FX Daily Strategy: Europe, November 11th

GBP risks on the downside on labour market data

USD gains on hopes of end to shutdown seem unjustified

JPY remains under pressure but has scope for a rally

NFIB a focus

GBP risks on the downside on labour market data

USD gains on hopes of end to shutdown seem unjustified

JPY remains under pressure but has scope for a rally

NFIB a focus

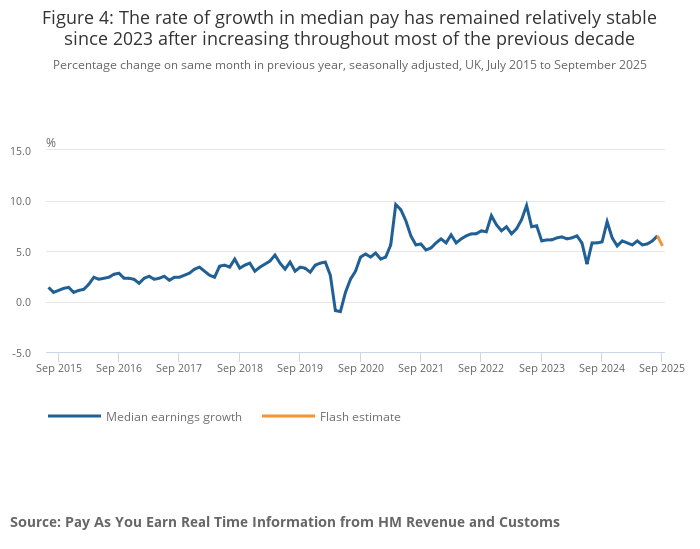

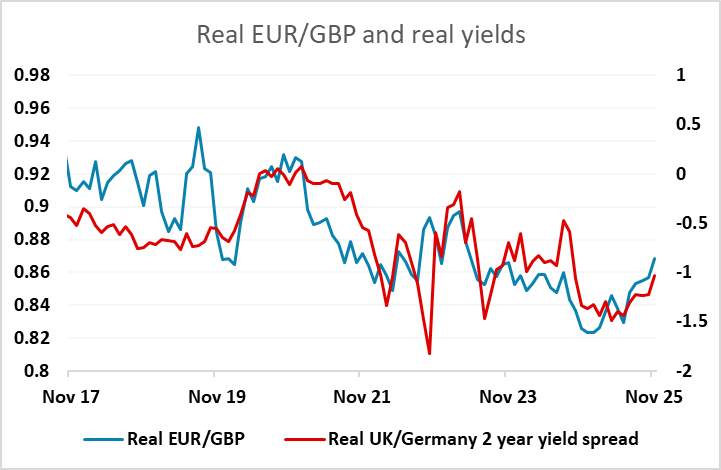

UK labour market data looks potentially important on Tuesday. The market consensus looks for another very slight decline in average earnings growth, but there will also be attention on the HMRC data which is more up to date and has increasingly been seen as just as if not more accurate than the ONS data. The HMRC data indicates that payrolled employment peaked over a year ago in July 2024 and has been trending gently lower since. It also suggests earnings growth is easing, but the decline has been choppy and the growth rate remains too high for the BoE hawks to be comfortable with rate cuts at this stage. Evidence of weaker earnings growth would certainly increase the chance of a BoE rate cut in December, which is still only priced as a 60% chance despite the 5-4 vote on the MPC in November. We see the GBP risks as being on the downside, as with a significant fiscal tightening likely to be announced in the November 26 Budget, we are very likely to see the extra vote required for a rate cut in December. The market looks to be underpricing the risk, so it’s hard to see a decline in UK rate cut expectations even on stronger labour market data. The 0.8830 high of the year in EUR/GBP could come under threat if we see weak data.

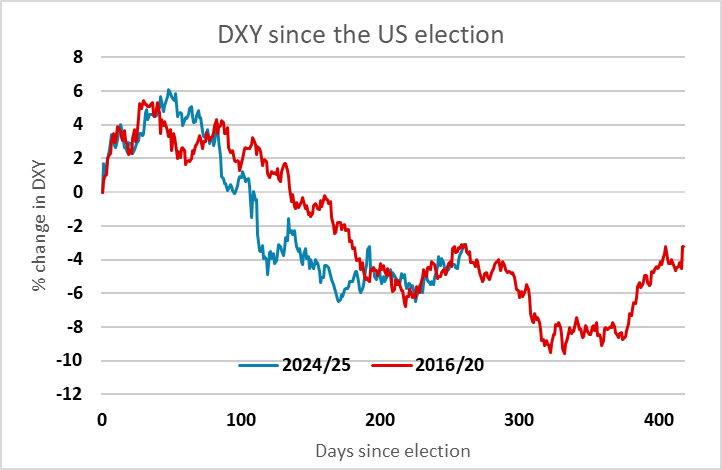

Monday was a fairly quiet day in the FX market with the USD gaining a little ground helped by the rising expectation of an end to the government shutdown. Of course, the USD didn’t really lose any ground due to the government shutdown, and nor did the equity market, so it’s hard to justify a significant reaction to the end of the shutdown. The USD has broadly continued to follow the path seen in the first Trump presidency, and the USD started to weaken again after the first year back in 2017. We do feel most of the good news is now in for both the USD and the equity market, so we mildly favour the USD and equity downside.

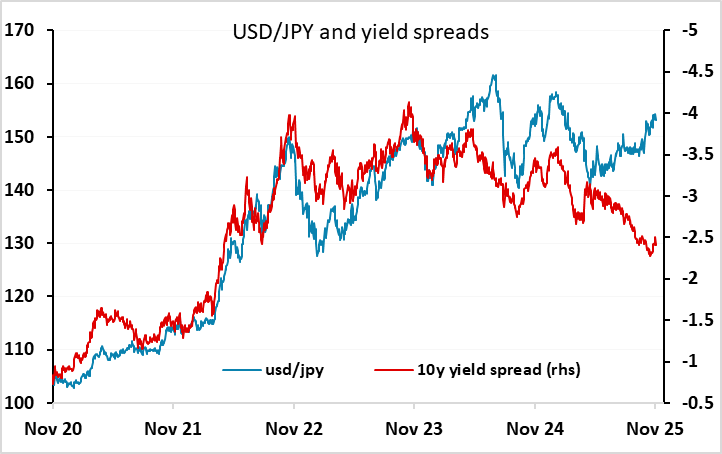

The JPY remains the currency with the most potential for volatility. There are some key resistance areas in both USD/JPY and EUR/JPY at 154.40/50 and 178.10/20 respectively, both of which broadly held on Monday. There looks to be every reason for the JPY to rally from here based on all the usual correlated metrics like yield spreads and risk premia, but a significant JPY rally still seems unlikely without either BoJ intervention, which is unlikely to be seen this side of 155, or a notable equity market downturn. Speculation around Japanese government influence on BoJ policy looks to us to be a red herring, as the BoJ has been reluctant to tighten until wage growth picks up since before the election of Takaichi as PM, and yield spreads have in any case already narrowed substantially without generating a JPY recovery.

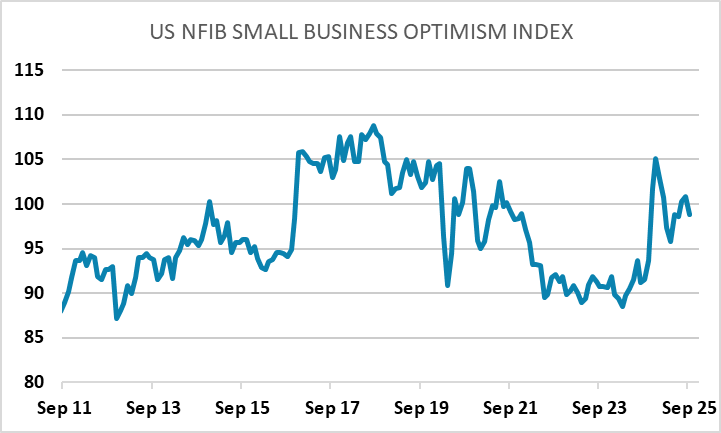

As well as the UK labour market data there is business sentiment data from Australia and the NFIB small business survey in the US. Domestic data in Australia continues to support the case for AUD gains, but for now the AUD continues to be driven more by global risk sentiment than domestic developments. As for the NFIB survey, it was notable that optimism surged on the Trump election, just as it did in 2016, but has started to edge lower. Any sign of weakness could lead to some further correction lower in equities and the USD.