FX Daily Strategy: APAC, June 19th

AUD can gain support from employment data

CHF unlikely to suffer much from SNB rate cut

GBP may recover slightly unless BoE sounds surprisingly dovish

AUD can gain support from employment data

CHF unlikely to suffer much from SNB rate cut

GBP may recover slightly unless BoE sounds surprisingly dovish

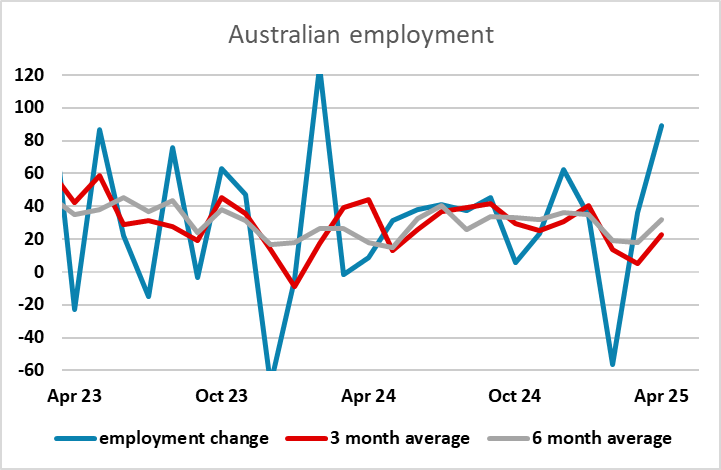

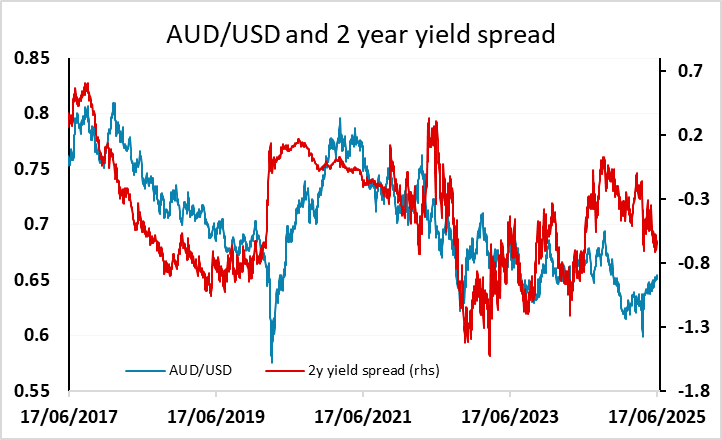

The US is on holiday so the USD may well be quieter than usual. Australian May employment data is the main data in Asia, and the AUD should be biased higher if the numbers are solid, with last month’s strong report calming some concerns about a deterioration. Yield spreads still suggest scope for AUD gains, and provided that the Asian equity markets continue to show resilience, we still se scope for AUD/USD to advance to wards 0.66.

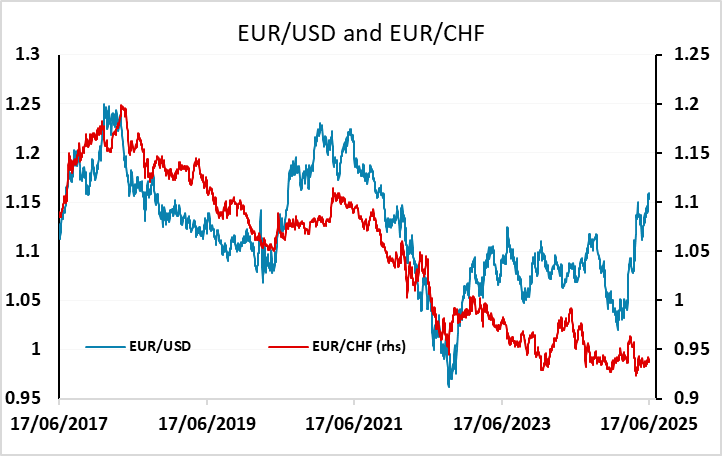

The SNB and BOE monetary policy meetings are the European highlights for Thursday. A further 25 bp cut (to zero) in the SNB policy rate now looks almost certain. Weak(er) business surveys suggest that the tariff threat is both tangible and growing and this is before key Swiss pharmaceutical exports come under fire. Meanwhile, there is the strong currency where FX intervention on any major scale could provoke US retaliation against alleged currency manipulators. Both these factors suggest a further SNB rate cut is likely, especially with zero CPI inflation undershooting even the SNB’s timid expectations. But going under the radar is the fact that the SNB may be judging the inflation undershoot in an even more worrying light as opposed to merely being a part-currency induced fall in import prices. Indeed, domestic inflation has fallen and is running near zero, suggesting that should further tariffs bring the global disinflation many anticipate then Switzerland may see persistent negative inflation rates. With this in mind the SNB is seemingly justified in not ruling out a return to negative policy rates.

However, we doubt they will take the plunge with negative rates at this meeting. Even though the market is pricing this as around a 25% chance, and a few forecasters are looking for a 50bp cut, the SNB are unlikely to see this as necessary at this point. They would prefer not to have negative rates, and there is enough uncertainty about the outlook for them to just cut the policy rate to zero for now, while leaving the possibility of negative rates open. A 25bp cut is unlikely to have much impact on the CHF, which is in any case pretty insensitive to yield spreads, and they may need to reserve a move to negative rates in case a reaction is needed in the event of a big flight to safe havens.

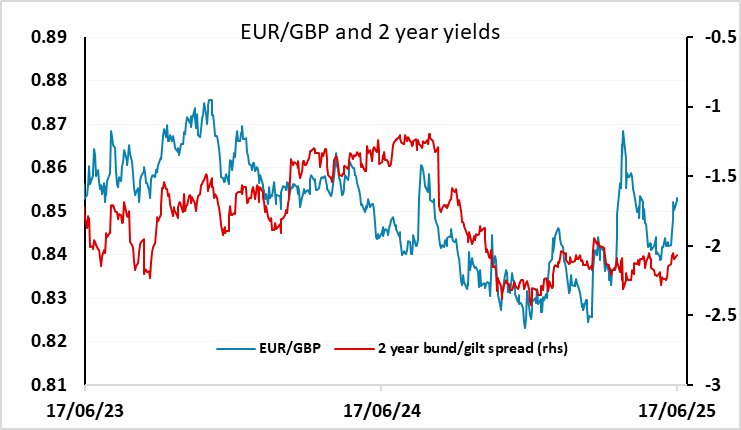

The BOE is likely to leave rates unchanged but the hawks are likely to have to moderate their previous concerns about a ‘tight’ labor market. We see two dissents in favour of a 25 bp rate cut but the statement is likely to repeat the need for policy to be framed carefully as well as gradually, also repeating that monetary policy will need to continue to remain restrictive for sufficiently long. The two hawks are still some way from thinking of another rate cut at this stage, but we wouldn’t rule out one of the more neutral members moving to the dovish camp. The market consensus concurs with our view of tow votes for a cut, so any further votes would be negative for GBP. But EUR/GBP has traded higher in the last week, exceeding the move implied by yield spreads, and may dip on an as expected decision unless the statement is more clearly dovish.