FX Daily Strategy: N America, October 10th

US CPI the focus but may prove a damp squib

Trend USD strength favoured to extend, particularly against the JPY

NOK upside risks on CPI data

Some risk of hawkish tone to account of ECB meeting, but limited EUR upside

US CPI the focus but may prove a damp squib

Trend USD strength favoured to extend, particularly against the JPY

NOK upside risks on CPI data

Some risk of hawkish tone to account of ECB meeting, but limited EUR upside

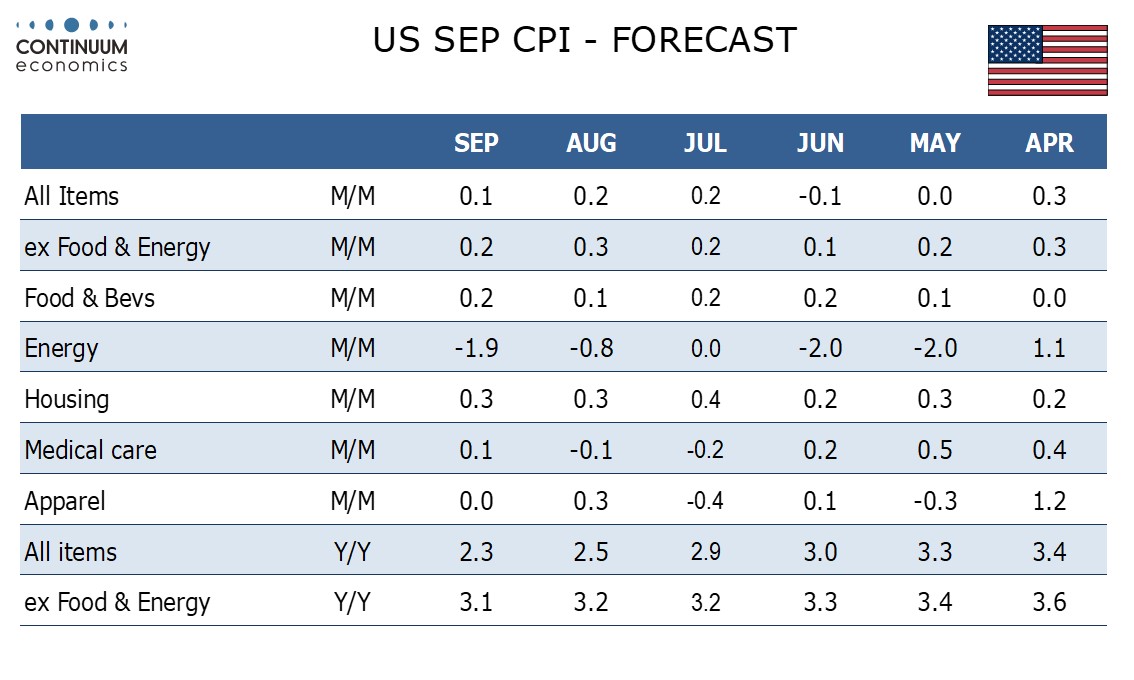

Thursday sees the main data of the week in the form of US CPI. We expect September’s CPI to increase by 0.1% overall with a 0.2% increase ex food and energy. We expect the core CPI to be very close to 0.2% even before rounding, but with a significant decline in gasoline prices expected, we expect the headline CPI to rise by only 0.06% before rounding.

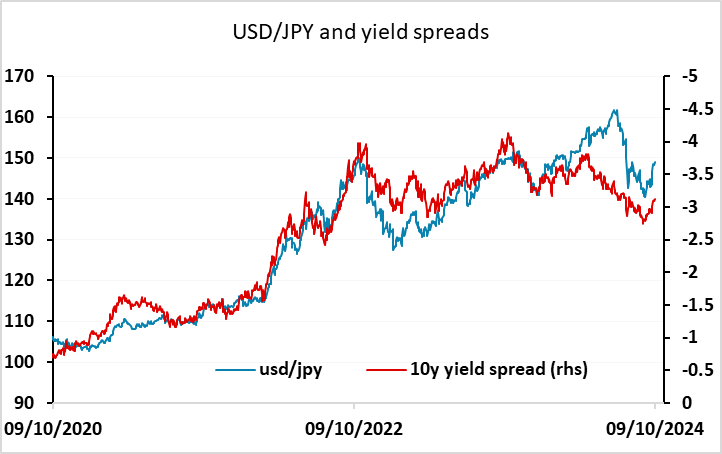

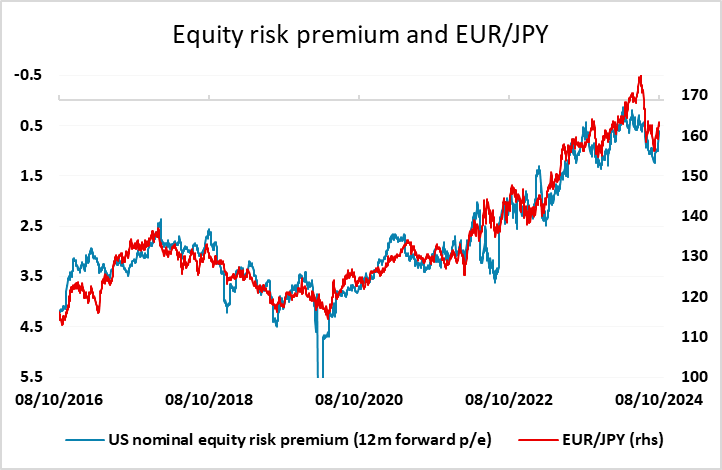

All in all, the situation is similar to that seen before the sharp JPY recovery in the summer, with low volatility, strong equities and carry trades being preferred. It’s hard to see this situation changing radically in the short run unless the US CPI data comes in significantly below consensus. There may therefore need to be some more stretching of the elastic on the JPY, with USD/JPY moving above 150 and EUR/JPY heading above 165 before we have the next snap back.

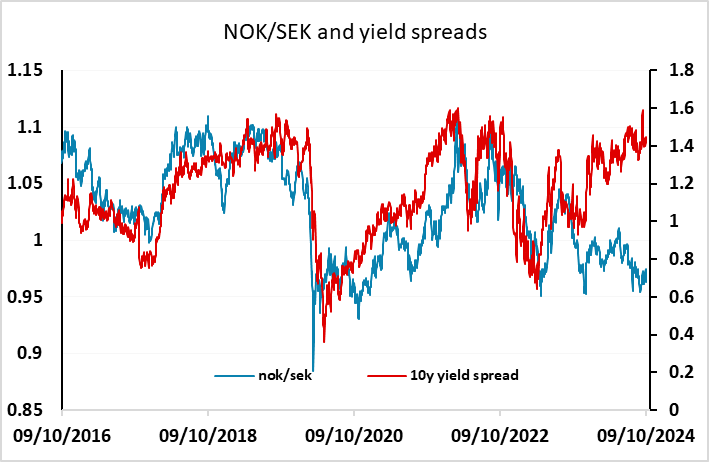

In Europe there was CPI data from Norway. This came in on the soft side of expectations, and EUR/NOK has moved higher in response, albeit not particularly sharply. While EUR/NOK has edged up to test 11.80, it is still 5 figures below yesterday’s high, and at these levels it’s hard to make a case for significant NOK losses. While there is scope for short term NOK yields to drop, as the market is currently only pricing a 40% chance of a 25bp rate cut by year end, yield spreads would even then still suggest there is NOK upside from here. SEK is performing better this morning, helped by the stronger than expected August GDP number, which showed a 1.1% gain after the 0.9% decline in July. But these numbers are so volatile that they lack real significance, and the Riksbank still looks likely to be easing rapidly over the coming months. NOK/SEK therefore still looks good value after the dip of the last couple of days. which is expected to show a significant rise in the headline rate to 3.2% and a modest rise in the core rate to 3.3%. With the headline rate likely to rise sharply even if it is below consensus, it’s hard to see this data as providing a reason for the market to anticipate a more dovish Norges Bank stance. Even if it does, the NOK continues to look cheap relative to yield spread metrics, although the softening of the oil price in the last couple f days may remove some support. Even so, we continue to favour NOK/SEK upside.

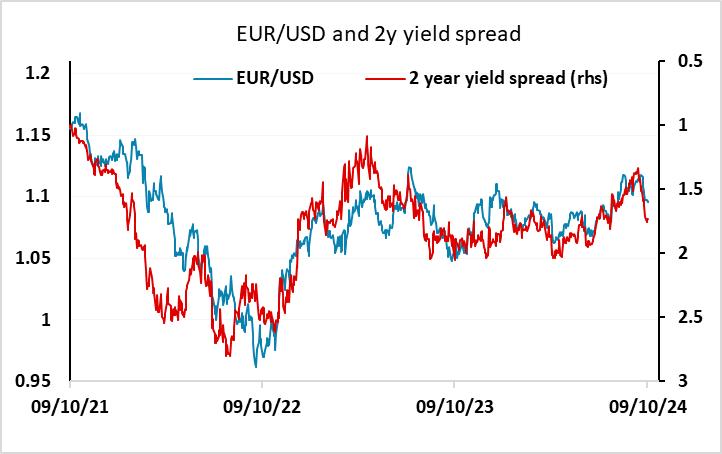

The account of the last ECB meeting will also be of interest as the market is now fully pricing in rate cuts in both October and December, following the recent dovish comments from Lagarde. The risks therefore look to be on the upside for EUR yields and the EUR if there is evidence of significant resistance from the hawks to an October cut. But with yield spreads currently suggesting EUR/USD downside risks we wouldn’t see any real prospect of EUR/USD threatening 1.10, and favour the downside.