FX Daily Strategy: Asia, April 5th

US employment report to dominate Friday

As expected data would encourage further carry trades

CHF remains the preferred finding currency

Canadian employment data unlikely to trigger a significant CAD move

US employment report to dominate Friday

As expected data would encourage further carry trades

CHF remains the preferred finding currency

Canadian employment data unlikely to trigger a significant CAD move

Friday is dominated by the US employment report, after a week in which we have seen general strength in the riskier currencies. These carry trades have been enacted in a relatively low volatility environment, with the market expecting the main central banks to hold policy rates at current levels until June, so there isn’t much expectation of any change in yield spreads. Eventually, rates are expected to be cut, and at the moment there is some optimism that this will be in an environment of declining inflation but recovering growth, so the tone is very much risk positive. This is all encouraging for carry trades, and this week e have seen all the higher yielding currencies gain against the JPY and CHF. The USD has also weakened, in spite of the relatively high USD yield, as it tends to do in risk positive markets, but it is hard to see consistent USD declines against weaker growth lower yielding currencies if US data remains strong and the market doesn’t anticipate any more substantial Fed rate cuts.

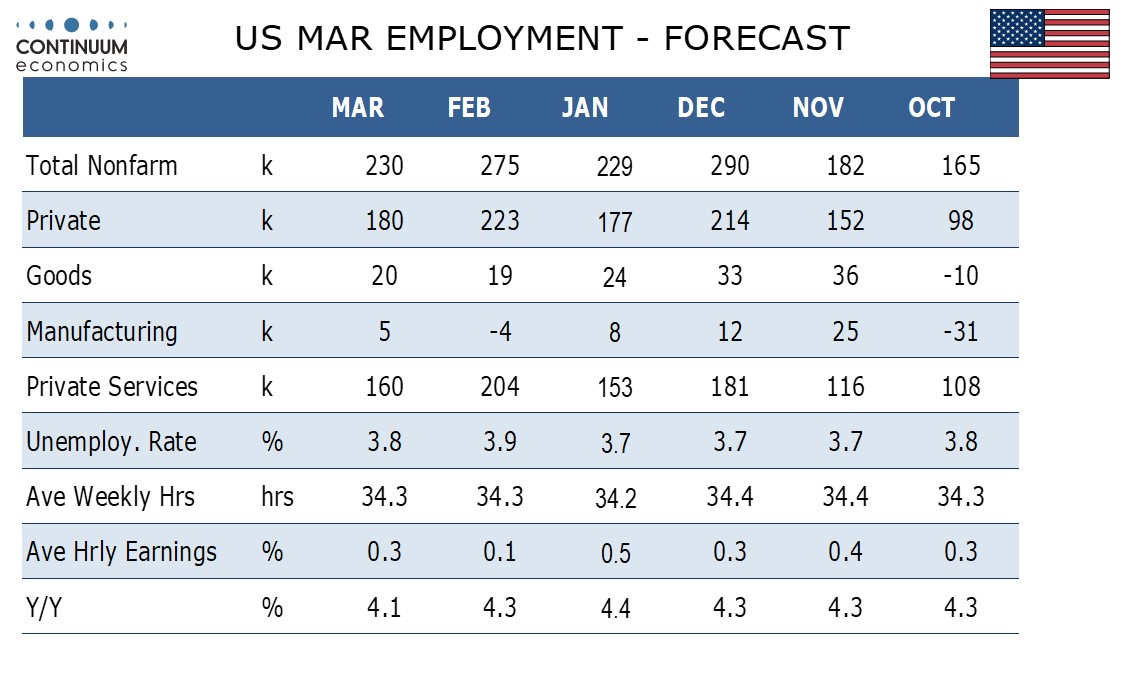

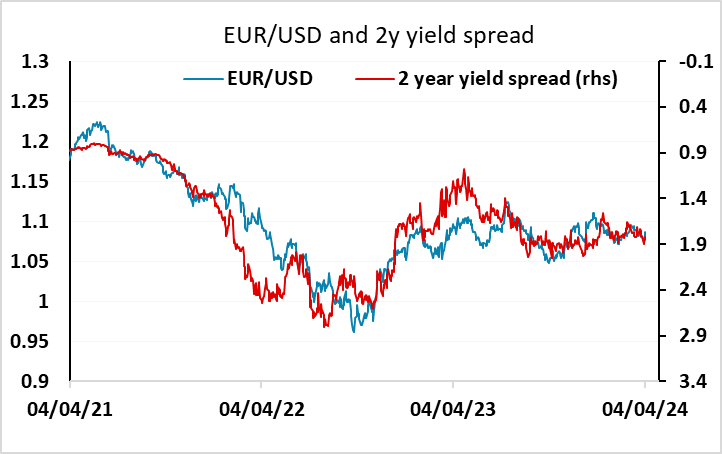

Against this background, an as expected US employment report would encourage the continuation of carry trades, maintaining a risk positive tone and dampening volatility. The consensus expectation of another payroll number just north of 200k with a steady unemployment rate at 3.9% and moderate earnings growth of 0.3% all suggest stable expectations of Fed policy, and would likely mean a continued tendency to favour the riskier currencies. Our own forecast is similar to consensus. We expect a 230k increase in March’s non-farm payroll, which would be in line with the 6-month average but slightly below the 3-month. We expect a correction lower in unemployment to 3.8% from 3.9% and a moderate 0.3% increase in average hourly earnings. But the USD decline against the riskier currencies is starting to threaten the recent ranges, and is starting to deviate sufficiently from the normal correlations with yield spreads to make further USD losses more difficult (especially since there is negative carry on short USD trades against all the other G10 currencies).

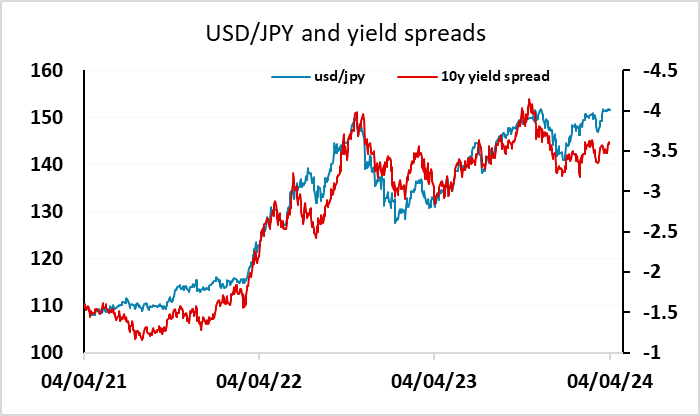

The JPY and the CHF are therefore likely to remain the most favoured funding currencies, but USD/JPY is continuing to bump up against resistance from the Japanese authorities towards further gains, and already looks extended relative to the correlation with yield spreads that has driven the large rise in the last few years. The JPY is also reaching valuation limits, trading at its lowest level in real terms in the floating rate era. The CHF therefore looks like the most attractive funding currency, with the SNB having already led the G10 in cutting rates, Swiss inflation down to 1% suggesting potential for more cuts, and the currency starting from very high levels. However, markets will want to see any BoJ reaction if there is a break above the previous 34 year high in USD/JPY at 151.97. Intervention could undermine carry trades in general, as well as against the JPY.

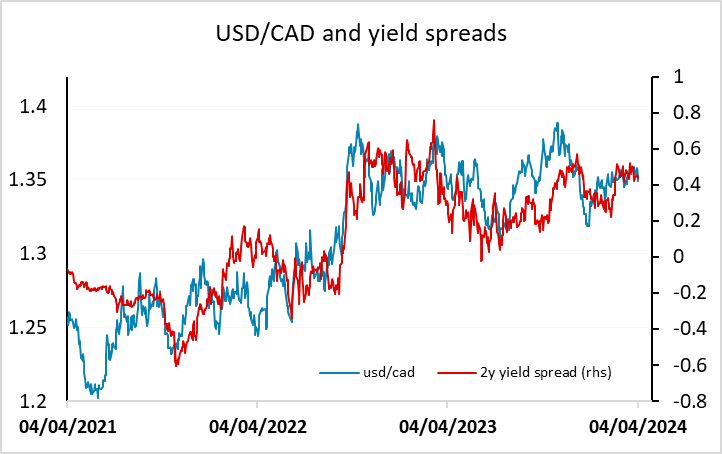

We also have the Canadian employment report, with the Canadian numbers also having shown a fairly steady and healthy rise in recent months. It would take something out of the ordinary to make a big difference to expectations of BoC policy, so we would expect USD/CAD to hold close to 1.35.