FX Daily Strategy: N America, November 6th

USD up on likely Republican clean sweep

JPY to struggle on the crosses short term

Initial USD gains might fade as policy actions may be delayed

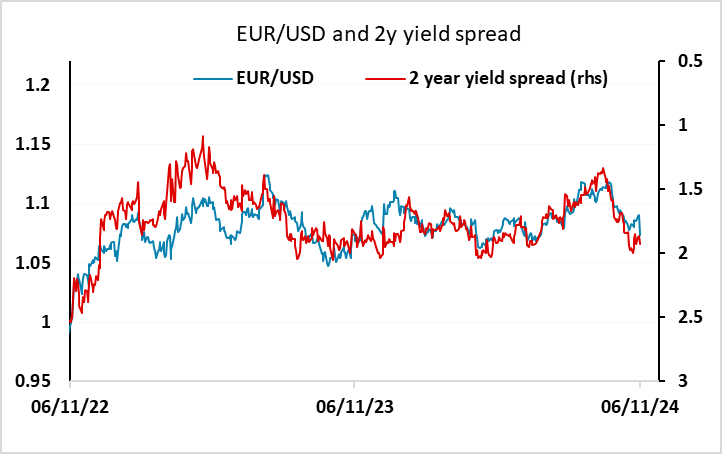

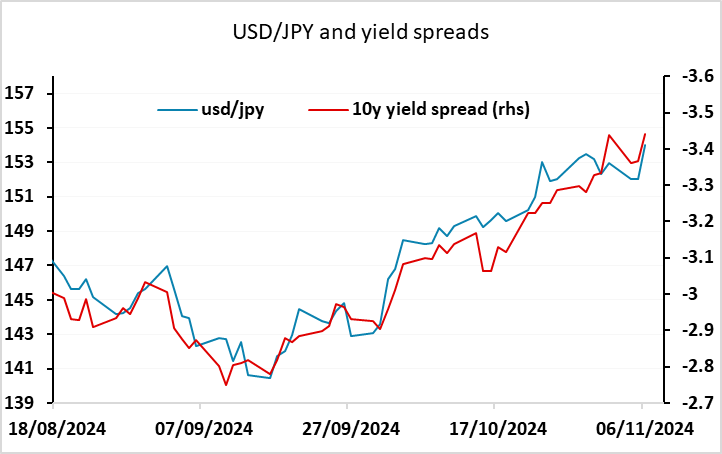

While the result on the House of Representatives may not be 100% clear for a couple of days, it’s looking very likely that there will be a Republican clean sweep in the US election. A Trump victory in the presidential race and a GOP victory in the Senate seem assured. This is generally USD positive as indicated in our pre-election view, based on the expectation of tax cuts and consequently less Fed easing, and the USD is up across the board. Higher US yields support the USD on a yield spread basis against all currencies. EUR/USD may be comparatively resilient, as front end yield spreads were mildly favourable to the EUR going into the election. USD/JPY is likely more vulnerable in the short term, based on the short term correlation with yield spreads. But longer term correlations suggests the JPY should find support, and there is an increased risk of intervention from the Japanese authorities at these levels which may limit USD/JPY upside.

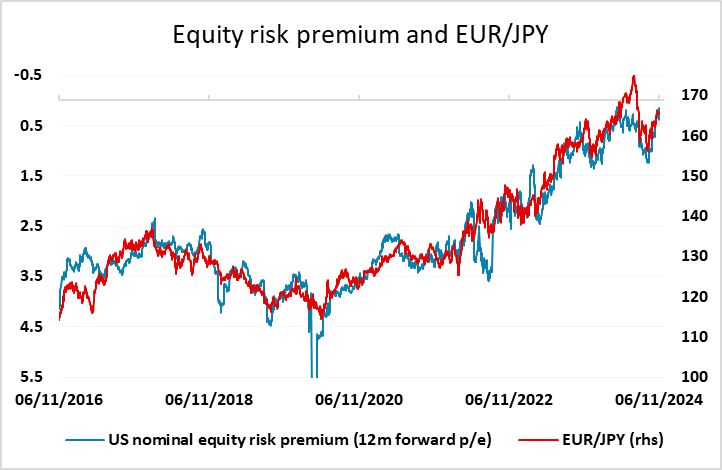

With US yields and US equities both initially higher, we also ought to see some benefit for the risk positive currencies against the JPY, as the implied decline in the equity risk premium typically correlates with a weaker JPY on the crosses. This is a metric that has little theoretical support but has shown a consistent correlation. While current levels of EUR/JPY are broadly consistent with the current equity risk premium, we do see a mild JPY downside risk near term. Of course, while the market is assuming Trump policies will be equity positive, in reality this is far from clear. He may not achieve significant tax cuts, and the markets may see his tariff policies as being growth negative (as all the main forecasters do). So we would be wary of assuming that any initial risk positive move extends far, especially given the already high valuations.

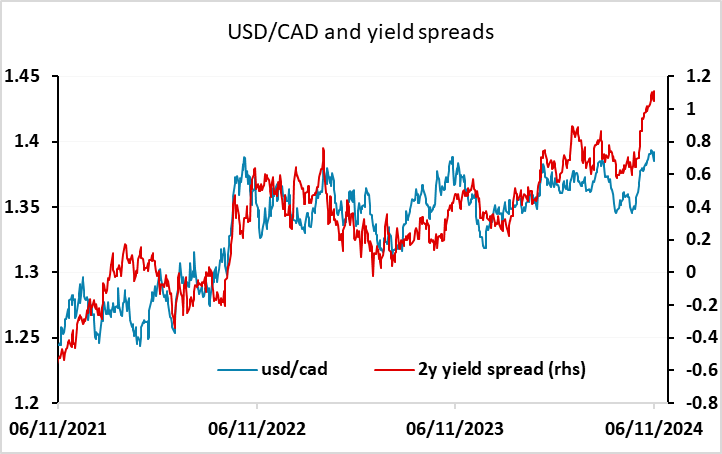

The initial moves have seen GBP and the CHF as the best performers among the European currencies, with the AUD also outperforming the EUR. The CAD is doing the best of the G10 currencies, despite the concerns that Canada could suffer from higher US tariffs, but the MXN has fallen sharply. USD/CAD may be vulnerable to further significant gains given the move we have seen in yield spreads, but speculative positioning is already very short CAD according to the CFTC data, so it may require real money to get involved if USD/CAD is to push beyond 1.40.