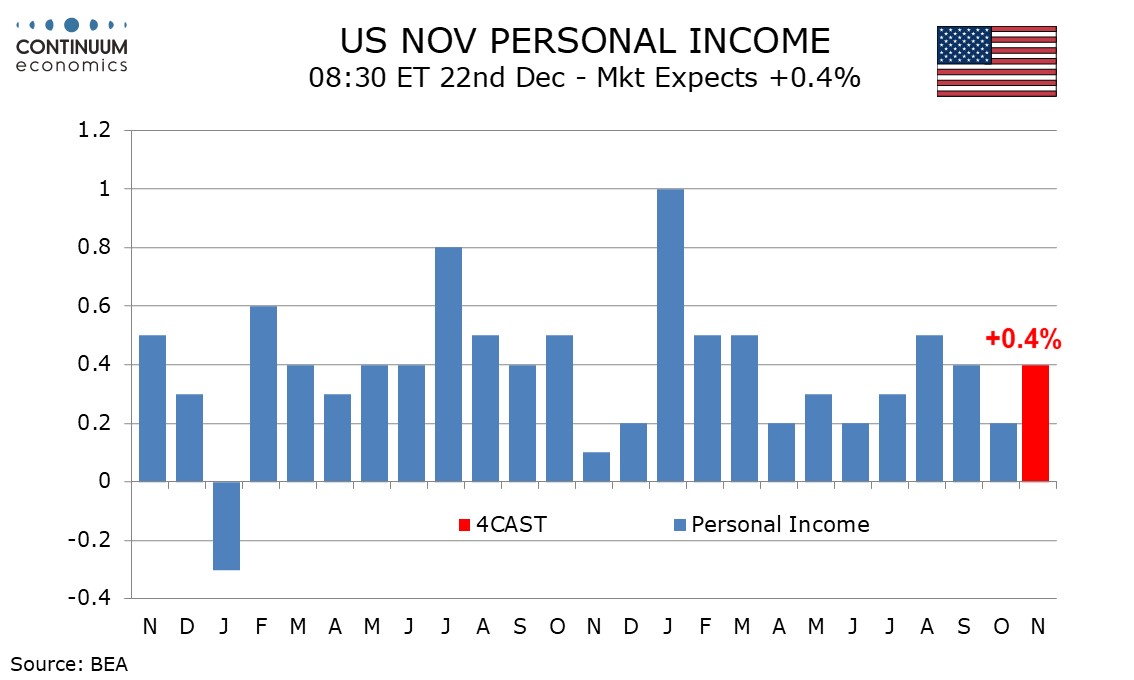

Preview: Due December 22 - U.S. November Personal Income and Spending - PCE Prices seen subdued, with downward revisons

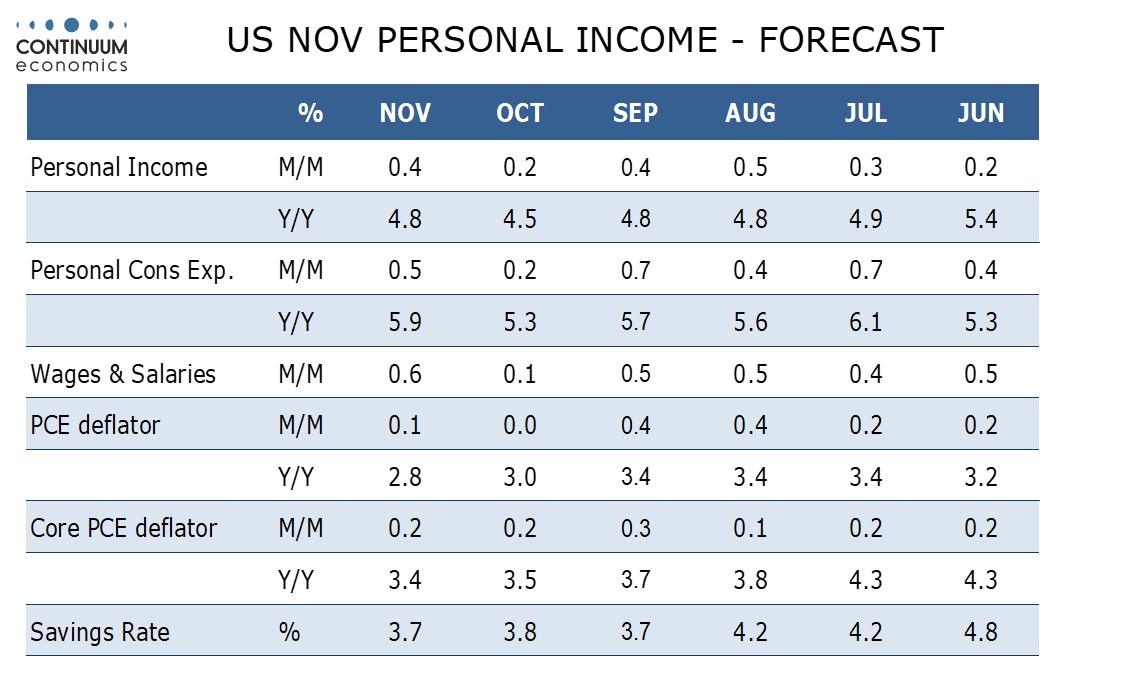

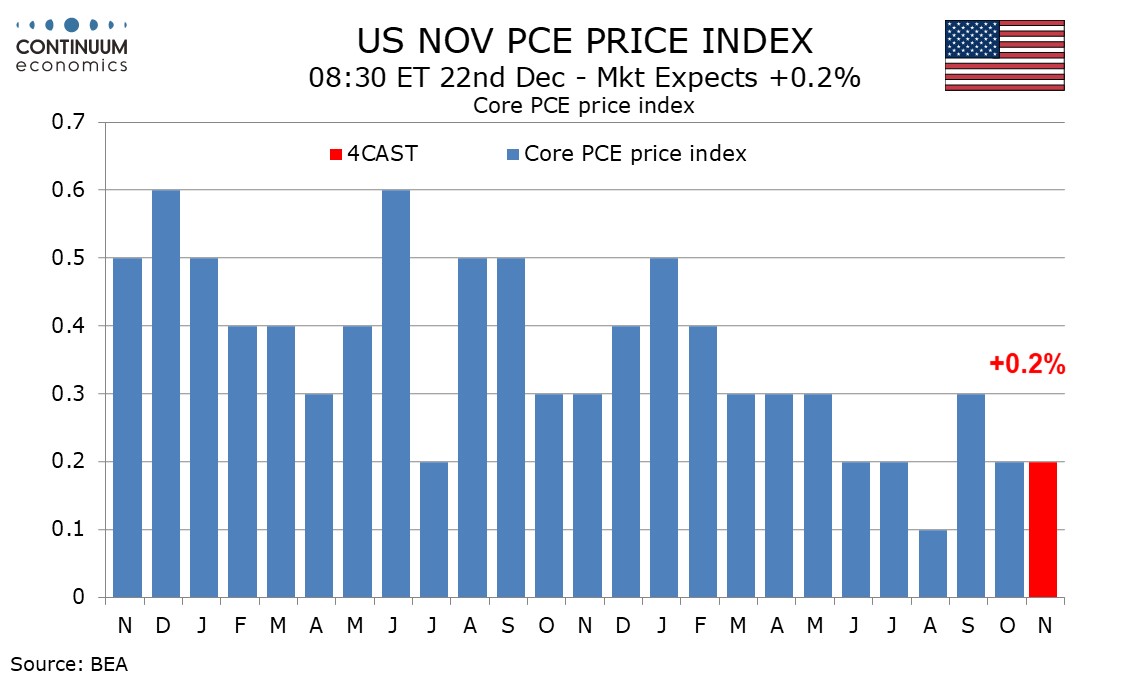

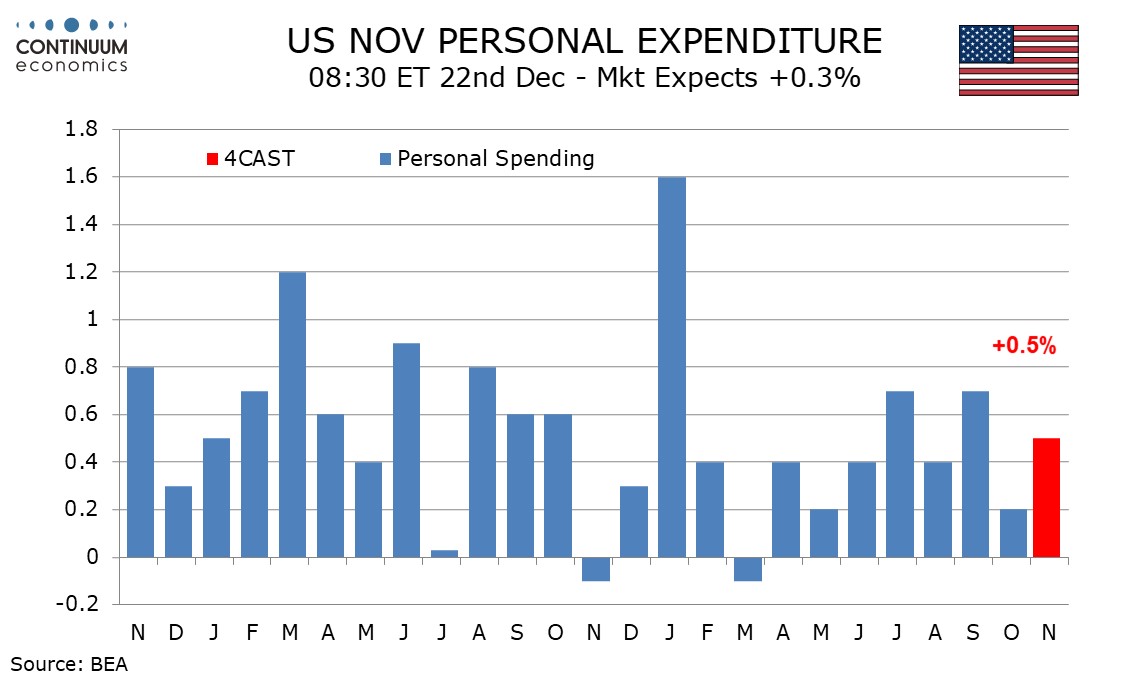

We expect November to see a 0.2% increase in core PCE prices, slightly softer than a 0.3% core CPI, with overall PCE prices up by 0.1%, that matching the CPI. Downward Q3 revisions will also be reflected in the price data. We expect gains of 0.4% in personal income and 0.5% in personal spending.

Core PCE prices tend to be a little softer than the CPI, which rose by less than 0.3% before rounding, and we expect core PCE prices to be rounded down to 0.2%. This will be stronger than October data which was rounded up to 0.2%. PCE prices tend to be less sensitive to gasoline prices than the CPI and we expect overall PCE prices to match the 0.1% CPI increase, though here the rounding is likely to be upwards.

While this implies yr/yr data showing core PCE prices slipping to 3.4% from 3.5% and overall PCE prices at 2.8% from 3.0%, the actual data will probably be around 0.1-0.2% lower than that due to downward revisions seen in Q3.

With November’s non-farm payroll showing stronger growth in the workweek and average hourly earnings we expect a 0.6% increase in wages and salaries. However we expect overall personal income to rise by only 0.4% with social security benefits unlikely to match an above trend October increase.

We expect a 0.5% rise in personal spending to come fully from a 0.7% increase in services. Retail’s contribution should be near flat. Industry data suggests the auto contribution will be a little softer than in the retail sales data while the strongest components in a 0.3% retail sales increase was a 1.6% rise in eating and drinking places, counted as services in the PCE detail.