Published: 2024-03-06T15:29:56.000Z

USD flows: USD softer despite mildly hawkish Powell comments

Senior FX Strategist

2

Powell proviees no real surprises, but sounds mildly hawkish in indicating the inflation fight is "not assured".

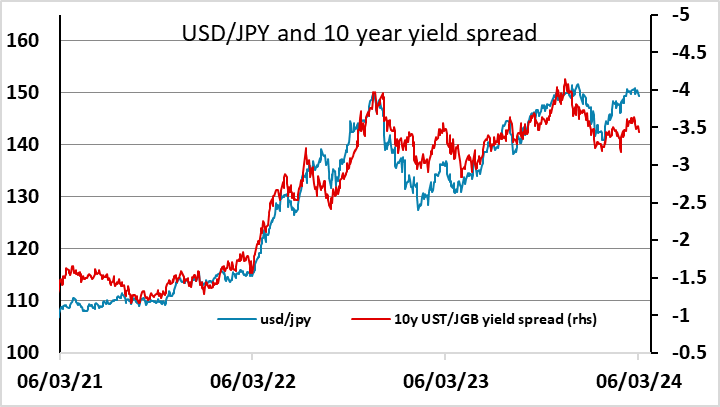

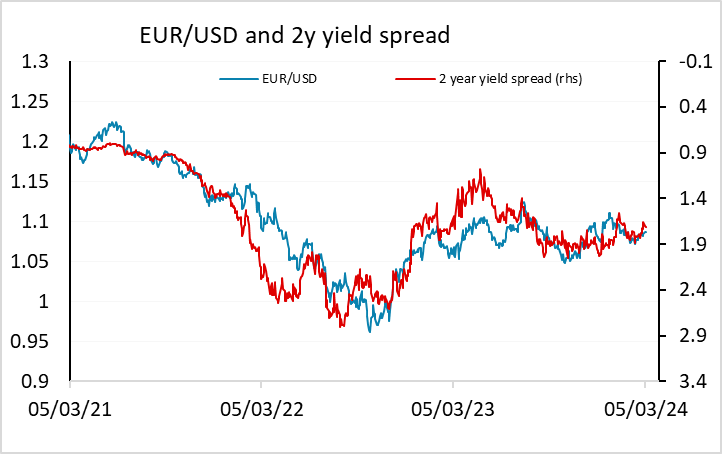

Nothing particularly surprising from Powell’s semi-annual testimony. If anything we would say his comments are mildly hawkish, given that he says the inflation fight is “not assured”, but the market seems to be cheered by his indication that he expects rate cuts this year, even though this is already well priced into the market. A June cut is near enough fully priced in with 2 ½ further cuts by year end. Even so, the USD has edged lower after the statement, with US yields also marginally lower. We don’t see anything in the comments or the US data to justify this, but the EUR and JPY had been firm through the day, and the comments perhaps didn’t provide a reason to oppose this trend. Even so, we would see 1.09 as short term toppy for EUR/USD, while there is perhaps some more downside risk for USD/JPY sub-149