FX Daily Strategy: APAC, March 14th

Mildly soft USD tone against riskier currencies to continue

US retail sales data to suggest a softish start to the year

Swedish CPI may allow some SEK decline against the NOK

GBP can continue to soften into the MPC meeting next week

Mildly soft USD tone against riskier currencies to continue

US retail sales data to suggest a softish start to the year

Swedish CPI may allow some SEK decline against the NOK

GBP can continue to soften into the MPC meeting next week

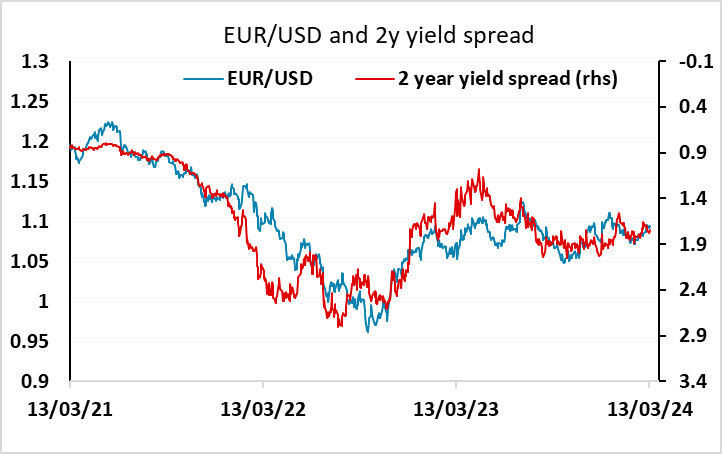

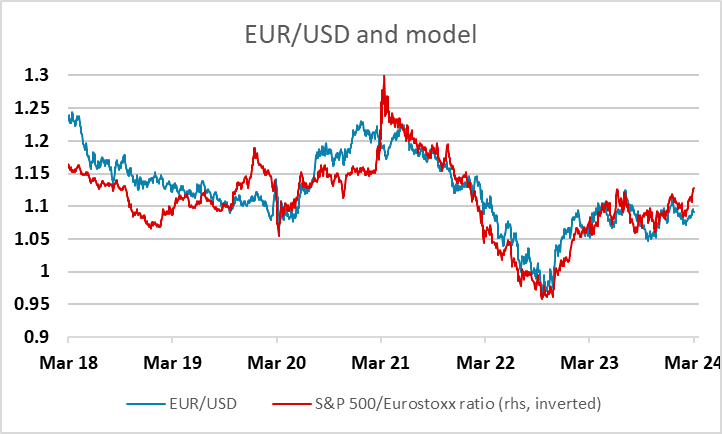

The USD continues to show a mildly soft tone in spite of the stronger than expected February CPI data this week, at least against the riskier currencies., with the strong performance of equities in general and European equities in particular underpinning European currencies. There hasn’t been a great deal of movement in yield spreads in recent days, so that the combination of outperformance from European equities, and the generally firm equity tone points to a softer USD against the EUR and the other riskier currencies if recent correlations continue. However, there is a risk that US yields edge higher in the run up to next week’s FOMC, given the stronger CPI data this week, improving the USD’s tone.

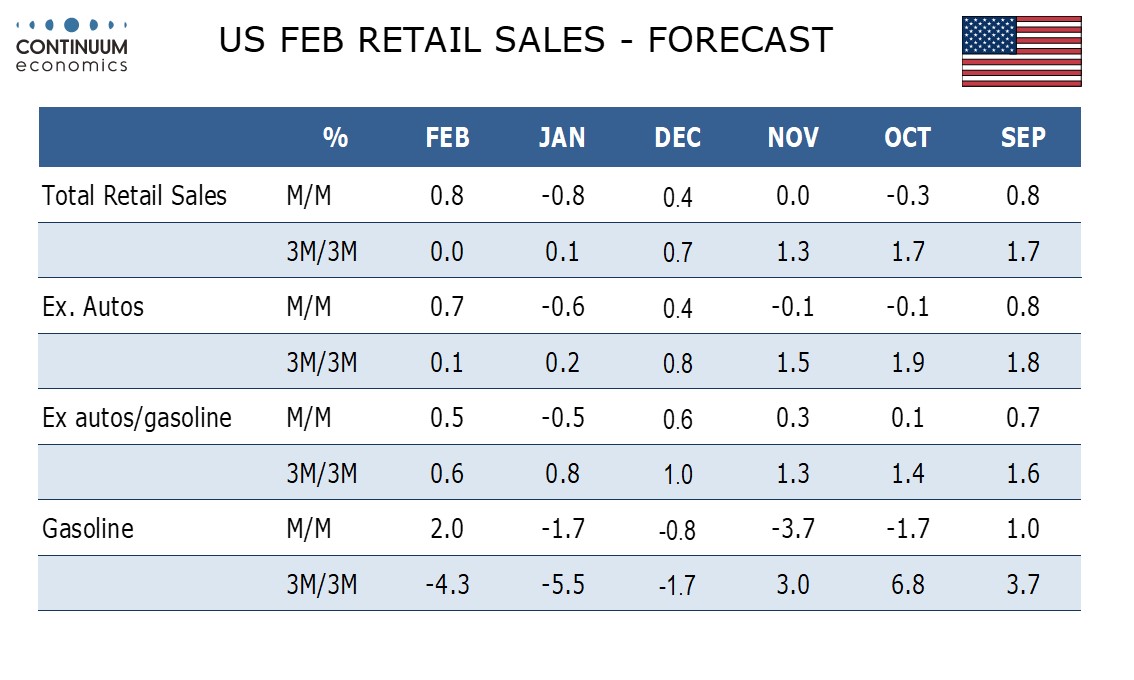

The US February retail sales data is the main data for Thursday, although there will also be interest in the PPI data for February and the latest jobless claims numbers We expect a 0.8% increase in February retail sales, fully reversing January’s 0.8% decline where weather probably depressed sales. Ex autos we expect a 0.7% increase to follow a 0.6% January decline, while ex autos and gasoline we expect a 0.5% increase to follow a 0.5% January decline. This is broadly in line with the market consensus, so probably wouldn’t provide the USD with any support. In any case, this would still leave the average of the two months down on December, suggesting a fairly soft start to the year, so if anything should be seen as a reason for lower yields, although in practice we would expect the market to treat such data as neutral. However, our models suggest there is some USD downside potential against the riskier currencies due to the recent rise in equities in Europe, so unless we do see some rise in US yields, there is scope for EUR/USD to test up towards 1.10.

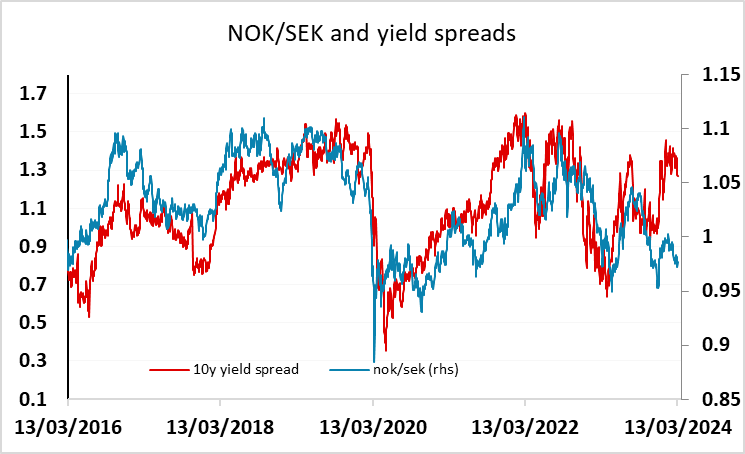

In Europe, we have Swedish CPI data, which may attract more attention after the weak Norwegian CPI data earlier in the week. Swedish headline CPI is at similar levels to Norway’s but core is significantly lower. Nevertheless both are expected to see a sharp drop in y/y terms in the February data, due mainly to base effects. It’s still the case that EUR/SEK looks unlikely to move far from 11.20 unless we see a major data surprise, with the currency well aligned with the historic yield spread relationship. However, there is still scope for the SEK to weaker against the NOK, based on the typical yield correlation. This still looks more likely to happen via EUR/NOK than EUR/SEK, but if we do see even weaker than expected Swedish CPI, we could see the beginnings of a NOK/SEK recovery.

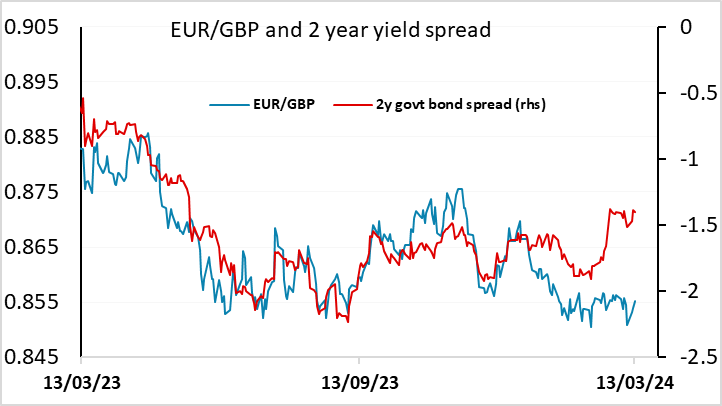

Most pairs have been fairly steady through this week, but EUR/GBP continued to edge up on Wednesday after the gains seen following the UK labour market data on Tuesday, even though we saw GBP yields rise slightly more than EUR yields after the UK GDP data came in in line with expectations at 0.2% m/m in January. GBP has been a strong performer this year, but this looks hard to justify on yield spreads or economic performance, with the UK GDP data failing to live up to the strength of the PMI data in recent months. In the run up to next week’s BoE MPC meeting there now might be scope to test the top side of the recent EUR/GBP range, as the market might start to anticipate a more dovish BoE stance.