FX Daily Strategy: Europe, Sep 9th

US benchmark payroll revisions unlikely to have any sustained impact

AUD/USD pressing top end of the range ahead of confidence data

SNB’s Schlegel may show concern about CHF strength

JPY weakness on Ishiba resignation unlikely to last

US benchmark payroll revisions unlikely to have any sustained impact

AUD/USD pressing top end of the range ahead of confidence data

SNB’s Schlegel may show concern about CHF strength

JPY weakness on Ishiba resignation unlikely to last

Tuesday is a quiet day for data, and there may consequently be more focus than usual on the US payroll benchmark revisions. This is a revision to the level of payrolls reported in March this year, so will have no impact on the subsequent data. The consensus expects a downward revision to the current reported level, perhaps of a few hundred thousand, but it isn’t clear that this will make any substantive difference to expectations of the data or policy going forward. There will be no revision to then household survey data, so the unemployment level and rate won’t be affected. Nor will there be any indication of where the revisions came on a monthly or quarterly basis. So while the revisions may grab some headlines, we see little reason why they should have any lasting effect on market prices.

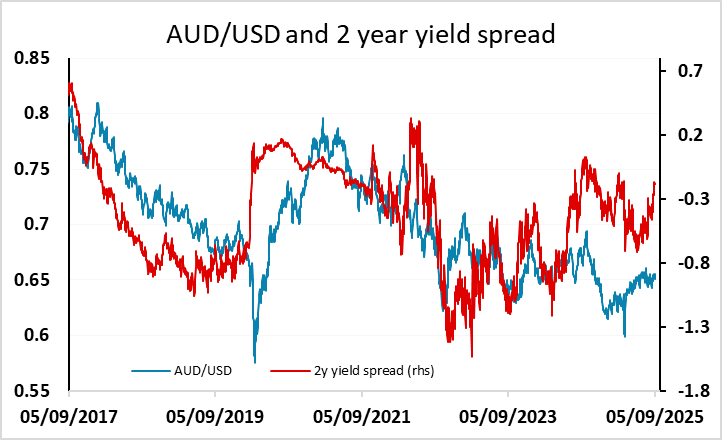

Otherwise, there is nothing major on the calendar, but the set of confidence numbers out of Australia may consequently be of interest. Consumer confidence numbers from Westpac and NAB business confidence numbers are both release, and may gain more attention than usual with AUD/USD pressing on the top end of its range near 0.66. Both the consumer and business confidence numbers were strong last time around, with the NAB business confidence number the strongest since August 2022. Another strong number would support the case for an AUD advance beyond 0.66, although we suspect it will be difficult to sustain such gains without some further general USD weakness.

There are a few central bank speeches in Europe, from the Bundesbank, SNB and the BoE, with the SNB’s Schlegel possibly having the most potential for market impact. Few expect the SNB to move to negative rates any time soon unless we see inflation dip into significant negative territory, and Schlegel is likely to confirm his. However, there may be sensitivity to any comments about the currency, with EUR/CHF once again dipping towards the 0.93 level in the last few days. Currency strength should now be even more of an issue for the SNB with high US tariffs on Switzerland already making them significantly less competitive. We continue to see the 0.93 area as likely to be an effective base for EUR/CHF in the absence of a major risk turn lower.

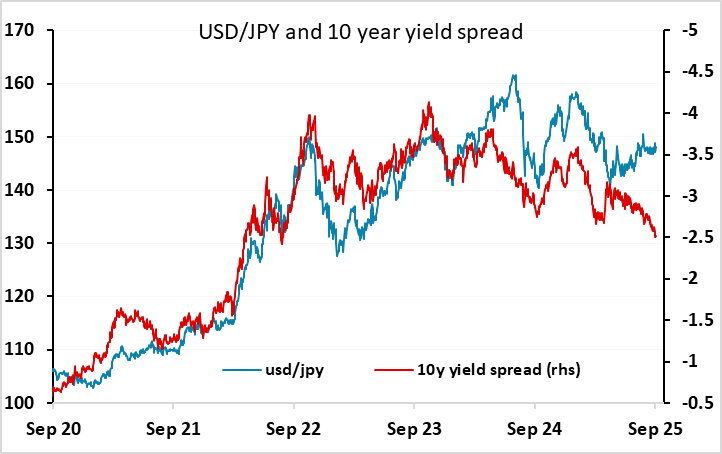

The JPY suffered in Asia on Monday as a result of the resignation of PM Ishiba at the weekend, but we see the resignation as likely to be at worst neutral for the currency in anything other than the short term. Ishiba’s replacement will not be fiscally more conservative, and may be more expansionary, so his departure makes BoJ tightening more rather than less likely. While the October 30 BoJ meeting may be too early, with the October 4th LDP election, there is only a 20% chance of a BoJ tightening priced at that meeting, and a December tightening remains our central view. This is priced as just a 50% chance. Of course, the JPY’s prospects will largely be determined by global rather than local factors, but yield spreads already suggest scope for substantial JPY gains, while the recent modest rise in risk premia is also typically JPY supportive, so we remain JPY bulls for the medium and long term.