U.S. December core PCE prices significantly softer than CPI

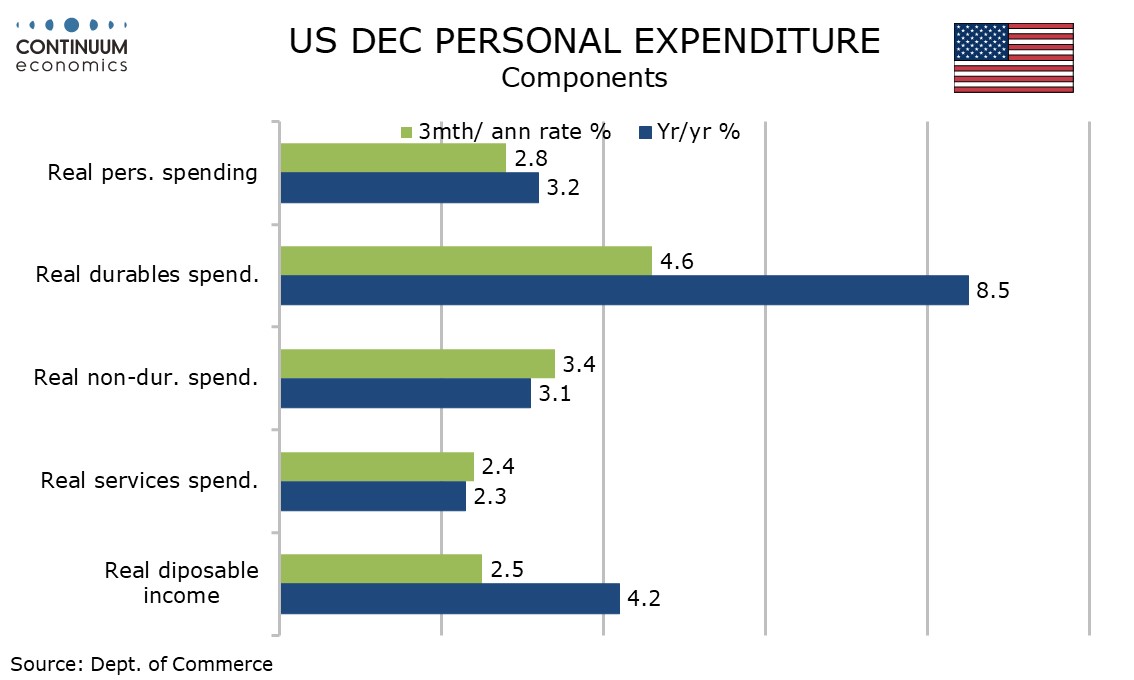

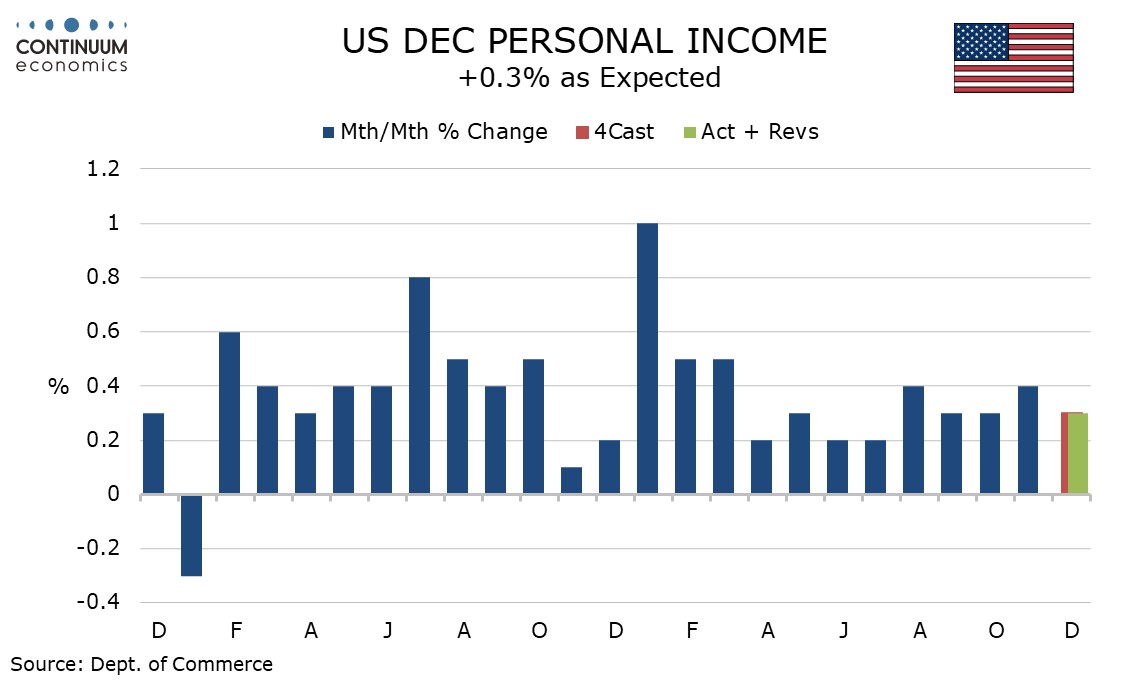

December’s personal income and spending report is largely old news with Q4 totals seen in the GDP report. The data confirms solid growth in real disposable income and spending, the latter finishing Q4 on a strong note. PCE price data is subdued, and more so than the CPI.

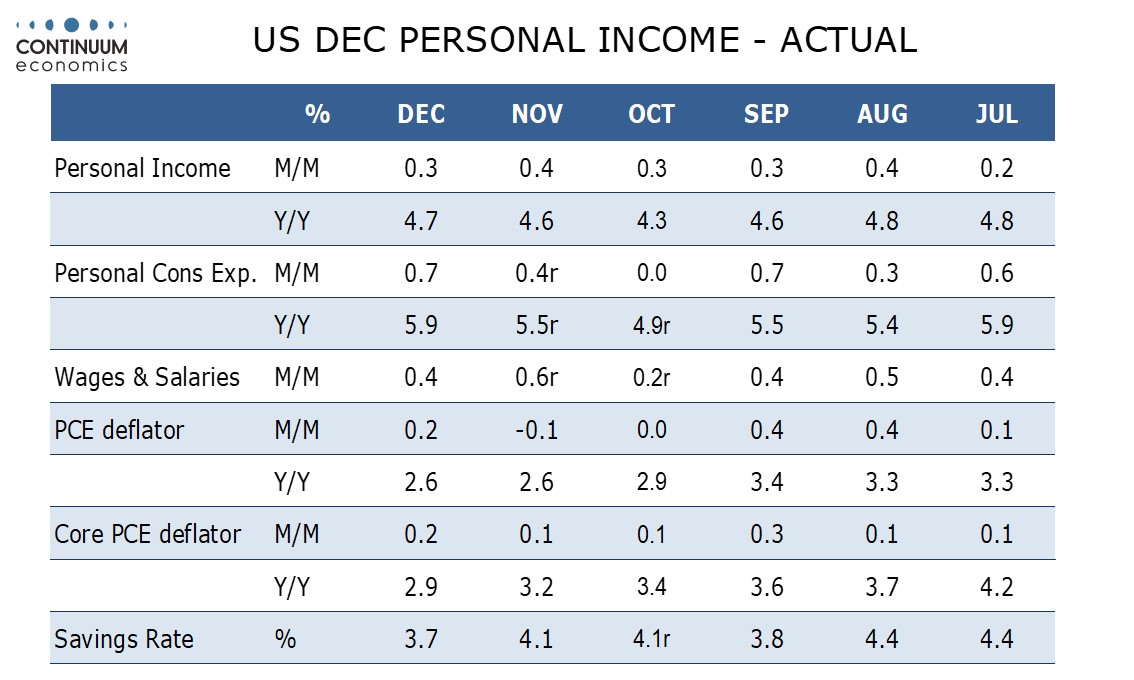

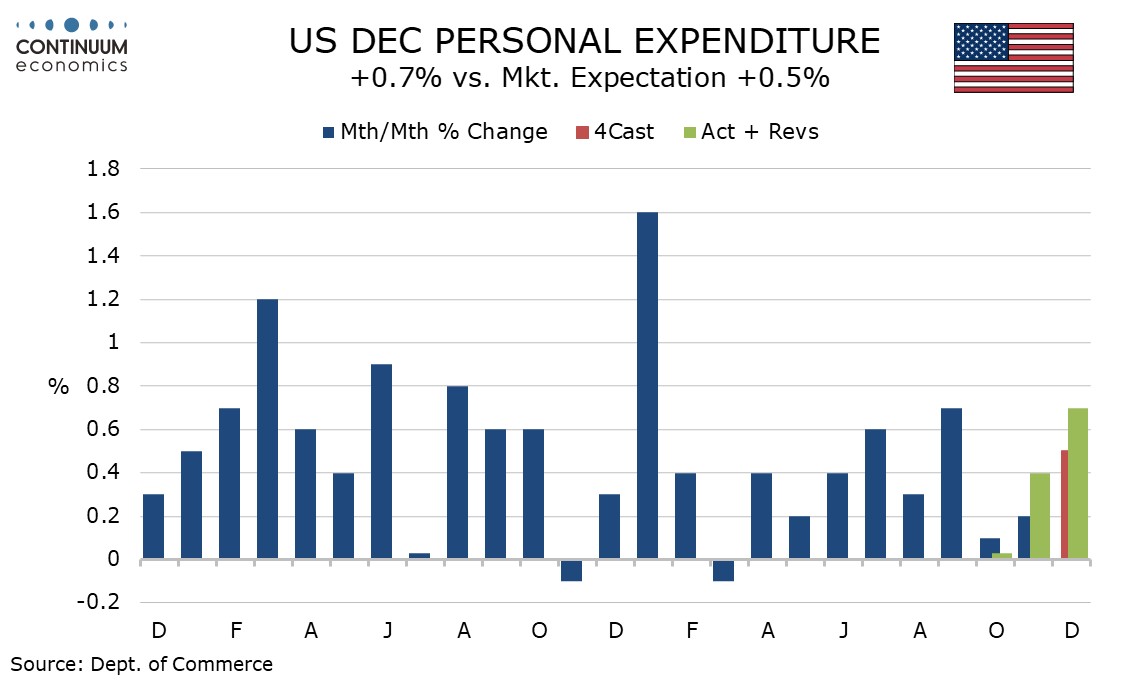

The 0.3% gain in personal income and 0.2% gain in the core PCE price index were in line with pre-GDP expectations, though the 0.7% rise in personal spending exceeded the consensus.

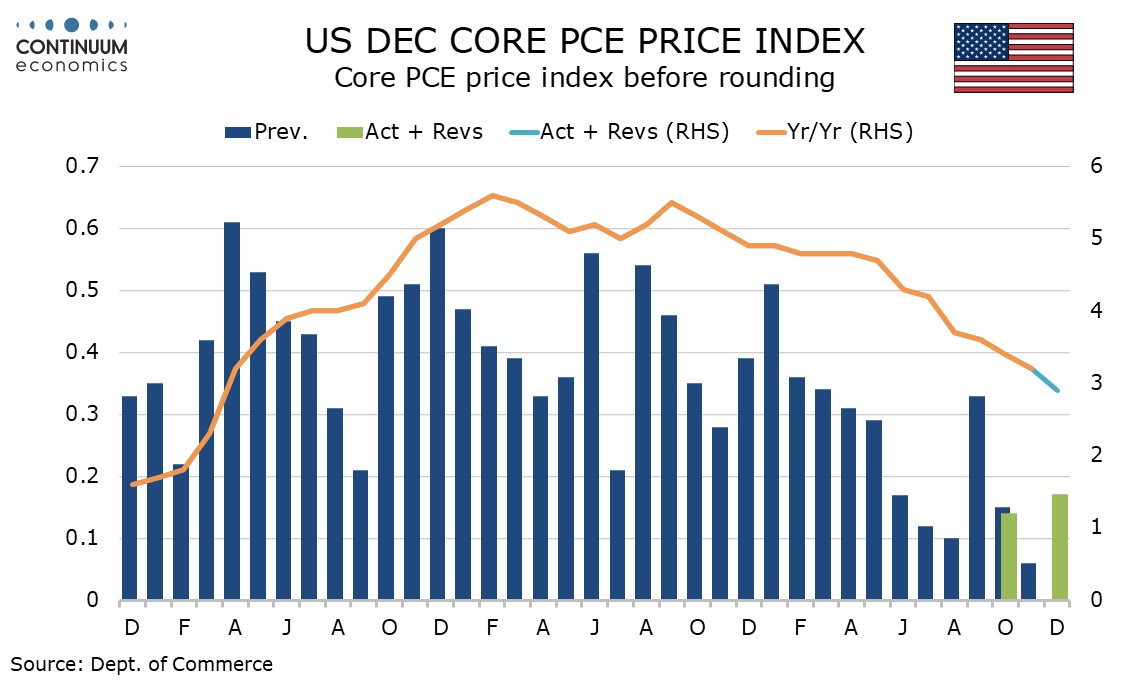

PCE prices rose by 0.2% overall and in the core rate, both softer than 0.3% gains seen in the CPI. The core rate rose by only 0.17% before rounding despite the core CPI having marginally exceeded 0.3%.

Yr/yr data showed core PCE prices sipping to 2.9% from 3.2%, slightly lower than expected, while the annualized gain was 2.0% in both Q3 and Q4, consistent with the Fed’s target. Overall PCE prices were steady at 2.6% yr/yr with Q4’s annualized gain being 1.7%.

Personal income details showed wages and salaries up by 0.4% with little growth elsewhere other than interest income. Spending details showed goods up by 0.9%, stronger than the 0.6% gain reported for retail sales, and services up by 0.6%.

Real disposable income rose by 0.1% on the month and 2.5% annualized in Q4, with the respective gains for real spending being 0.5% and 2.8%. The savings rate of 3.7% is at a 12-monh low, down from 4.1% in November.