FX Daily Strategy: N America, Oct 28th

Quiet Tuesday calendar suggests positioning for events later in the week

CAD risks on the upside with BoC cut nearly fully priced

Equity strength weighing on JPY but valuation very stretched

EUR/CHF to hold above key 0.92 support but modest upside scope

Quiet Tuesday calendar suggests positioning for events later in the week

CAD risks on the upside with BoC cut nearly fully priced

Equity strength weighing on JPY but valuation very stretched

EUR/CHF to hold above key 0.92 support but modest upside scope

There is very little of note on Tuesday’s calendar, with just some regional Fed surveys from Richmond and Dallas and some consumer confidence numbers from Germany and Italy. All in all, there’s nothing to disturb the broadly risk positive tone that we saw on Monday, unless we see some backtracking on the US/China deal. All the major events are in the back end of the week, with the FOMC, BoC, ECB and BoJ meetings, and the quarterly results from Amazon, Apple, Microsoft, Alphabet and Meta, as well as the Trump/Xi meeting in South Korea. Tuesday therefore seems like a day for final positioning for these events.

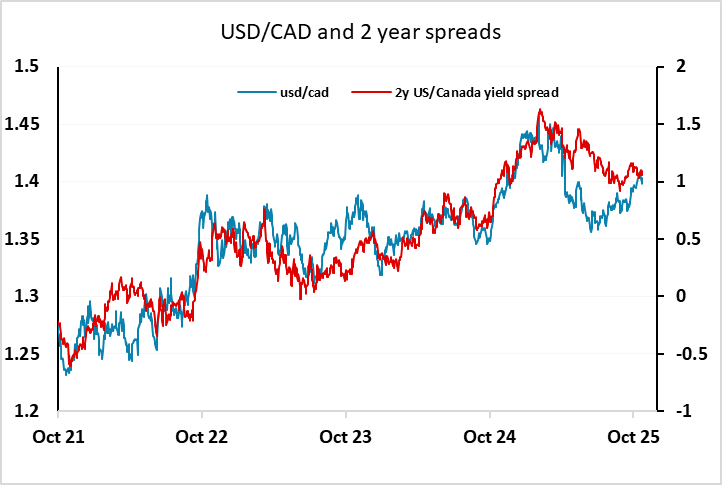

Of the central bank meetings, the BoC and BoJ have the most potential to be market moving, with the Fed and the ECB very unlikely to deviate from market expectations. The BoC is first up on Wednesday, and could potentially be influenced by the weekend deterioration of US/Canada relations which led to the announcement of a further 10% US tariff on Canada. This may not finish up being levied for long, if at all, but some see it as an extra reason for a BoC rate cut, which is now 90% priced in. However, we still see the BoC decision as a close call after some recent stronger Canadian data, and we slightly prefer a no change decision, which suggests significant CAD upside risks, while the downside risks are modest given the current market pricing. USD/CAD hasn’t had much reaction to the tariff news, although it was a little firmer in the North American session on Monday, but with USD/CD currently broadly consistent with the long-term yield spread relationship, the risk from here should be on the downside.

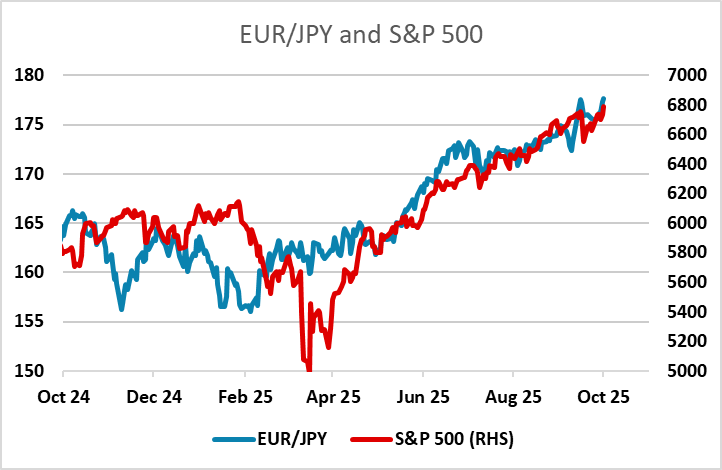

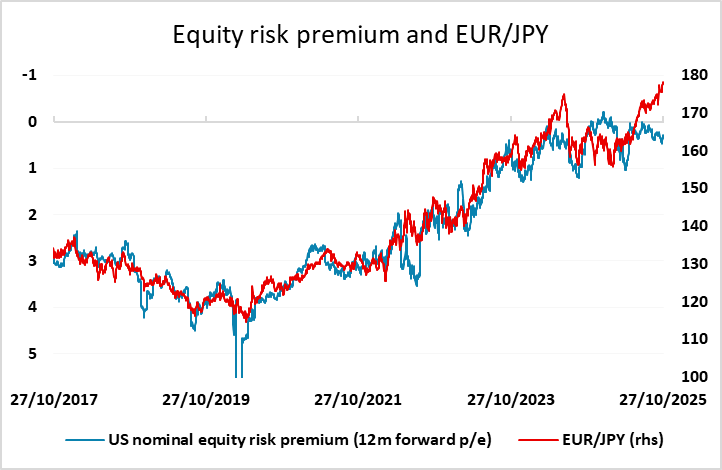

The most notable market move on Monday was the break to yet another new high in most US equity indices in response to the Trump/China news, although this also owes a lot to the recent decline in US yields helped by the weaker CPI data last week. US equity risk premia have edged down, but are above recent lows seen when US 10 year yields were much higher. EUR/JPY hit another new all time high in response, and in recent weeks seems to be moving with equity indices rather than with equity risk premia as it did for most of the last 8 years. However, the case for JPY weakness was slightly reduced by the comments from new cabinet secretary Minoru Kihara, who called for the JPY to move in a stable manner and reflect fundamentals. While this doesn’t suggest that the new government is about to actively intervene to strengthen the JPY, it does suggest that they are not seeking a weaker JPY. A turn in EUR/JPY could be seen if there is any correction in equities on the back o this week’s tech earnings. There is also a risk that the Fed undermines the recent equity rally by sounding more hawkish than the very dovish profile that the market currently prices in, even though they are all but certain to cut the funds rate on Wednesday,

EUR/CHF has edged up from its lows near 0.92 in response to then more risk positive market tone on Monday, but remains at very low levels given the generally risk positive tone seen in recent years. The safe haven status of the CHF against the EUR means it continues to benefit from any concerns about intra-Eurozone divergence even if the aggregate picture looks reasonably comfortable, so tension around weakness in France is likely to prevent a major CHF rally. However, it will be hard to justify a break sub-0.92 without a major turn in risk sentiment.