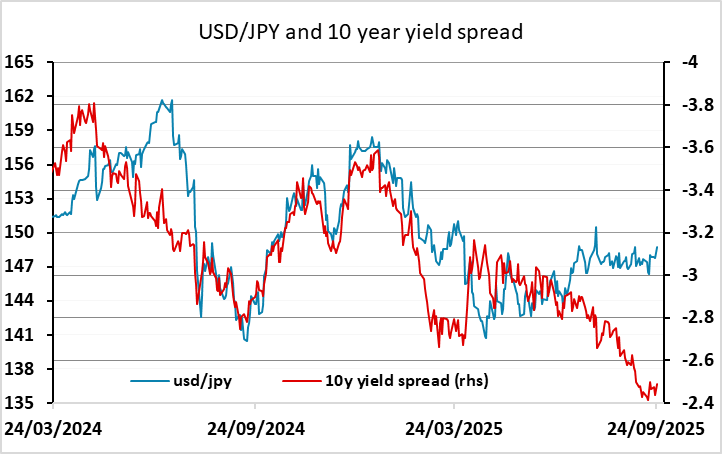

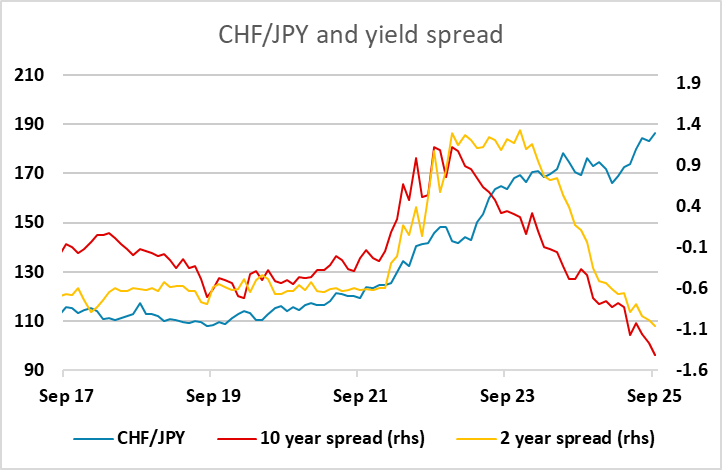

The USD was strong on Wednesday, with Powell’s comments on Tuesday being cited by many as a cause. However, while it could be argued that Powell’s comments were slightly on the hawkish side, there was no significant move in US yields, so it’s hard to argue that his comments were behind the stronger USD. For the EUR, the weaker than expected IFO survey could be seen as a reason for weakness, but USD strength came across the board. USD/JPY consequently looks the most anomalous, reaching its highest level since September 3, while CHF/JPY hit yet another all time high. It’s hard to see this as a result of Powell’s comments, so we are inclined to look at the USD strength and JPY weakness as primarily technical. A downward revision in historic GDP could take the edge off USD strength, although in practice it’s not clear that it would make much difference to Fed policy or yields. The jobless claims data may be more significant for policy and yields after last week’s decline.

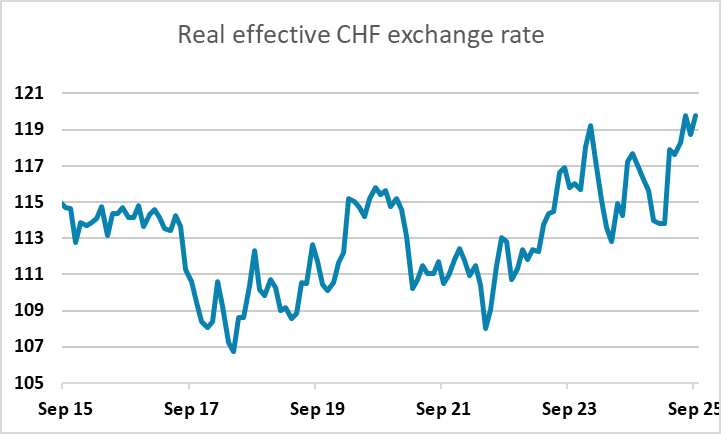

While EUR/CHF initially dipped slightly after the SNB decision to leave rates unchanged, it has subsequently rallied, and still looks to be well supported at 0.93. The SNB’s indication that they are prepared to be active in FX markets is standard, but their concern about the economic impact of tariffs increases the significance of Swiss franc strength. The 39% tariff from the US, on top of the 10 year high in the CHF real effective exchange rate, means Switzerland is an uncompetitive as it has ever been. It is unclear what the SNB might do to alleviate the problem, as all methods to weaken the currency have been tried and failed. Interest rate spreads are already unattractive, and the history of intervention has been mixed at best. While intervention can limit strength in the short run, history shows it risks sharp CHF gains when it is halted. Negative rates are unlikely to be used, and if they are won’t necessarily prevent CHF strength, as no-one is holding CHF for yield anyway. But at some point the persistent strength of the CHF must be challenged. It may be we need o see a Swiss recession for this to happen, At the moment, the latest data doesn’t suggest this is imminent, so although we would expect EUR/CHF to hold above 0.93, don’t expect any sharp gains near term.