FX Daily Strategy: APAC, May 21st

UK CPI the main focus with big rise seen in the y/y rate

GBP unlikely to be much affected with 0.84 good support in EUR/GBP

Markets remains generally rangy awaiting data – JPY still looks cheap

UK CPI the main focus with big rise seen in the y/y rate

GBP unlikely to be much affected with 0.84 good support in EUR/GBP

Markets remains generally rangy awaiting data – JPY still looks cheap

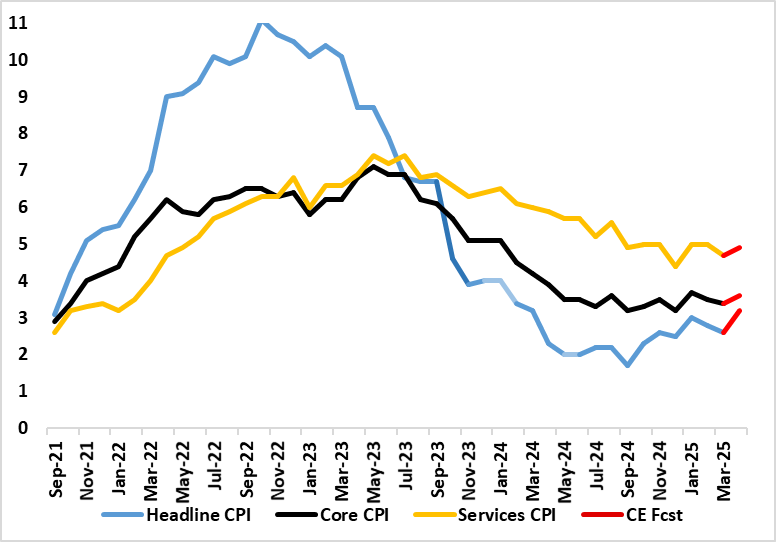

April CPI Inflation to Jump Broadly – albeit Temporarily?

Source: ONS, Continuum Economics

UK CPI is the main data for Wednesday. The UK faces a surge in inflation, (largely home-grown) just as the rest of Europe sees their respective inflation fall back to near target. April is likely to see a series of energy, utility, post office and some other regulated and service price rises, albeit offset somewhat by a fall in petrol prices. This array of rises, all domestically generated, should see headline CPI inflation rise from 2.6% to 3.2%, with the BoE seeing an even larger rise to 3.4%. The market consensus is for a rise to 3.3%.

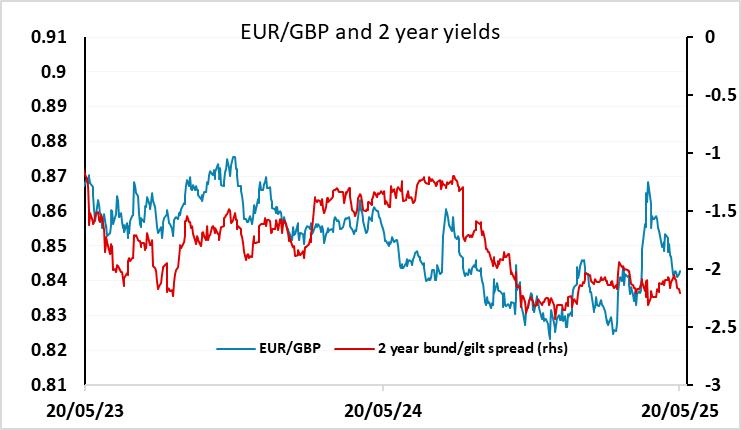

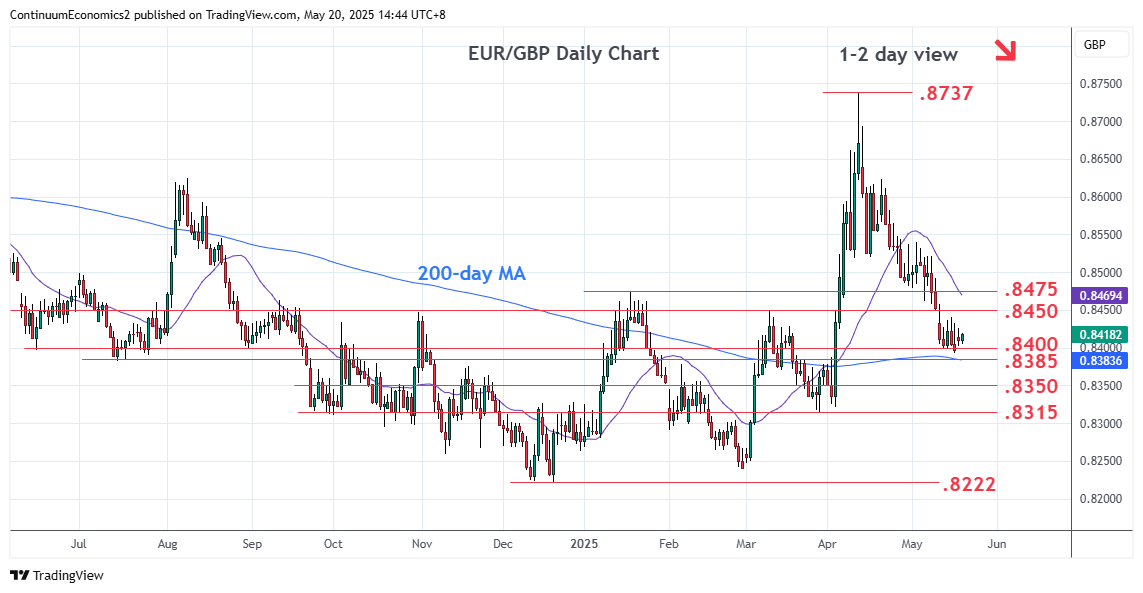

However, the April number should represent a peak, and given that it is due largely to energy and administered prices, seems unlikely to have much market impact. Of course, the hawks on the MPC remained concerned about the stickiness of inflation, and while their concerns focus mostly on wages, as indicated by BoE chief economist Pill on Tuesday, they might argue that higher inflation numbers will encourage higher wage rises. Nevertheless, we doubt that EUR/GBP will react much unless the numbers are 0.2% or more away from consensus, given the various factors impacting the data. EUR/GBP continues to look well supported near 0.84, and there is less sensitivity to yield spreads than there is to expectations of growth and general risk sentiment. Inasmuch as higher inflation could damage growth expectations and increase the risk premium on GBP, it could even be argued that higher inflation might prove negative for the pound. On balance, we do see EUR/GBP risks as being on the upside, as we do expect the BoE doves to gain the upper hand later in the year.

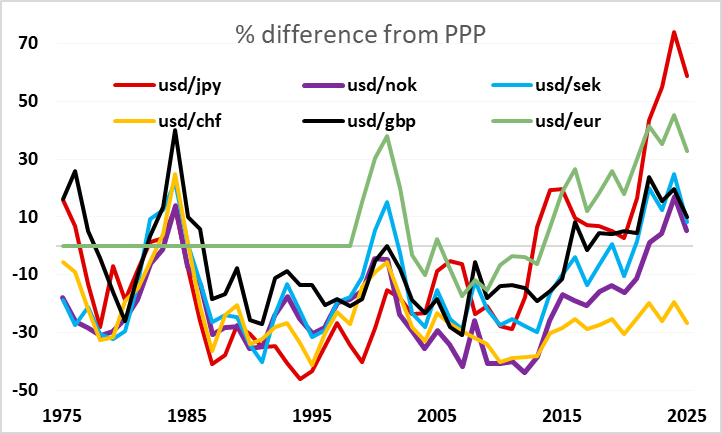

Otherwise, there is little on the calendar and markets are looking quiet as we await evidence of any impact from the tariffs and/or any new policy developments. The PMI data on Thursday is therefore the main data of the week. We continue to see equity markets as somewhat overoptimistic at current levels, with US risk premia in particular historically very low. This suggests substantial potential upside for the JPY, which in any case remains extremely undervalued relative to long term fundamentals. But some evidence of weaker growth looks likely to be necessary to trigger any move lower in equities, so for now ranges seem likely to hold.