USD, JPY, EUR, AUD flows: USD lower on weaker ADP

Decline in ADP employment increases expectatinos of Fed ease, suggests scope for more USD losses, particularly versus AUD and JPY

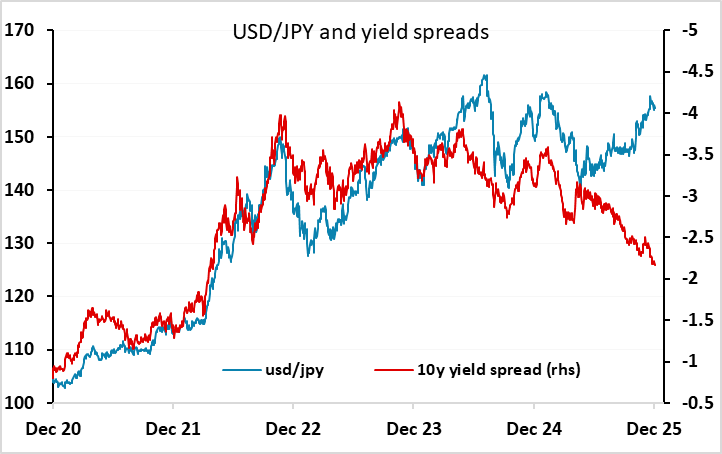

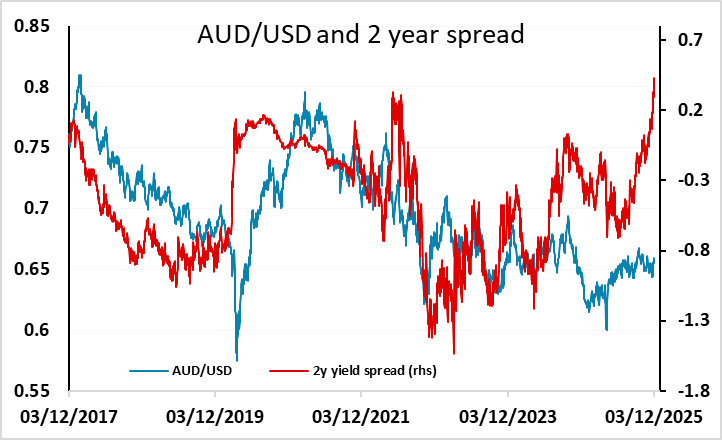

The November ADP decline of 32k is significantly weaker than the market consensus of a 10k rise, and the USD has slipped lower as a result, albeit fairly modestly. The data has pushed US yields lower and the market is now pricing a 25bp Fed cut at the December 10 meeting as an 86% chance. The ADP data takes on more significance as there is no official employment data until December 16th when the October and November numbers will be released together, and no CPI data until December 18th. But with a Fed ease now close to fully priced the USD downside looks more limited against most currencies. However, against the AUD and JPY there is substantial catch-up possible with the yield spread moves in the last few months, so we see more scope for AUD/USD gains and USD/JPY losses, while EUR/USD upside looks more restricted.