FX Daily Strategy: Europe, July 3rd

USD could suffer on weaker US employment report

USD/JPY likely to respond most to lower US yields

GBP struggling as UK fiscal policy continues to disappoint

USD could suffer on weaker US employment report

USD/JPY likely to respond most to lower US yields

GBP struggling as UK fiscal policy continues to disappoint

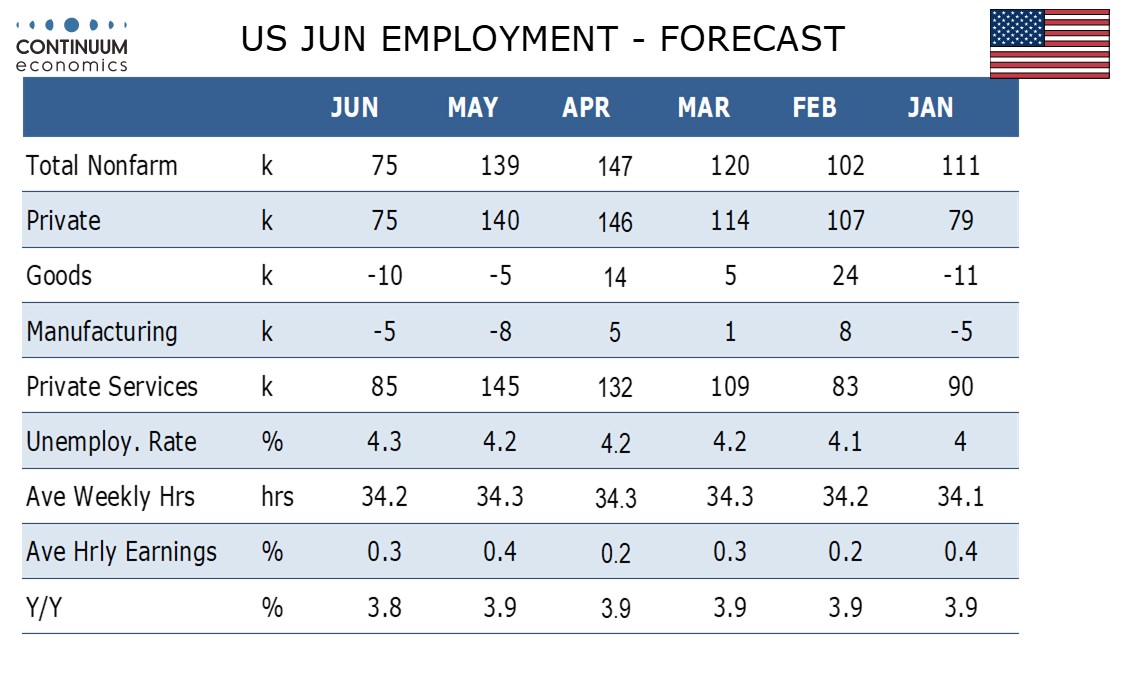

The US employment report will be the primary focus for markets on Thursday. We expect a 75k increase in June’s non-farm payroll, significantly slower than May’s 139k though consistent with a slowdown in growth rather than an economy entering recession. We expect an in line with trend 0.3% increase in average hourly earnings and an uptick in unemployment to 4.3% after three straight months at 4.2%. ADP’s June estimate of private sector employment showed the first decline since March 2023, contrasting positive job openings data on Tuesday, but consistent with recent higher initial claims data. ADP surveys have recently been underperforming non-farm payrolls, for which it is not a particularly reliable guide, so we aren’t altering our forecast in response. However, our forecast was already below the market consensus of a 120k rise, and although the market may be expecting something lower than this after the ADP data, our forecast would still be seen as a weak outcome.

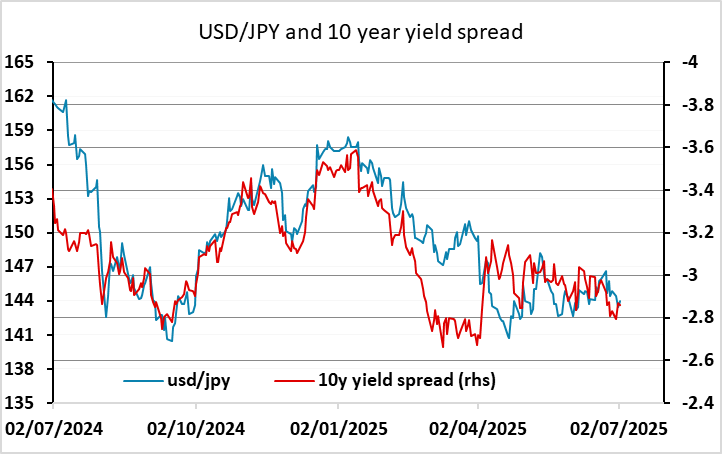

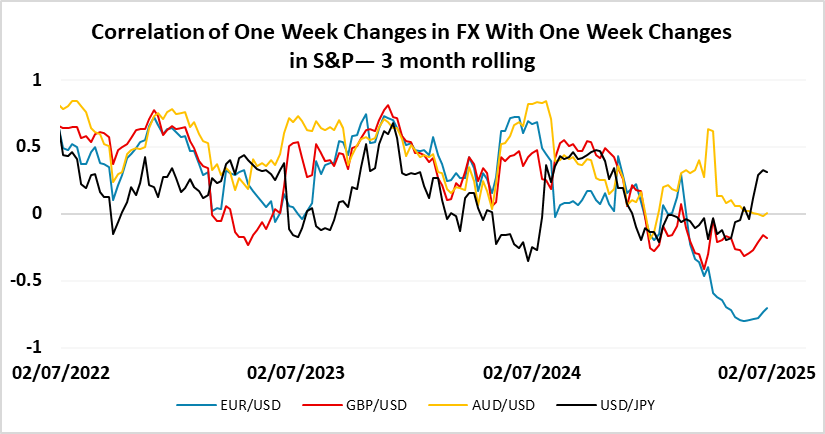

Of course, in reality the difference between 75k and 120k is modest in an economy the size of the US, but the market is on watch for evidence that the economy is slowing, and particularly that the labour market is weakening, so we would expect an increase in expectations of Fed easing on numbers in line with our forecast. For FX, this should most clearly be negative for USD/JPY, which remains the pair that is most closely correlated with yield spreads. The USD could also be expected to weaken elsewhere, but the reaction could depend on the equity market reaction. If equities hold up despite weaker data, due to lower US yields, the risk sensitive currencies might also perform well. However, the correlation of the USD with equities is no longer clear cut, with the USD suffering on the equity sell off from February to April. So we would tend to favour general USD weakness, led by the JPY, if the data is in line with our forecasts.

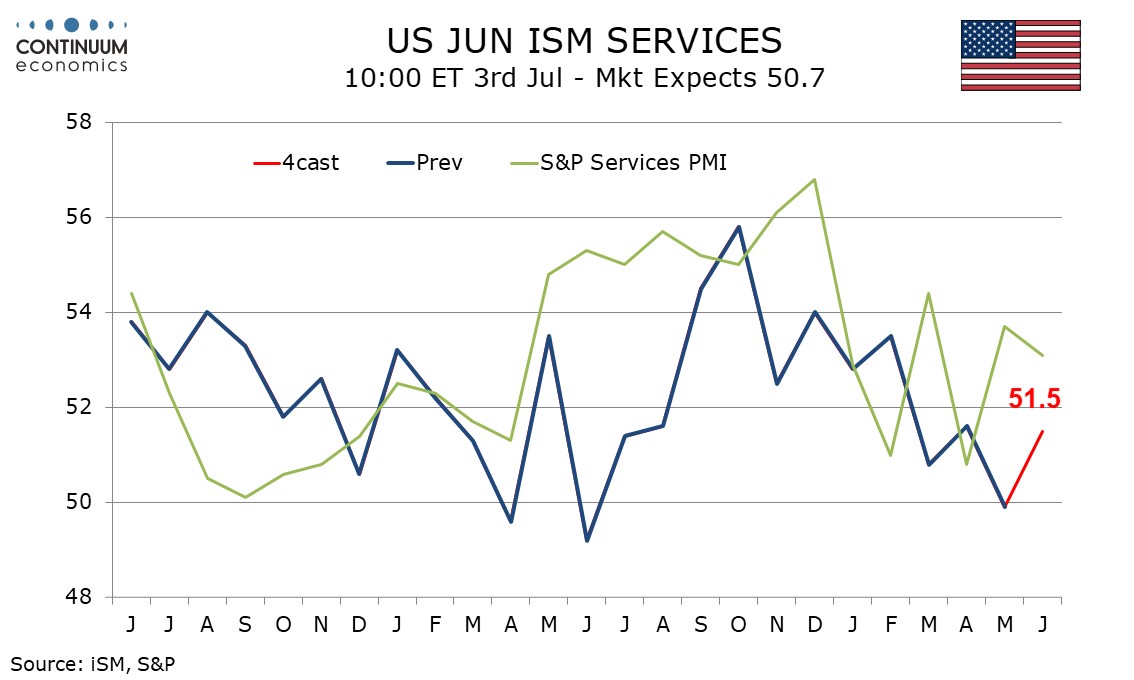

We also have the ISM services data out of the US. We expect a June ISM services index of 51.5, rebounding from May’s 49.9 which edged below the neutral 50 for the first time since June 2024. The recovery will reflect reduced concerns over tariffs and associated worries in the equity market. In this case out forecast is a little above market consensus, so, if correct, may limit the damage to the USD from a weak employment report.

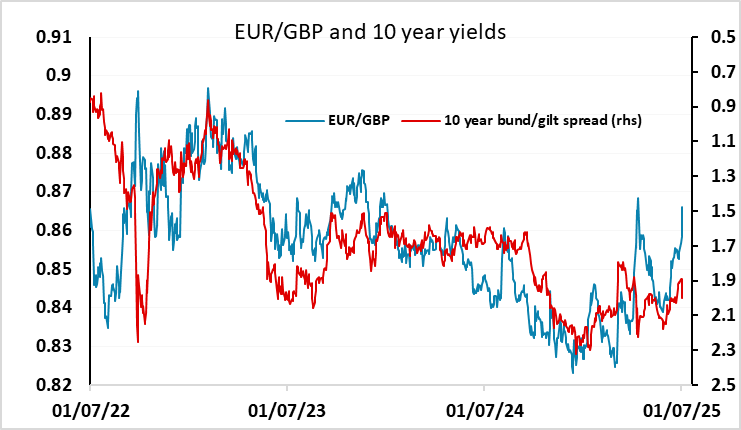

The most significant move on Wednesday was in GBP, which fell across the board at the same time as UK yields rose, once again reflecting a loss of confidence in the UK fiscal position. The sharp rise in UK yields reflects both disappointment at the failure of the government to get their spending cuts through parliament and talk that Finance minister (Chancellor of the Exchequer) Rachel Reeves may resign. We saw a similar move after Reeves’ first UK budget, which itself was a smaller scale version of the reaction to the Truss/Kwarteng budget in 2022. On the previous occasions the spike in UK yields and the decline in GBP have been relatively short-lived, and it is likely to be similar this time around. But EUR/GBP may in any case have upside scope with expectations of policy turning more dovish, so although the rise in yields looks unlikely to persist for long, the decline in GBP may endure.