FOMC Preview For June 12: Hawkish Dots, Flexible Press Conference

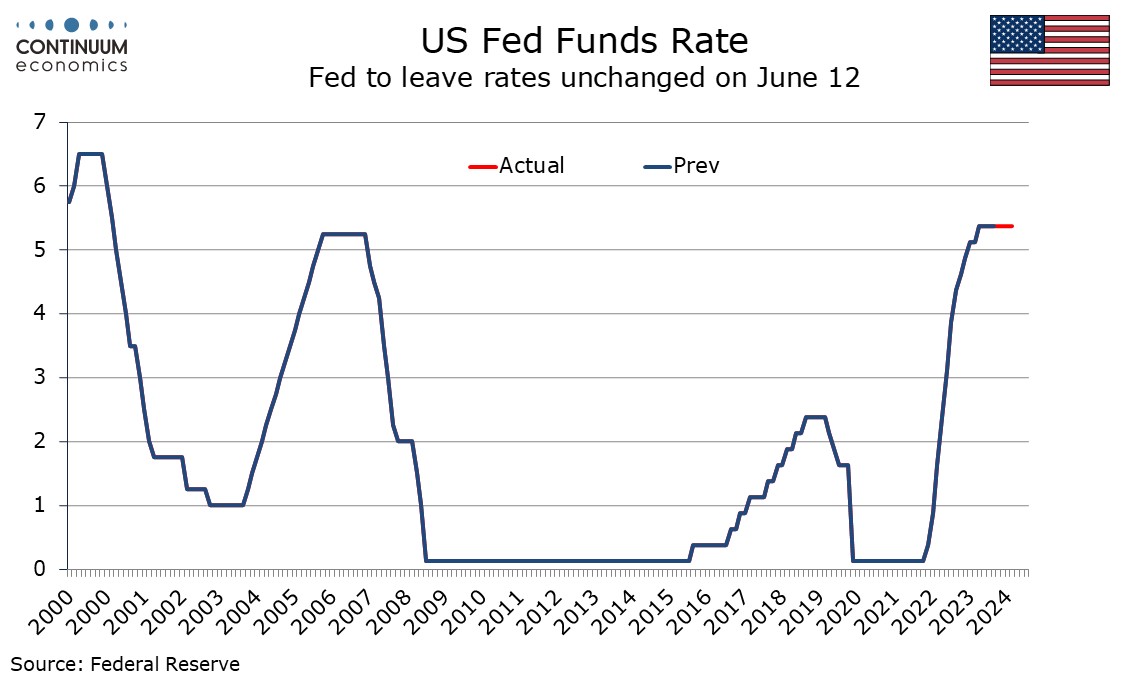

Bottom Line: The FOMC meets on June 12 and looks sure to leave the target range unchanged at 5.25%-5.50%. The tone of the statement may be influenced by the May CPI that will be released on the morning of the decision, but even if CPI surprises on the downside is unlikely to give any hints easing is close. We suspect the dots will be more hawkish, which could be the focus of the initial reaction, but Chairman Jerome Powell at his press conference may downplay the significance of any hawkish dots.

The statement

After the strong May non-farm payroll data, even after a downward revision to Q1 GDP the FOMC is unlikely to adjust its May 1 view that economic activity continues to expand at a solid pace, with job gains remaining strong and the unemployment rate low. Whether they fine tune the hawkish addition to May’s statement that saw a lack of further progress in recent months toward the Committee’s 2% inflation objective will depend on the CPI, but even with a downside surprise any fine tuning is likely to be cautious. The FOMC is likely to repeat that it does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%.

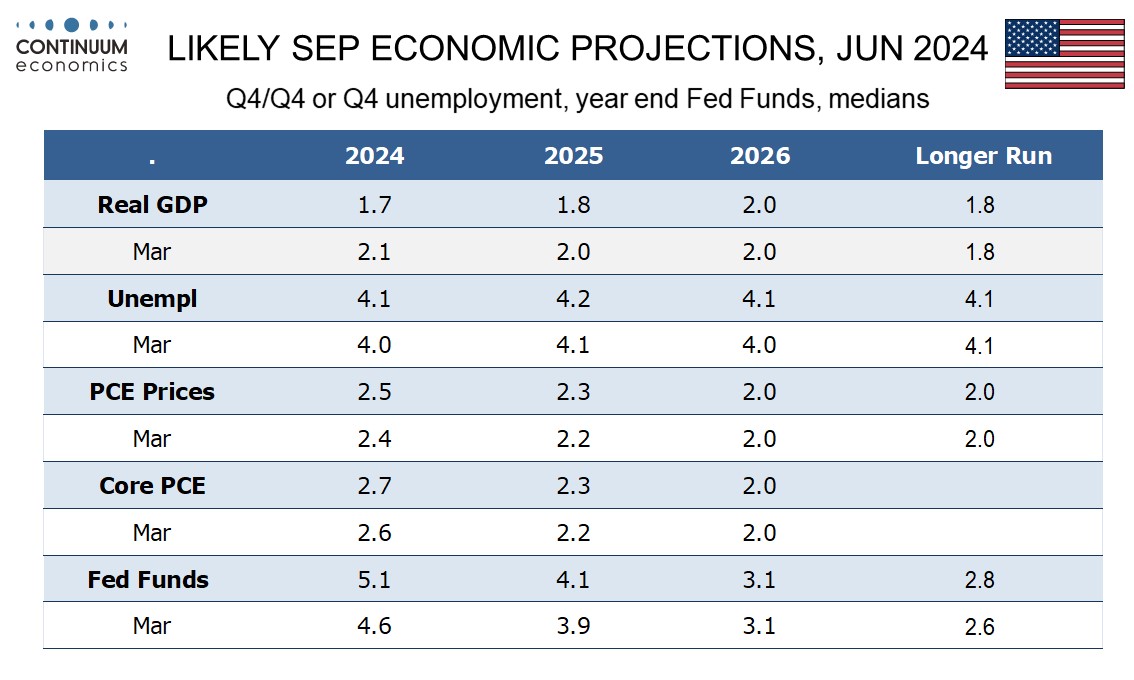

With the statement likely to see few significant changes, initial focus is likely to be on the dots. While the statement will be adjusted from May’s the dots will be adjusted from March, and thus reflect March’s strong CPI that helped shift May’s statement in a more hawkish direction. March saw a median of three 25bps easings projected in 2024, but only one respondent needs to move to a more hawkish position to turn the median to two. With several likely to shift in a more hawkish direction we see risk that the median will project only one easing in 2023, particularly if May CPI shows inflationary pressure persists. We however expect that four 25bps easings will be projected for 2025, rather than three, though that would leave the end 2025 rate marginally above 4% rather than marginally below as was the case in March. Several recent Fed speakers have also suggested the neutral rate may have increased. We expect a modest upward adjustment to the long term neutral rate to 2.8% from 2.6%.

While the dots will be more hawkish, we doubt that the FOMC will revise up its inflation forecasts sharply, with most still likely to look for a slowing in forthcoming months. A slower Q1 GDP is likely to see GDP forecasts revised lower while recent gains in the unemployment rate will see unemployment forecasts revised slightly higher, despite continued strength in employment growth. There may even be a contradiction between economic forecasts looking for the economy, and inflation, to lose momentum, and dots showing caution towards easing due a lack of confidence in the central view. During the press conference, Powell may downplay the significance of the dots, stressing data-dependence, and suggest that easing in excess of the dots is possible if inflation clearly loses its recent momentum. He may also suggest that if data remains firm, the Fed could hold rates steady through 2024. While he will not rule out further tightening, the bar for further rate hikes appears to be quite high.