FX Daily Strategy: APAC, November 14th

GBP has further downside risks

AUD well supported on solid employment data

SEK well bid but expensive against EUR and NOK

CHF strength on trade hopes shouldn’t lead to new highs

European data likely to be ignored

Concerns about weak US labour data may undermine the USD

Fed comments suggest December rate cut chances are receding

GBP weakness may pause

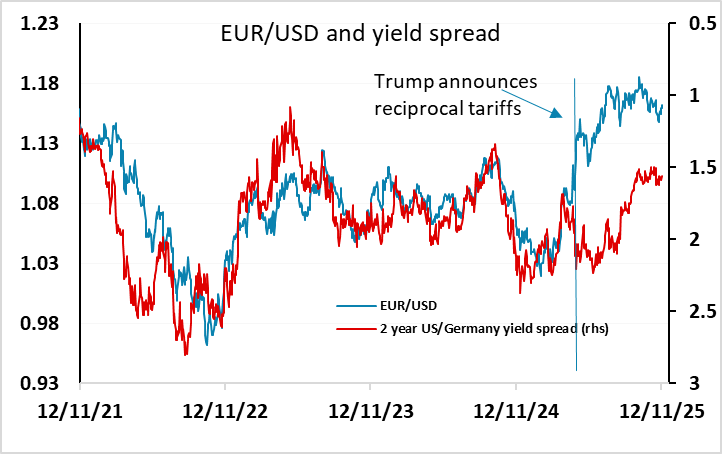

Friday sees revised Eurozone GDP data for Q3, but these are unlikely to differ significantly from the preliminary numbers, and the Q3 employment data and the French and Spanish final CPI data also look unlikely to move markets. The focus now is on the US data that will be released now that the government shutdown has ended, with the first numbers likely to come out next week. The October employment report is seen as likely to be one of the first releases, and some weakness in the private sector surveys has led to some speculate that the official data may also be weak. This may account for the softer USD tone through Thursday, with some long positions being taken off the table.

However, while there might be some softness in the US employment data, we doubt there will be notable weakness, with the underlying trend still likely to be flat to marginally positive. Meanwhile, the recent comments from FOMC members suggest the chances of a December Fed ease are receding, with Mary Daly – typically a dove – expressing some doubts on Thursday. Currently, the market is pricing a December Fed cut as around a 50-50 chance, but unless we see weak US data, we would expect that to move towards no change given the latest Fed commentary. This should be USD supportive, but also somewhat negative for the riskier currencies as a rise in US yields could be expected to undermine equities. Fed speeches from Bostic and Logan on Friday are likely to be on the hawkish side, but both are known hawks so shouldn’t have too much impact.

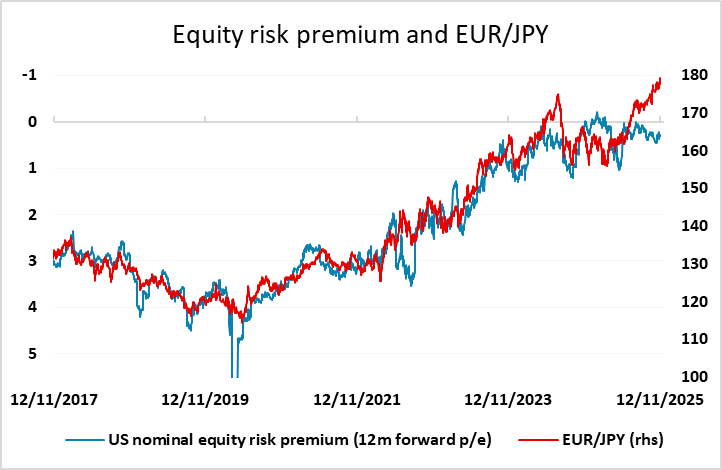

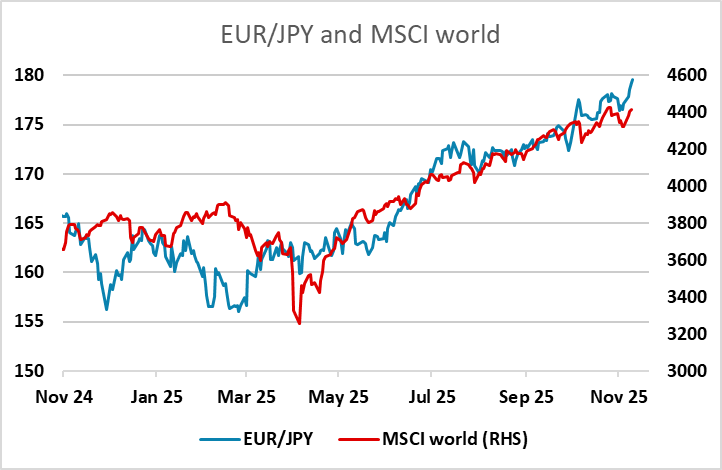

The slide in equities on Thursday saw the USD weaken against European currencies and the JPY, but EUR/JPY still looks overextended against all the normal metrics. A JPY recovery nevertheless looks likely to require significant volatility, with mild corrections in equities only preventing further JPY losses. Intervention might be effective, but seems unlikely unless we see USD/JPY breach 155. Even so, it’s hard to justify the continuing extreme CHF strength compared to the extreme JPY weakness.

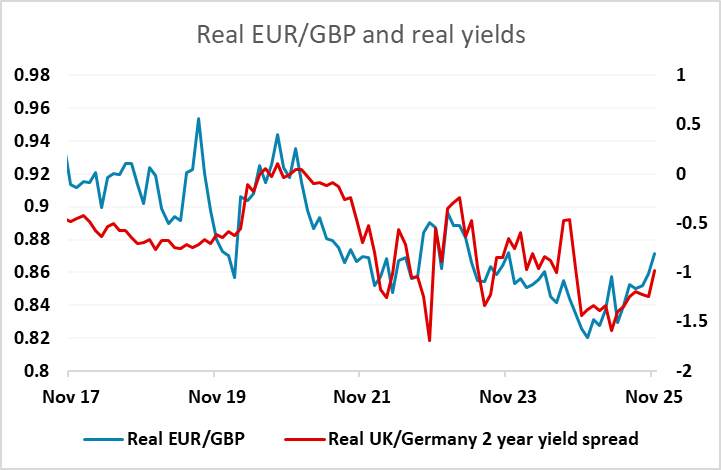

EUR/GBP briefly made new highs for the year above 0.8840 on Thursday, but political uncertainty should now fade with a challenge to PM Starmer’s leadership looking unlikely in the near term. The weaker than expected GDP data also looks likely to be corrected in October as Jaguar Landrover resumed production after the September cyberattack. While there is likely to be a contractionary Budget on November 26, this is now expected and a December UK rate cut is 80% priced in, so we would not see a lot of upside for EUR/GBP near term, with 0.8850 likely to be a struggle.