FX Daily Strategy: Europe, February 15th

US retail sales unlikely to have a big impact.

USD remains well supported, but USD/JPY extended

AUD vulnerable as employment disappoints

GBP has further downside risks on UK GDP

US retail sales unlikely to have a big impact.

USD remains well supported, but USD/JPY extended

AUD vulnerable if employment fails to bounce strongly

GBP has further downside risks on UK GDP

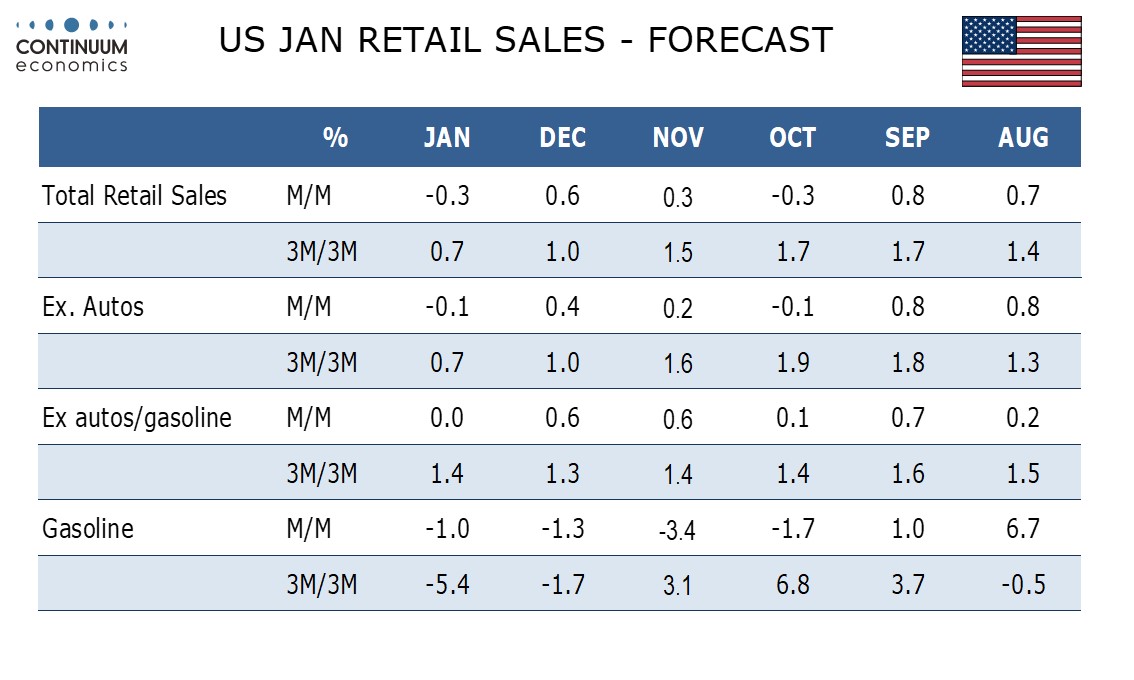

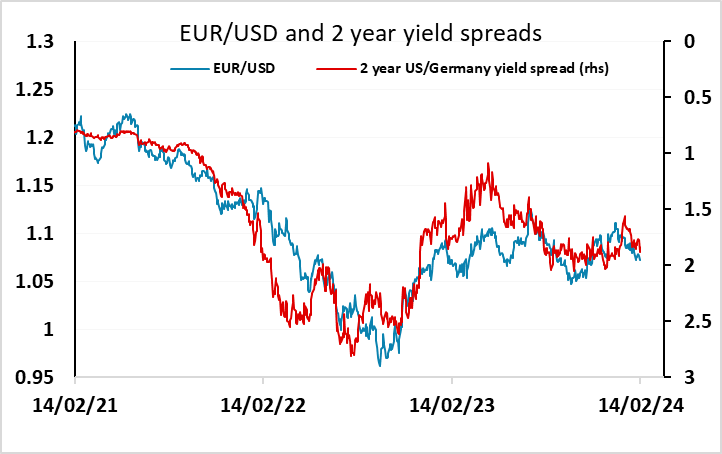

Thursday sees a variety of data from around the world. The US retail sales data will be the main global focus. We expect a 0.3% decline in January retail sales, with a 0.1% decline ex autos and an unchanged outcome ex autos and gasoline. The data should be seen alongside a strong December with weather probably providing some restraint in January. The consensus is slightly more optimistic, although at -0.2% headline, 0.2% core it is insignificantly different for a relatively volatile and likely weather affected number. While the retail sales trend has been slowing a little, and will slow a bit further if the consensus forecast is correct, it seems unlikely that this will have much impact on the USD with the focus still very much the unexpectedly large rise in CPI in January. While the Fed’s Goolsbee provided a dovish take on the CPI data on Wednesday, he is on the dovish side of the Fed debate and most will see the latest CPI data as a barrier to early rate cuts.

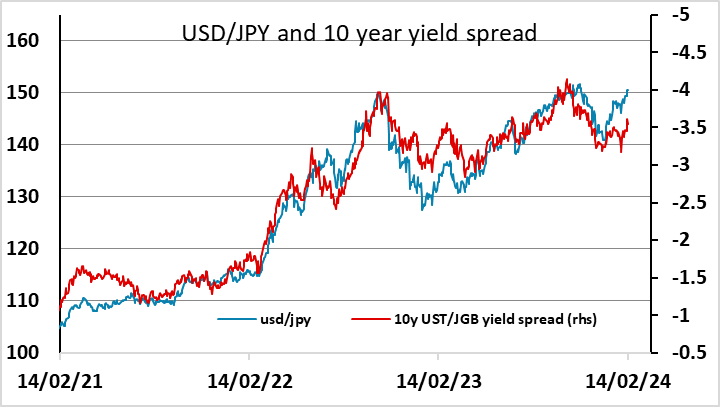

However, with only around 40% chance of a rate cut now priced in for May and a little under four rate cuts priced in for the year, there isn’t a lot more upside for US yields at this point. That being the case, USD/JPY in particular looks stretched as it has outrun the rise in yield spreads this year, and the comments from Japanese Finance minister Suzuki on Wednesday suggested the possibility of intervention if JPY weakness extends. This might only have a temporary impact, but if the BoJ tighten in the spring there may be a more fundamental support for the JPY down the road.

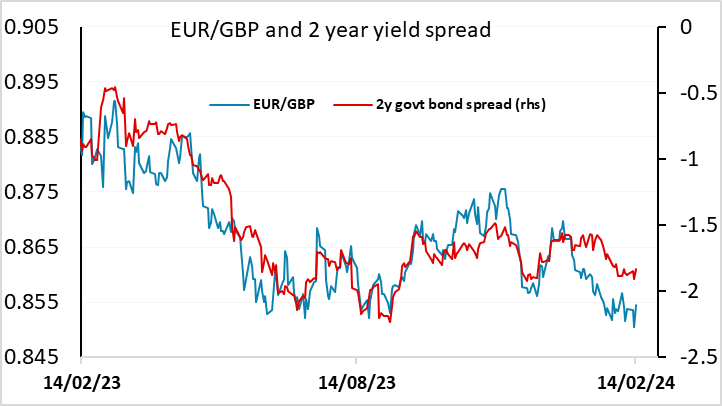

There may be slightly more downside for the EUR, as the rise in EUR yields that has followed the rise in US yields in the last week or two is not supported by the European data. While there hasn’t been a lot of news from the Eurozone, the sharp decline in Swiss CPI and the lower than expected UK CPI this week underline that price pressures are easing in Europe, and the case for ECB easing remains much stronger than the case for the Fed. While there is now more ECB easing than Fed easing priced in, there is scope for yield spreads to move further in the USD’s favour.

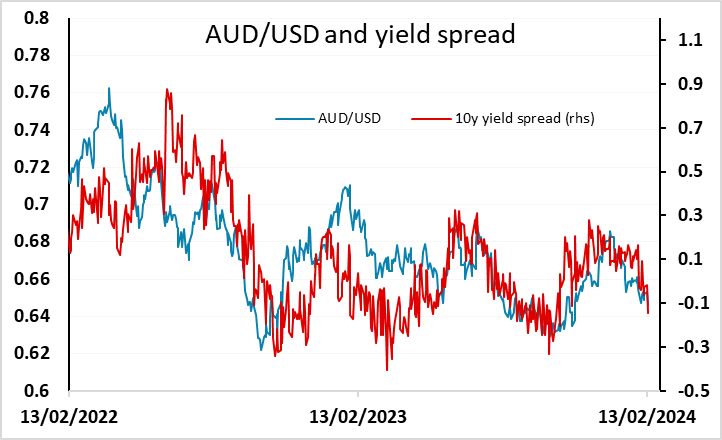

Before the US retail sales data, we have Australian employment numbers and UK GDP data on Thursday. The sharp decline in the Australian employment numbers in December is expected to be partially corrected, but the consensus rise won’t prevent a further deterioration in the 3m/3m trend. While the RBA sounded a little hawkish in the latest meeting, and this lead to some reduction in rate cut expectations, his means there is scope for steeper cuts to be priced in on weak fata. The AUD is in any case under a little pressure as the rise in US yields took to steam out of the equity rally, so risks look to be on the AUD downside.

While the headline employment change for Jan kept its foot in positive territory of 0.5K, the unemployment rate rose to 4.1% from 3.9%. It seems to suggest the strength of Australian market maybe seeing a turn after peaking in early 2023 and feeling the effect of cumulative hikes. There is also a huge negative full time employment change revision. Yet, this report is very unlikely to change the path of cash rate for CPI remains the key focus.

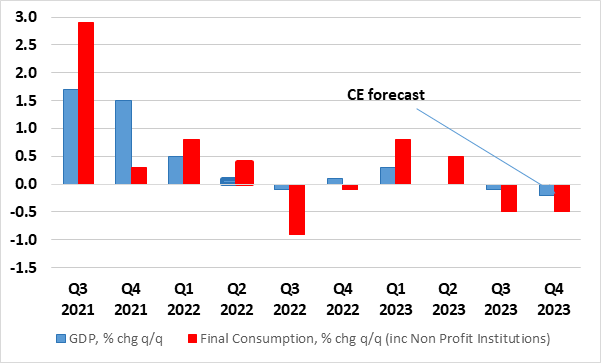

A Second Successive Fall in Both GDP and Consumer Spending?

A Second Successive Fall in Both GDP and Consumer Spending?

Source: CE, ONS

The UK GDP data is the third significant UK data release this week, following the slightly stronger than expected labour market data and the slightly weaker than expected CPI data. GDP rose by 0.3% m/m in the November data, a result that meant that the surprise drop in October was exactly reversed. But we think this will have been a short-lived reprieve, with a 0.4% m/m drop in December, not least on account of the plunge in retail sales and abnormal weather. We see the December result leading to a 0.2% q/q Q4 drop, below the BoE’s flat projection and meaning that, after the Q3 decline, the economy may be in formal recession. The consensus is less pessimistic, at -0.2% for December an -0.1% for Q4, but this would still be below the BoE forecast and would still represent a recession. So the risks look to be on the downside for GBP. The bounce form 0.85 in EUR/GBP should extend, but we continue to see GBP/JPY, which hit a new 9 year high earlier this week, as offering the most potential for a decline, although this still look to be dependent on a less robust US equity market.