FX Daily Strategy: APAC, January 3rd

Limited data and events to move the market

JPY weakness is extreme – risks on the JPY upside

USD strength hard to oppose, but Trump effect could be negative

GBP strength hard to square with economic weakness

USD to hold firm with support from ISM survey

JPY downside looks more limited with some verbal intervention from Japan

US curve steepening may not be a positive sign for the USD longer term

European data may favour EUR/GBP downside

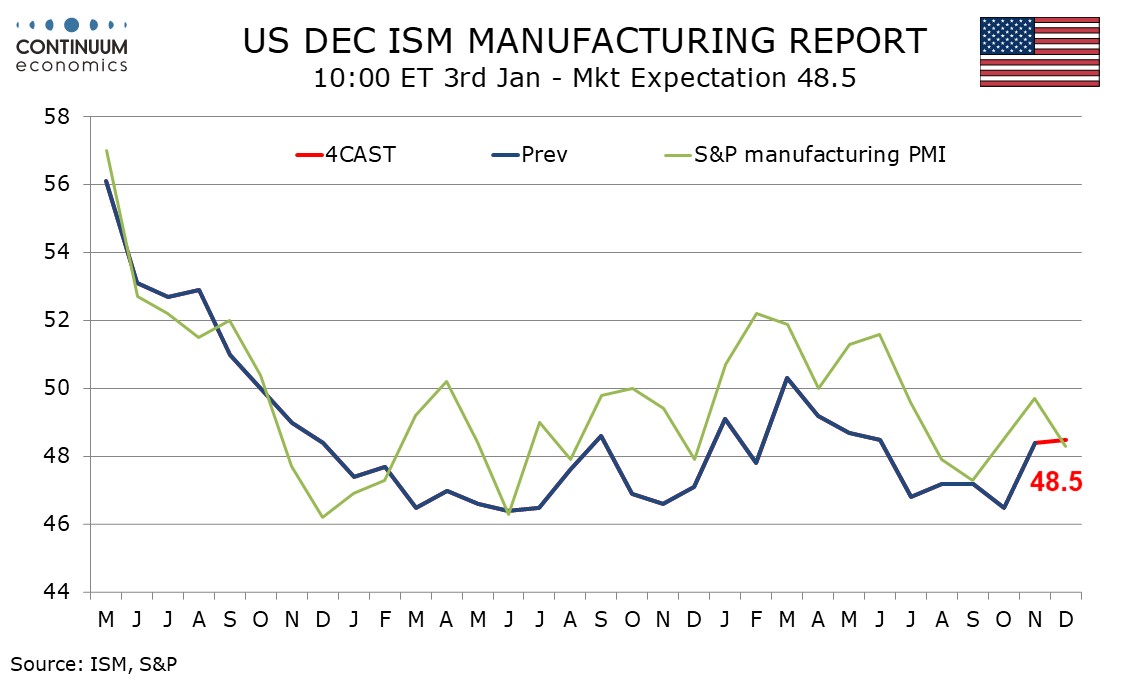

With the US employment report for December not released until January 10, the main data focus on Friday will be the US manufacturing ISM survey. Despite a correction lower in the S and P manufacturing PMI and weakness in some regional surveys, we expect December’s ISM manufacturing index to sustain the November improvement, edging up to 48.5 from 48.4. November saw the ISM manufacturing index bounce from a weak 46.5 in October, which may have had some restraint from hurricanes and a strike at Boeing. The gain was led by new orders which edged above the neutral 50 for the first time since March. While new orders may correct lower supportive seasonal adjustments limit downside risk, while even more supportive seasonal adjustments in production could bring a significant bounce in that index. This could see the ISM manufacturing index holding up better than most surveys in December.

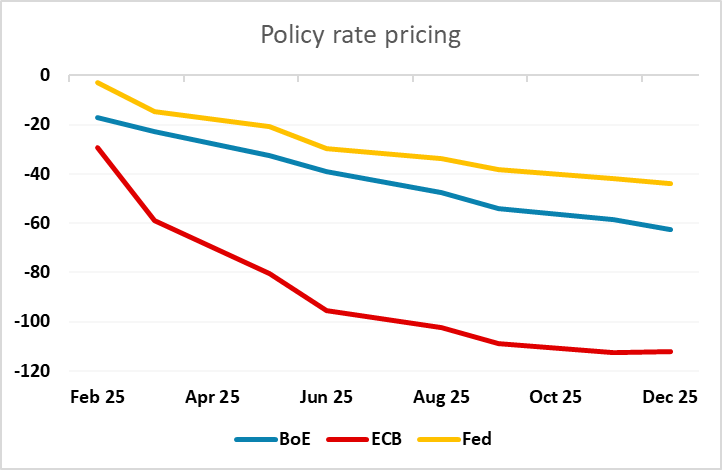

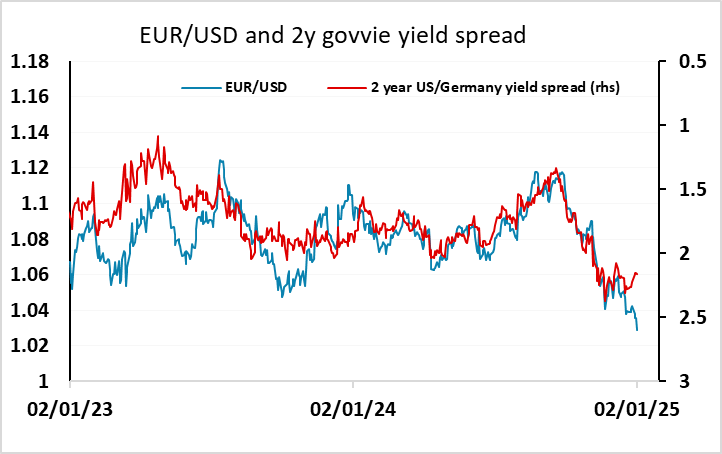

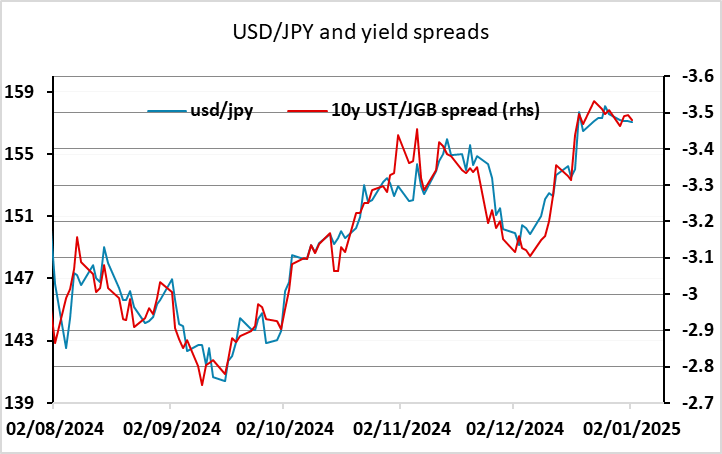

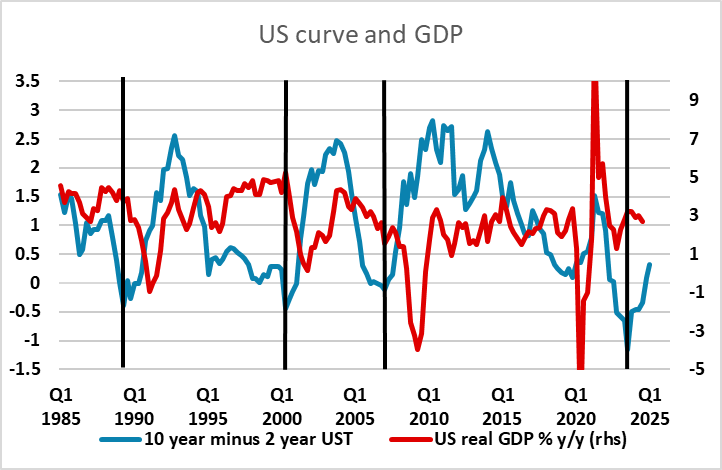

In practice, the market is really more focused on the services sector, so there is unlikely to be any major impact from the ISM survey on the FX market, but with our forecast slightly on the strong side of consensus, the data should help sustain the firm USD tone we have seen at the start of the year. The USD continues to be underpinned by firm US yields, due partly to the reduction in Fed easing expectations in the wake of strong US data and expectations of fiscal easing from the Trump administration. However, there has also been a significant steepening of the US curve, largely because the market is increasingly concerned about the rising US Budget deficit and the prospect of a further rise under the Trump administration as taxes are cut. For the FX market, a bear curve steepening tends to mean a weaker JPY, other things equal, because while the USD tends to benefit in general from rising yields, USD/JPY has tended to be more affected by long term yield spreads while EUR/USD has been more influenced by short end spreads. However, Thursday’s trading saw the JPY gain slightly on the crosses and EUR/USD continue to decline despite yield spreads suggesting scope for recovery. It’s too early in the year to conclude that paradigms have changed, but with the Japanese authorities likely to oppose a USD/JPY move to 160, it feels as if either the USD will turn lower or the JPY will turn higher on the crosses (or both).

The steepening of the US curve has also in the past been a signal of impending US recession, with recession emerging within 2 years of the start of steepening of the US curve in 1990, 2000 and 2007. This time may well be different, but if we do see a US downturn, this is also likely to benefit the JPY more than the riskier currencies.

Before the US data we have German unemployment data and UK money and credit data in Europe. Neither seem likely to be particularly market moving, but we have been seeing a steady rise in the German unemployment rate, and a further rise to 6.2% as indicated by the consensus would do nothing to halt the current EUR weakness. UK M4 growth has started to recover through the last year or so, as have mortgage approvals and mortgage lending, and more evidence of this may help support the pound, although we see some downside risks to GBP given the recent downward revisions to growth and what we consider is an overly hawkish view of BoE policy.