FX Weekly Strategy: October 28th - November 1st

BoJ may not hike but is likely to sound hawkish

US employment report may be weak but weather affected

USD/JPY downside risks as yield spreads should shift in JPY’s favour

GBP may benefit even though the budget is likely to be looser than previously thought

Strategy for the week ahead

BoJ may not hike but is likely to sound hawkish

US employment report may be weak but weather affected

USD/JPY downside risks as yield spreads should shift in JPY’s favour

GBP may benefit even though the budget is likely to be looser than previously thought

The US employment report on Friday is likely to main event of the week, although there is potential for Thursday’s BoJ meeting to surprise, while the UK budget on Wednesday is likely to have some impact on GBP.

We expect the BoJ will keep rates unchanged at 0.25% but guide there will be more tightening soon. The BoJ took a hawkish tilt in the July meeting with echoes from BoJ officials over the past months, the latest being board member Adachi saying conditions are already in place to start normalizing policy. However, market expectations of tightening were reduced in response to the initial comments from new PM Ishiba, although he has since walked back on his initial dovish comments. While Ueda also suggested in early October that the time was not ripe for further tightening, the weakness of the JPY through October may well induce a more hawkish stance. There is an outside chance of a hike this month, even though the market has almost no risk priced in, as the Ueda BoJ has a history of surprise moves. But it is more likely that Ueda’s comments will signal a strong likelihood of a hike in December. This could be 25bps or just 10bps, but the market is only pricing 6.5bps so any indication of a December hike would be seen as JPY positive.

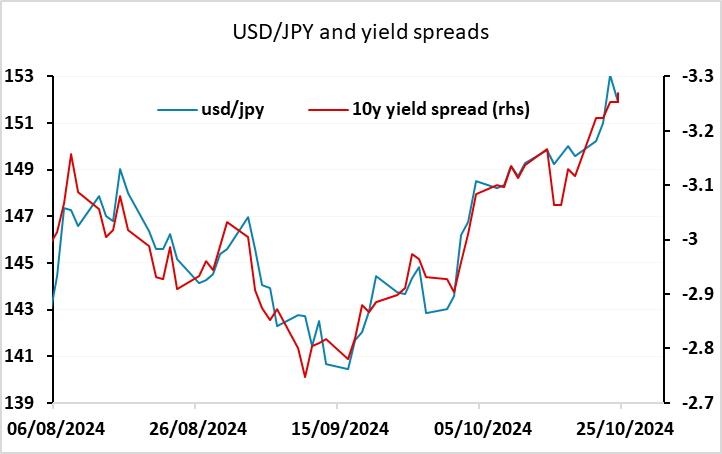

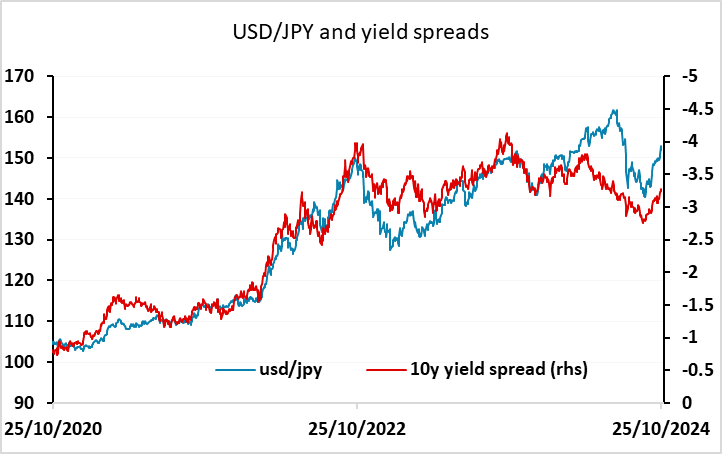

However, even though the comments from Ueda and Ishiba undermined JPY sentiment, most of the weakness of the JPY in October has been due to rising US yields rather than changing expectations of BoJ policy. 10 year yield spreads continue to be the main driver of USD/JPY moves, and even though the spread has widened sharply in October, (more than) all of this has been due to higher US treasury yields. 10 year JGB yields have actually risen 10bps on the month, but 10 year UST yields are up 45bps. There is scope for JGB yields to move up on the back of the BoJ meeting, but the move is unlikely to be large if there is no rate hike. 5bps could be worth a figure and a half in USD/JPY, but for a real turn in the short term trend we are likely to need to see a topping out in US yields. Longer run, we still see a substantial USD/JPY decline, driven largely by higher JGB yields, but the short term volatility is more likely to come from the US.

It is possible we see a big move in US yields on the back of the US employment report, where the forecast is more uncertain than usual because of the weather and potentially large effects from Hurricanes Helene and Milton. Our forecast of a 75k rise in payrolls is well below the market consensus of 140k, but it is likely than any weakness along these lines will be seen as partially weather related, so we wouldn’t expect a big move. Nevertheless, with the market underestimating the risks form the BoJ and a weaker than expected US employment report, we would see some risks to the USD/JPY downside by the end of the week.

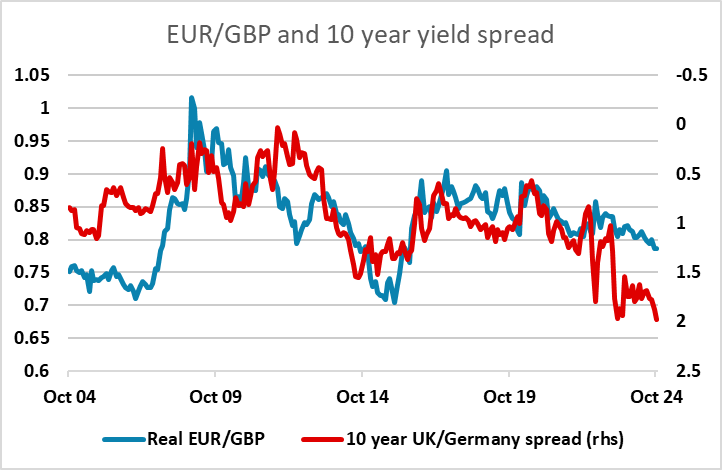

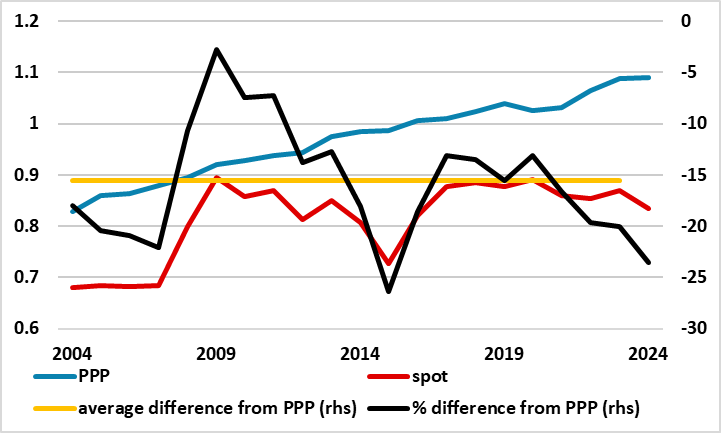

The impact of the UK budget on GBP is hard to assess. There is believed to be a large funding gap between current spending and tax plans, and this was until recently expected to produce significant tax increases and some spending cut. But the latest talk is that the government will be redefining its fiscal rules so that the budget will be less tight than previously thought, with the target being shifted away from debt levels to net financial liabilities in order to allow more borrowing for investment. It is unclear how GBP will react. While a looser budget would be positive via monetary policy expectations being consequently tighter, it might also mean a risk premium on GBP if the markets saw the budget as irresponsible, as was the case with the Truss/Kwarteng budget in 2022. However, the risk premium on GBP that emerged due to that budget has never really completely disappeared, so we doubt it will increase further this time around, especially as the IMF appear to have given their blessing to the government’s budget plans. Indeed, the risk premium may even decline if the budget is seen as fostering growth and helping to improve UK productivity. So we see upside risks for GBP on the budget. Even though the pound is starting from quite expensive levels against the EUR from a longer term perspective, yield spreads suggest it can get mor expensive still.

Data and events for the week ahead

USA

It is a busy week for US data, with GDP, core PCE prices and non-farm payrolls the highlights. Monday however is quiet. On Tuesday we expect September’s advance goods trade deficit to increase to $101.0bn from $94.2bn in a number that could impact expectations for GDP. October consumer confidence and September’s JOLTS report on job openings follow.

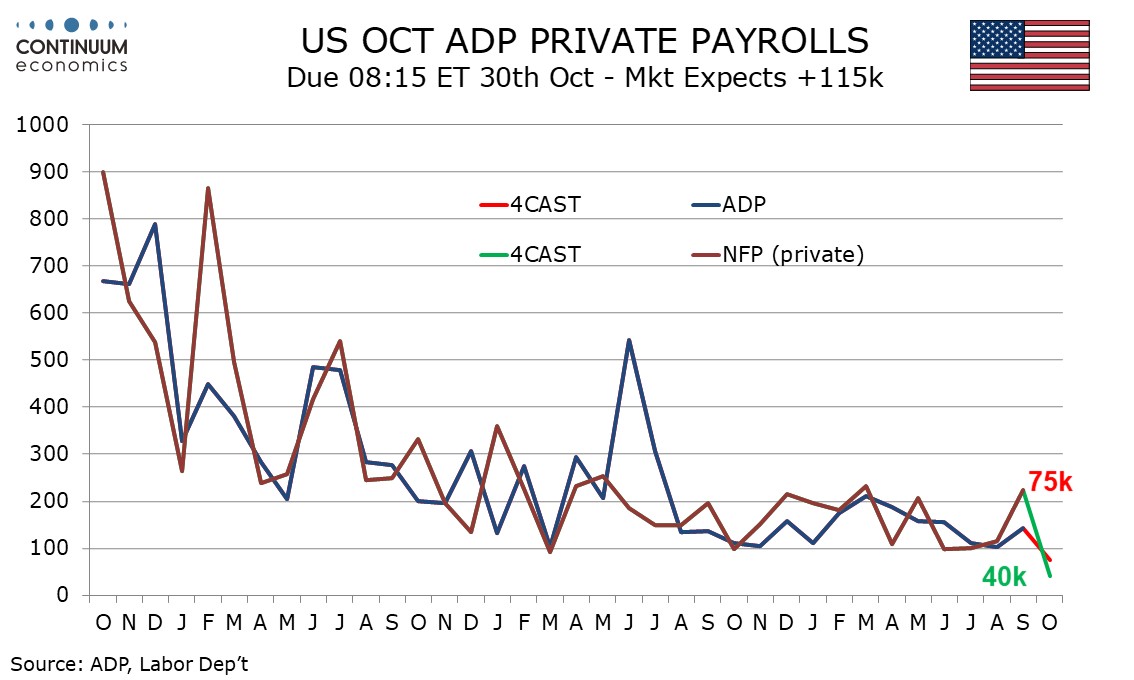

Wednesday sees October’s ADP estimate for private sector employment growth, where we expect a slower 75k increase, restrained by Hurricanes Helene and Milton. Q3 GDP follows shortly afterwards, where we expect a 2.4% annualized increased led by consumer spending with a 2.0% annualized gain in core PCE prices, consistent with the Fed’s target. September pending home sales follow.

Thursday’s personal income and spending data will be largely old news, with Q3 totals released with GDP the day before, but ahead of GDP we expect a stronger 0.3% rise in core PCE prices, and gains of 0.3% in personal income and 0.5% in personal spending. The Fed will also be watching the Q3 employment cost index, where we expect a rise of 0.9%, matching Q2’s. Weekly initial claims are also due.

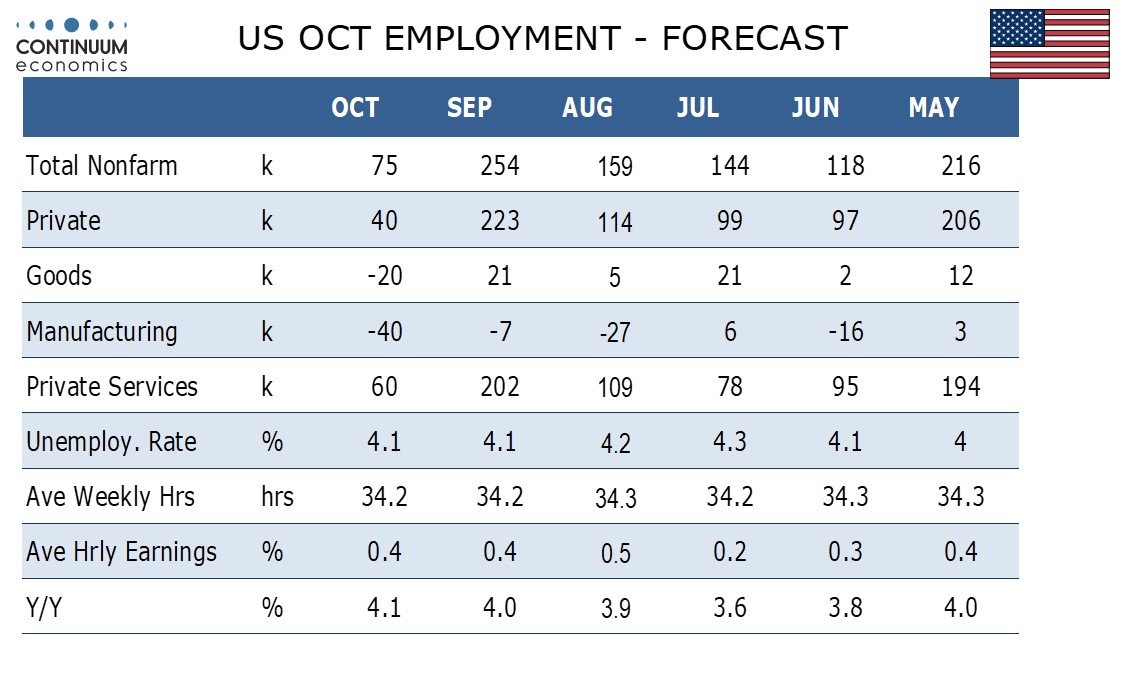

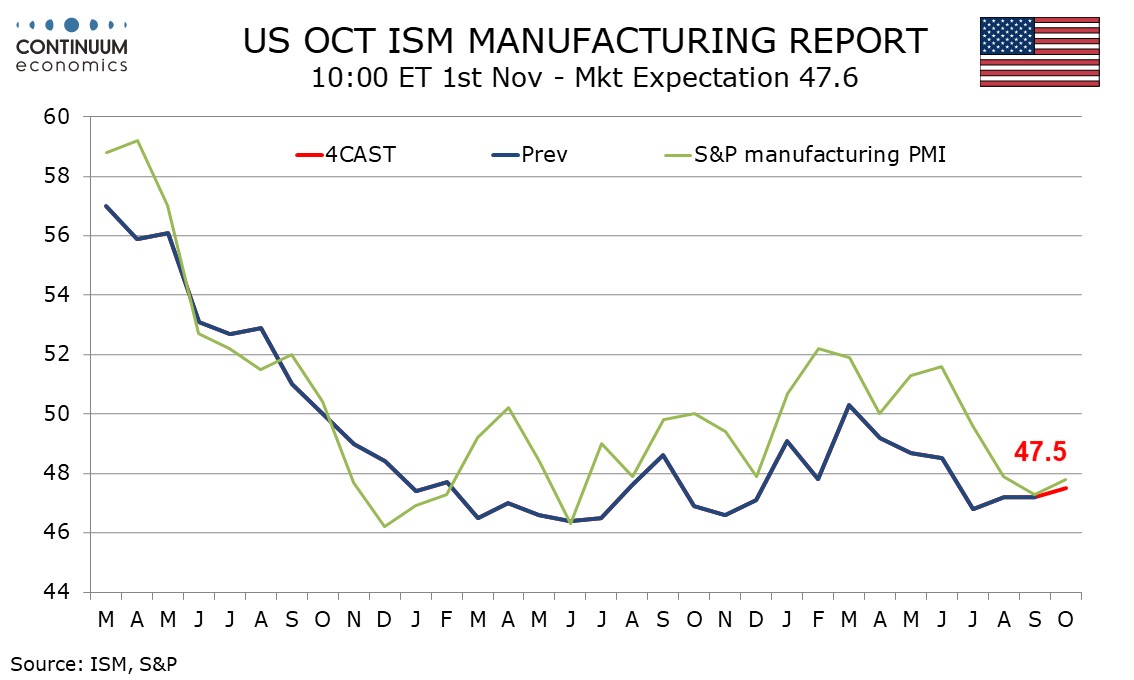

Friday sees October non-farm payrolls. We expect a 75k increase with a rise of only 40k in the private sector, thus underperforming the ADP report which tends to be less sensitive to weather than non-farm payrolls. While we expect payrolls to be weak we also expect the labor force to be restrained by bad weather leaving unemployment unchanged at 4.1%, while we expect average hourly earnings to be on the firm side of trend with a rise of 0.4%. October ISM manufacturing data follows, and we expect a marginal rise to 47.5 from 47.2. September construction spending is also due.

Canada

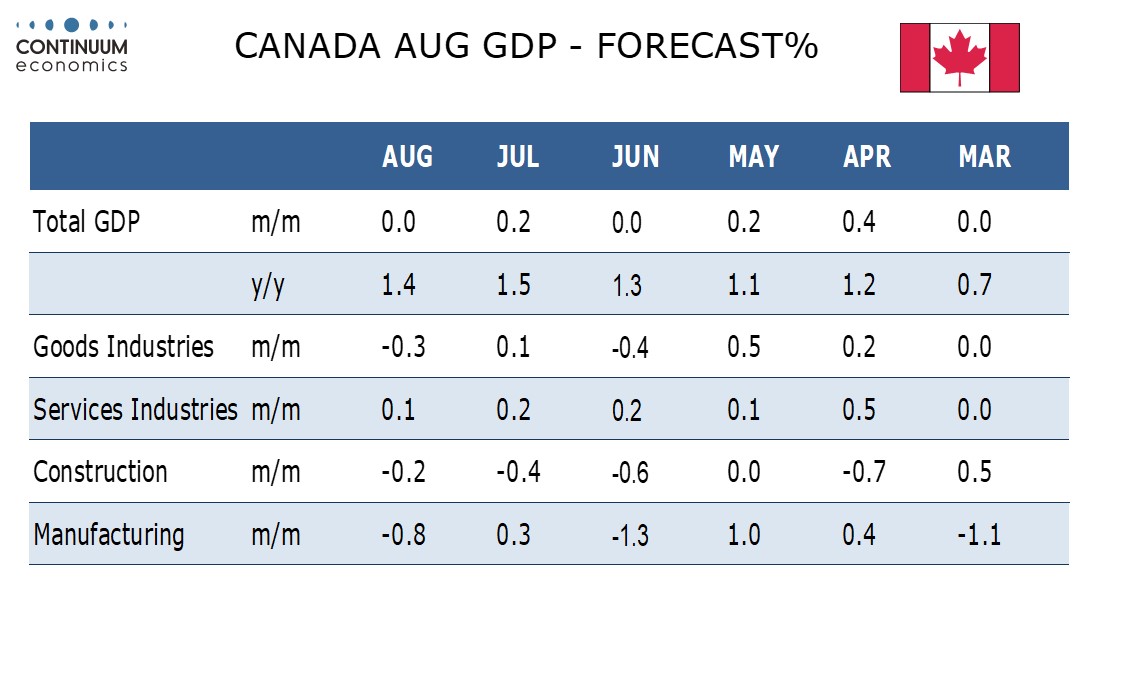

Canada’s data highlight is August GDP on Thursday. With July’s report a preliminary estimate for unchanged was given. An upside surprise or a stronger September will be needed for Q3 to reach the Bank of Canada’s downgraded forecast for a 1.5% annualized increase.

UK

After more weak data, any insights from the BoE will be all the more interesting and in this regard Dep Governor Breeden speaks on Thursday. But the key event is the Budget and Spending Review (Wed). With speculation that the Chancellor faces a £ 40 bln funding gap which will be addressed largely through tax rises, it seems as if the UK economy faces a larger fiscal tightening than was planned under the previous government. However, it seems likely that the Budget measures will actually be less restrictive and should therefore reinforce the Office for Budget Responsibility’s already relatively upbeat growth outlook

Datawise, the main interest BoE Money/Credit numbers (Tue).

Eurozone

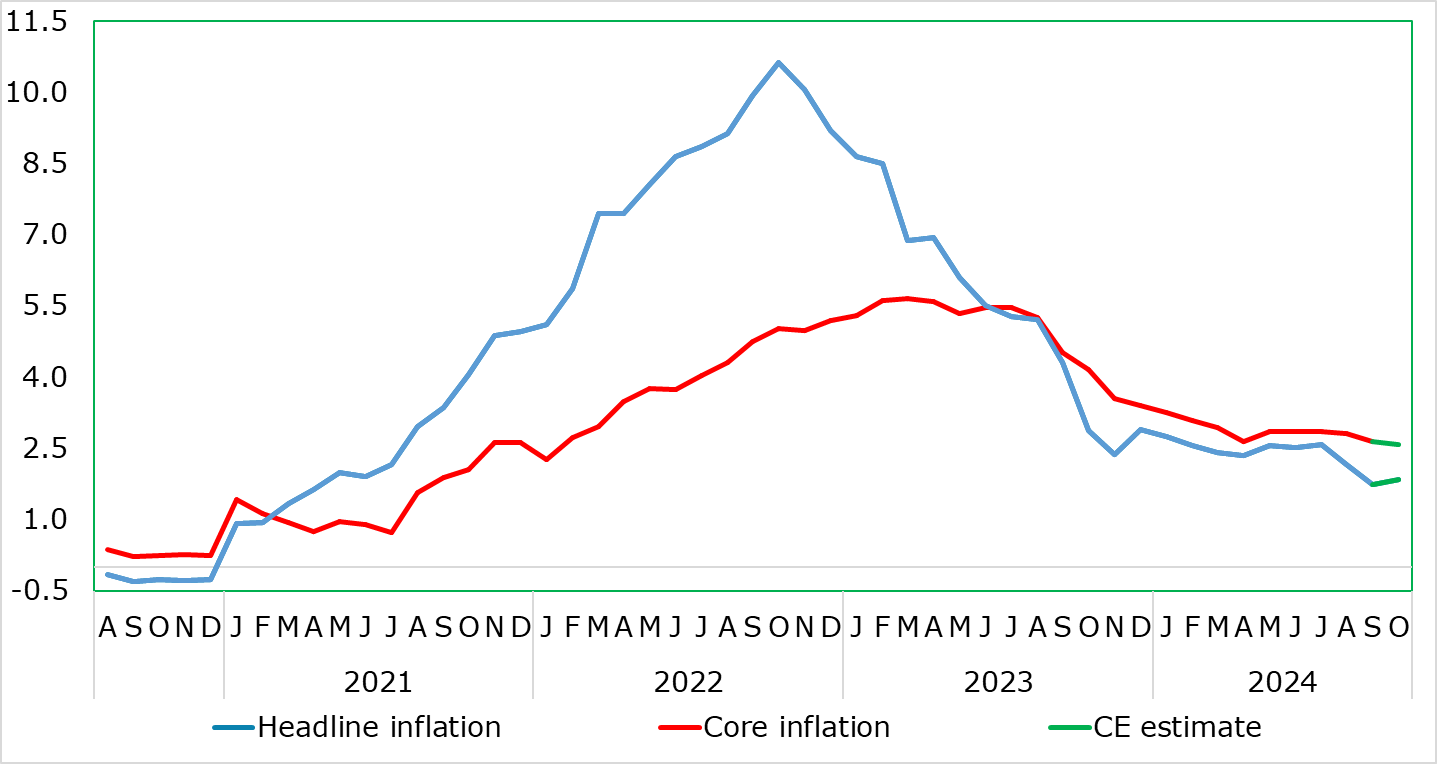

ECB comments are also expected from Panetta (Wed) and Schnable (Thu) offering insights from both side of Council thinking as may the ECB Bulletin (Thu). But over and beyond unemployment figures (Thu) inflation data are the focus. Lower energy costs were the main factor behind the sharp fall in HICP inflation, which fell from 2.2% in August to 1.7%, the latter revised down a notch from the flash estimate. This is the first sub-target reading since June 2021. Services inflation also edged lower, this allowing the core rate to fall 0.1 ppt to 2.7% a six-month low. We see energy-related base effects and m/m rise in fuel prices taking the headline EZ HICP rate back up to 1.9% in October (Thu) but with the core falling a further 0.1 ppt. German data come the day before; we see energy related base effects and possible fuel price rises taking the headline up a notch to 1.9%.

Headline Stays Below Target – For Now?

Source: Eurostat, CE, % chg y/y

But GDP data for the EZ and most member economies (Wed) may be the media focus. At best, the EZ economy is diverging ever more clearly as Germany falters while Spain prospers. However, the risks are that the whole of the EZ is weakening. Indeed, in contrast to ECB and consensus thinking of a second successive quarter of 0.2% q/q GDP growth, we see a clear risk that the EZ economy failed to grow in Q3. Thus would accentuate the slowing seen in the previous quarter, even though the various economies will again still see contrasting fortunes. Otherwise, European Commission data should add to signs of faltering activity and disinflation.

Rest of Western Europe

There are key events in Sweden, with (expected to be weak afresh) monthly GDP indicator data (Tue). The Economic Tendency Survey arrives on Wednesday. Switzerland sees important CPI figures (Fri) and the monthly KOF survey (Wed).

Japan

The BoJ meeting will be held on Thursday. It is possible the BoJ will hike again but on balance we think not. The balance hangs on BoJ’s assessment towards the latest wage/price dynamic and whether there is any political pressure from the new PM. However, they may well give a strong signal of a December hike. From the inflation perspective, a hike in Oct and Dec is both feasible and does not seem like a change in stance of future monetary policy. We see the BoJ to at most hike once by year end 2024 and to 1% in 2025. We also have retail trade and housing data on the same day. Else, unemployment rate will be released on Tuesday.

Australia

Q3 CPI on Wednesday will be critical. We feel like there is a good chance it will show moderation from Q2, preview by monthly CPI. The magnitude of moderation is critical, currently we favor a read below mid 3% as we see CPI will be around the upper bound of target range in Q4. The current RBA forecast sees no rate changes until mid 2025 and it may trigger a revision if the Q3 CPI is close to our forecast. Retail sales is on the same day but carries less weight. There are also some tier two data on Thursday and Friday.

NZ

Business confidence and outlook on Thursday and Building permit on Friday.