Published: 2024-01-05T14:43:10.000Z

CAD flows: CAD recovering as employment details more favourable

Senior FX Strategist

-

Details of the US employment report were a little less strong than the headline, while the strength of Canadian wage growth should underpin the CAD. Even so, CAD looks a little stretched.

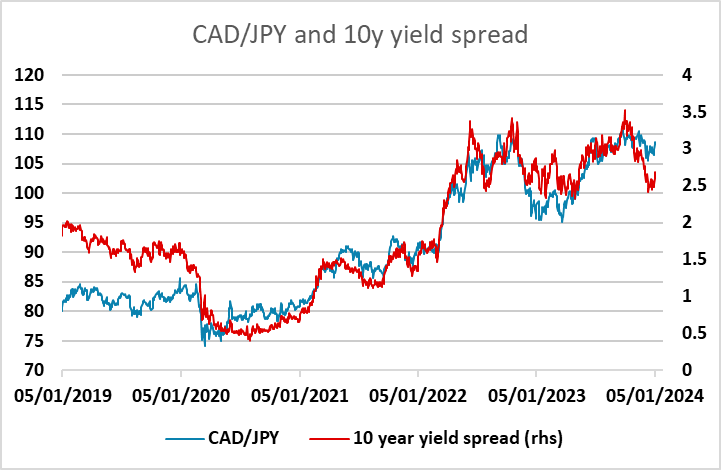

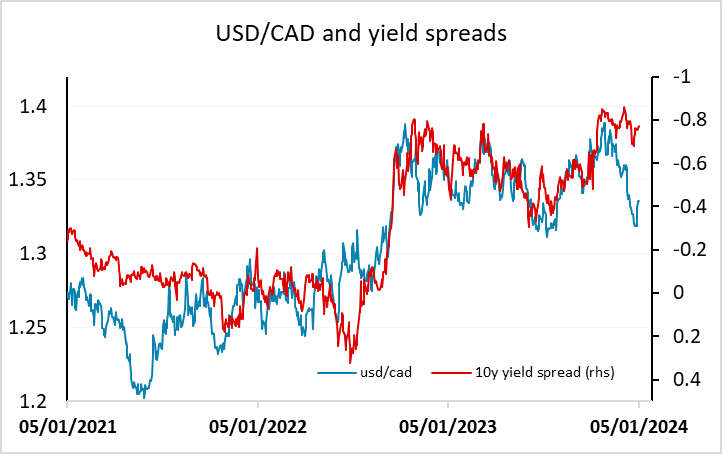

The USD has slipped back as the market notes the detail of the employment report being slightly weaker than the headline numbers, with downward revisions to past months and a weaker workweek. Nevertheless, the data is at worst mixed, and the USD should remain reasonably well supported. The Canadian numbers were weak on the surface, with a smaller than expected gain in employment, all seen in part-time, but the wage numbers were very strong, rising to 5.7% y/y, the highest since 2006, pandemic excluded, suggesting persistent inflationary pressure. Even so, Canadian yields haven’t risen much, and the CAD still looks a little stretched based on current yield spreads against the USD and JPY.