FX Daily Strategy: N America, April 10th

US CPI the focus

Neutral data likely to favour carry trades

Strong numbers may lead to a test of the BoJ’s resolve

NZD recovers after RBNZ

NOK still favoured medium term but may dip on Norwegian CPI

US CPI the focus

Neutral data likely to favour carry trades

Strong numbers may lead to a test of the BoJ’s resolve

NZD recovers after RBNZ

NOK still favoured medium term but may dip on Norwegian CPI

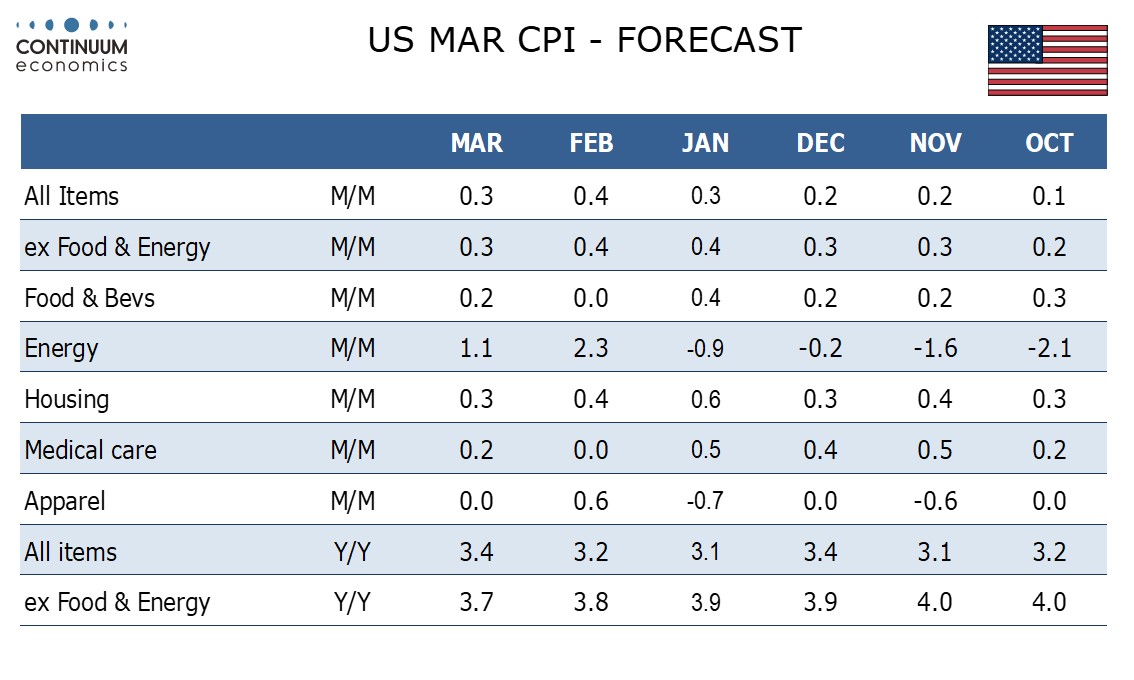

US CPI is the main focus for Wednesday. We expect March CPI to rise by 0.3% both overall and ex food and energy, though before rounding we expect the headline at 0.31% to exceed the core rate at 0.27%, the latter a return to trend after two straight disappointing 0.4% gains seen in January and February. Our forecast is in line with the consensus, and while it wouldn’t make a Fed rate cut in June any more or less likely, it would probably restore the more risk positive tone seen earlier in the week after the dip seen near European close on Tuesday. The market’s default position in the last week or two has been to favour the carry trade in relatively quiet, low volatility conditions, but there has been little net movement as we have seen the generally positive tone succumb to a couple of sharp corrections (as is often the case with carry trades).

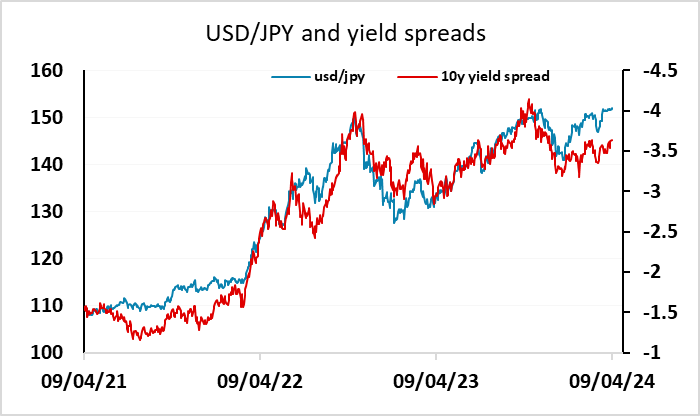

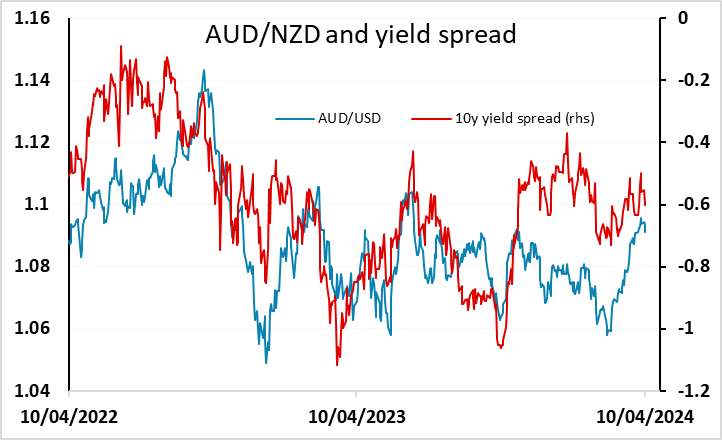

Weaker than expected CPI would clearly favour the risk positive tone, although the USD could also be expected to slip lower against the lower yielders if US yields fell in response to weaker numbers. The converse is also true, and the response to a stronger than expected number would probably be more interesting, as it would renew upside pressure on USD/JPY and ask the question of the Japanese authorities as to whether they are prepared to intervene to oppose USD strength. But if the data is as expected, the AUD would probably be the biggest beneficiary among the G10 currencies.

RBNZ kept rates unchanged at 5.5% but suggest OCR to stay restrictive for a sustained period of time. The statement is balanced as they reviewed both the upside and downside of inflation outlook. They seems to be preparing market participants of a spike in Q1 CPI from preliminary data they have reviewed and suggest such to be transitory. The key takeaway from the April meeting would be the cut by year end 2024 shown in the February OCR forecast may not materialize unless inflation is back to target range by that time. NZD firmed a little in response. There wasn’t a great deal of movement in NZD yields, but there was some correction due to the uptrend in AUD/NZD seen in the last month, and this could now extend further below 1.09.

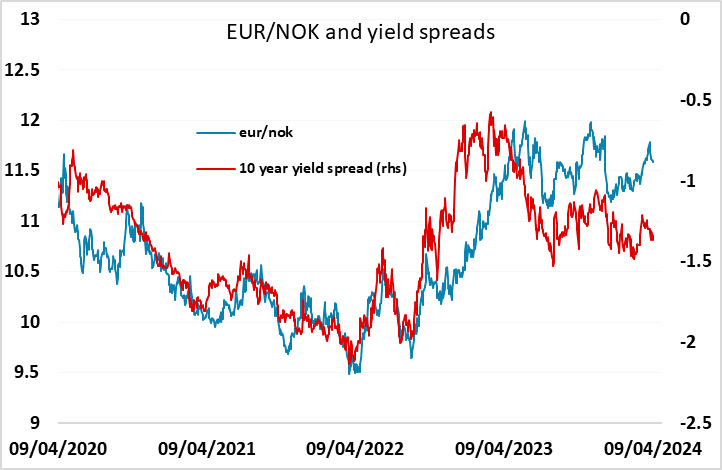

Norwegian March CPI came in below market consensus at 4.5% for the targeted CPI-ATE measure, and was also below the Norges Bank projection. EUR/NOK is a little higher in response, but has been trading on the high side relative to yield spreads, so even if this leads to some decline in NOK yields, it shouldn’t mean a weaker NOK other than in the short term. There may be scope to trade up to 11.65, but longer term we would target a move back to 11.