Brazil CPI Review: Food Prices Lead the Rise in January

The Brazilian National Institute of Statistics reported January's CPI, rising 0.42% (m/m), slightly above expectations, with a Y/Y index drop to 4.5%. Food and Beverages saw the biggest increase at 1.4% (m/m). Despite CPI exceeding expectations, underlying measures show marginal improvements, suggesting minimal impact on BCB strategy. Inflation persistence expected in 2024, forecasting CPI to end at 4.0%.

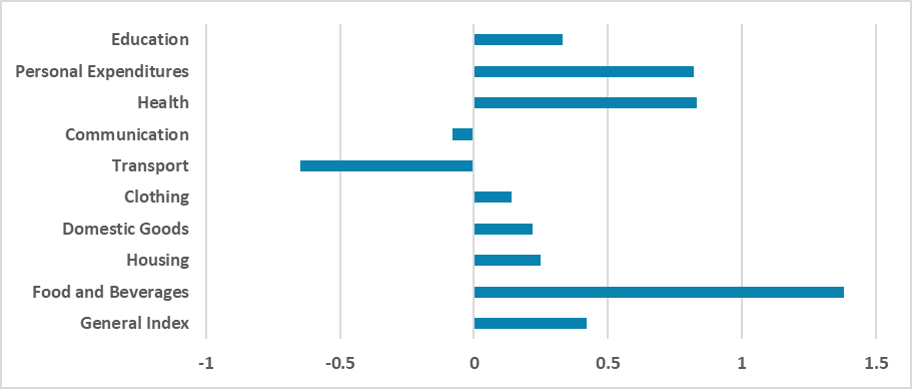

Figure 1: CPI by Groups (m/m, %)

Source: IBGE

The Brazilian National Institute of Statistics has released the Consumer Prices Index (CPI) numbers for January. The data showed that the CPI has risen by 0.42% (m/m), slightly above market expectations of 0.36% according to the Bloomberg Survey. Therefore, the Y/Y index has marginally fallen to 4.5% from 4.6% in December. Note that the index is still inside the BCB bands (1.5%-4.5%), but it is at the upper limits.

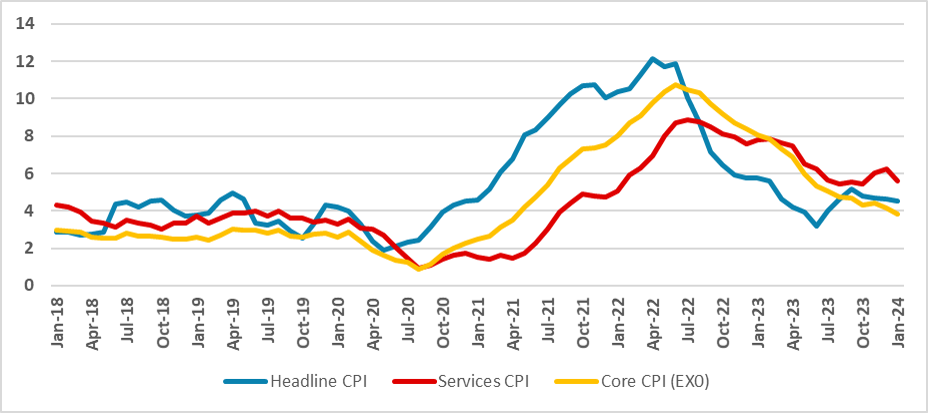

Figure 2: CPI (Y/Y, %)

Source: IBGE and BCB

The biggest rise in January comes from Food and Beverages, which grew by 1.4% (m/m) in January. It is the second month in which Food and Beverages have grown above 1%. However, due to the strong drop in food prices in the middle of 2023, Food and Beverages CPI has grown only 1.4% in the latest 12 months. The BCB has already advocated that due to the El Niño phenomenon, it is very likely that food prices will continue to rise, but the limits of this uptick are yet to be seen. Transport CPI has decreased by 0.6% in January as a direct response to lower airfare tickets, which were readjusted downwards after the end-of-year vacations.

Looking at some underlying measures, we see no deterioration in the inflationary outlook. Services CPI continues to show some persistence, standing at 5.6% (Y/Y), although it has lowered from 6.2% in December. Core CPI is standing at 3.8% (Y/Y), which is its lower figure since April 2021.

Although the CPI measure came above market expectations, the underlying measures continue to show some marginal improvements, and it should not change much of the BCB strategy. The major risk will be whether the rise in food prices, coupled with a strong labor market, will translate into renewed inflationary pressures. We believe this will not be the case as the demand is starting to weaken a bit and job creation is decelerating. However, we also see no reason for any sort of discussion on increasing the current 50bps pace of the cuts. Inflation will continue to show persistence during 2024, and monetary policy needs to continue to be restrictive during 2024, meaning the BCB does not want to get to neutral rates too soon. We continue to forecast the CPI ending the year at 4.0% (Y/Y), above the 3.0% target but inside the BCB bands.