U.S. March PPI - Some acceleration in core goods. but outweighed by weakness elsewhere

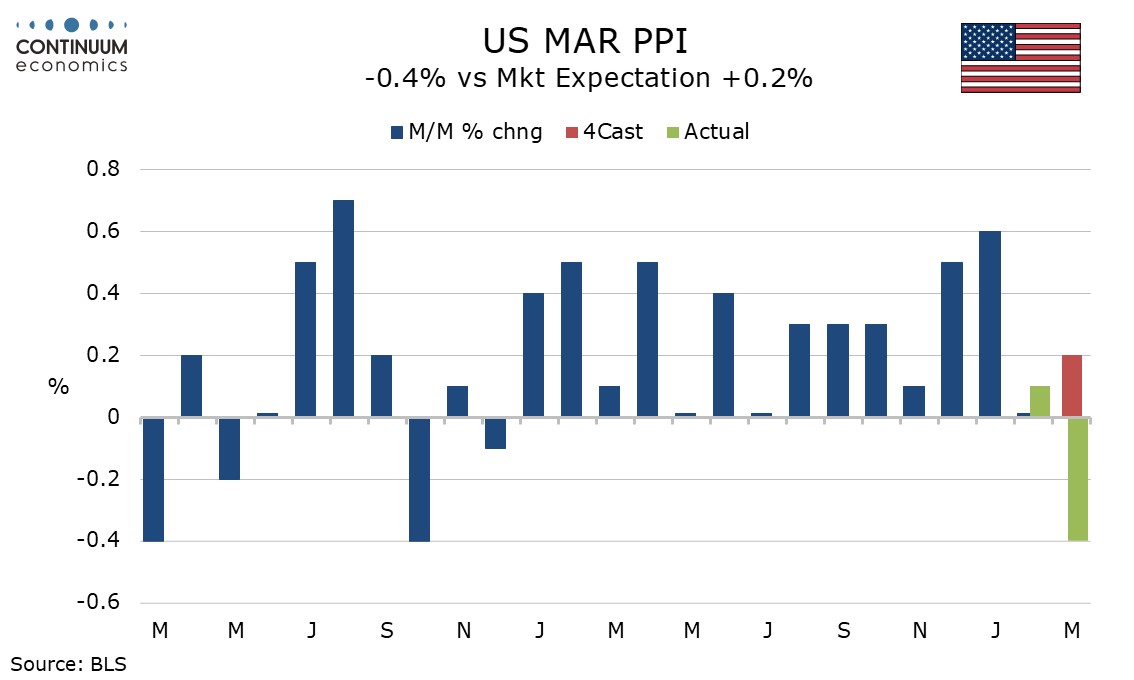

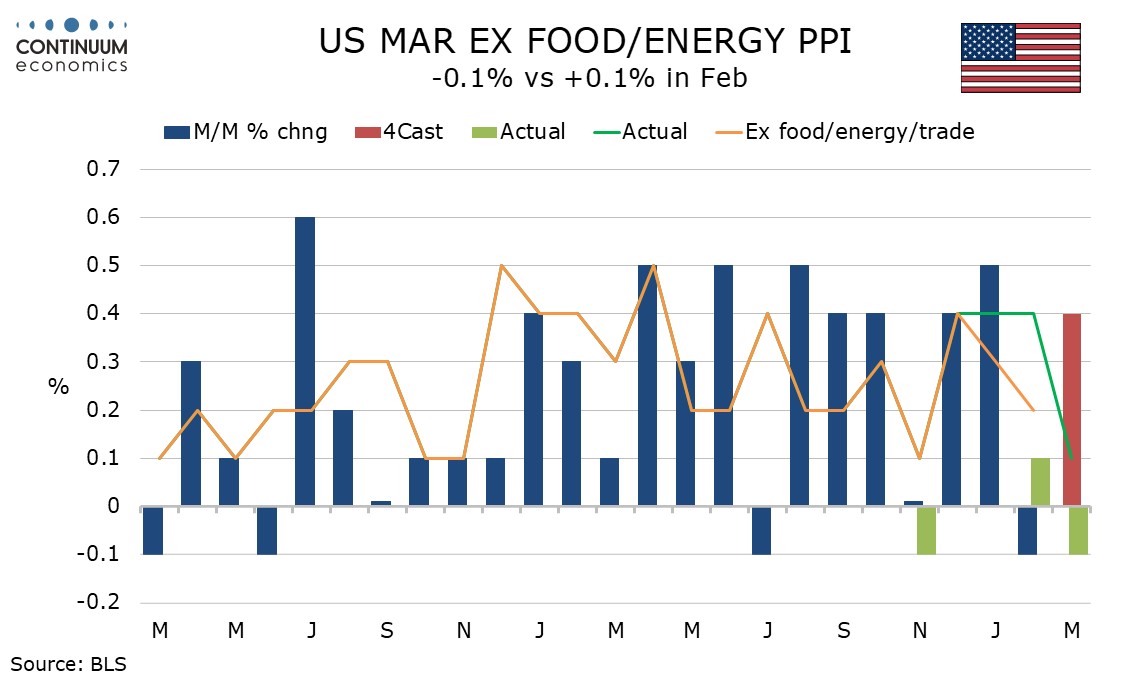

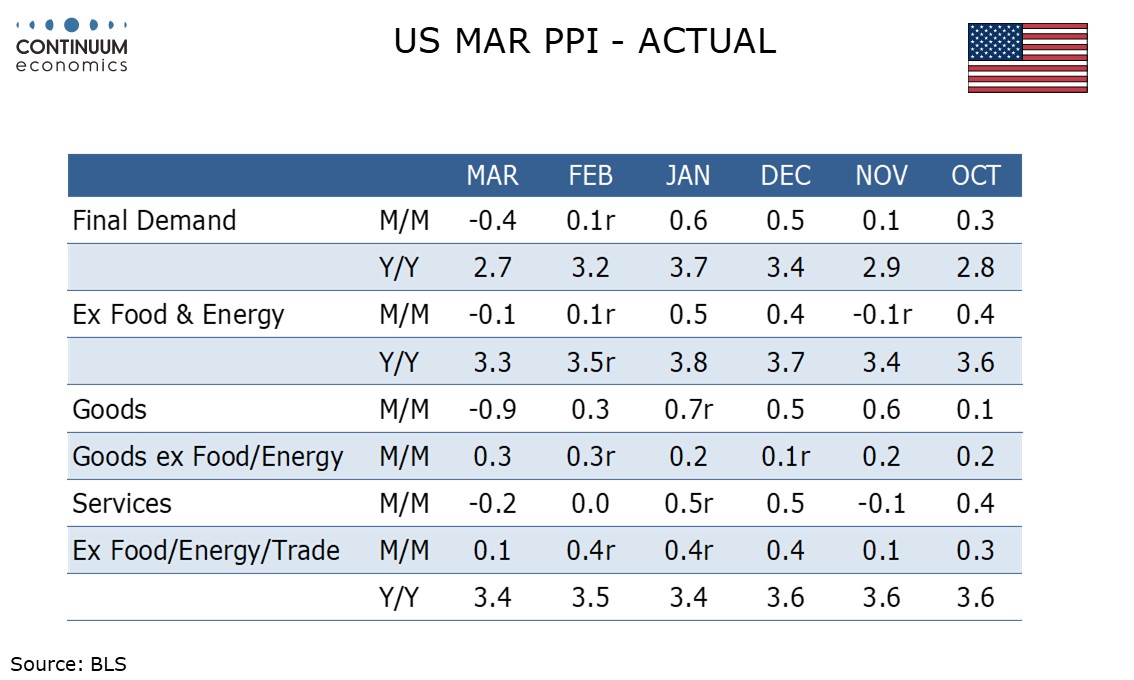

March PPI, like the CPI and February’s PPI, is surprisingly subdued at -0.4% overall, -0.1% ex food and energy with a modest 0.1% increase ex food, energy and trade. There is some sign of stronger inflation in core goods, but this outweighed by easing pressures in services, food and energy.

Food prices fell by 2.1% after two straight strong gains. Eggs fell by 21.3% after two straight dramatic gains. Energy fell by 4.0% led by a fall of 11.1% in gasoline.

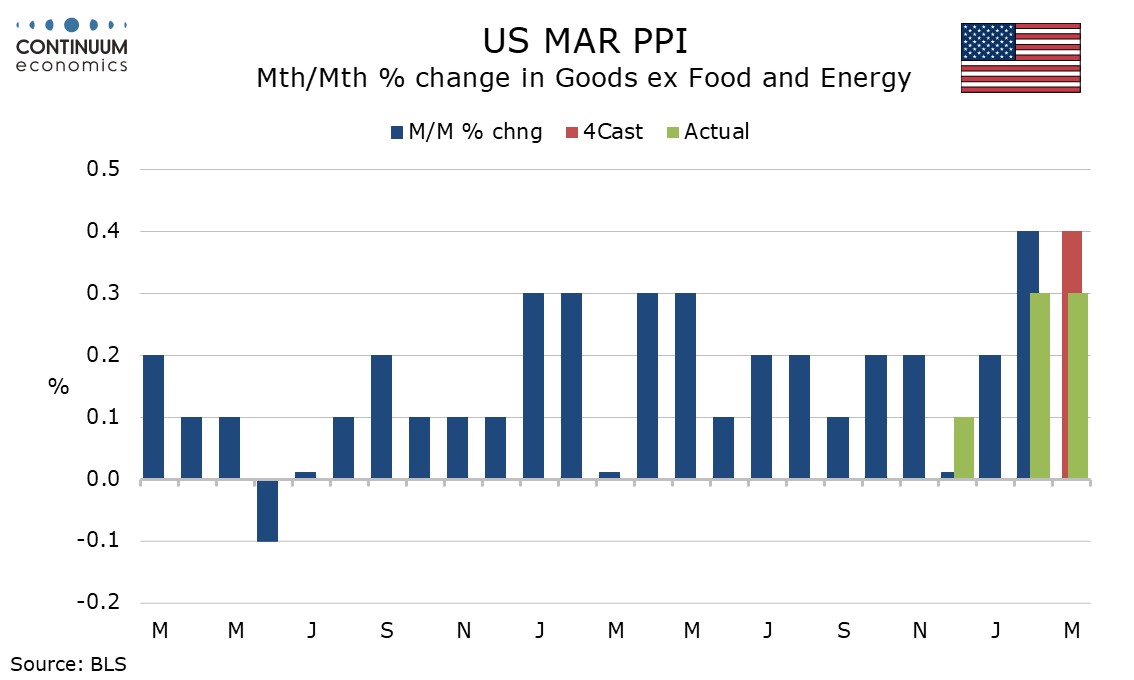

Goods ex food and energy were quite firm with a second straight rise of 0.3%. This is an acceleration with each month from June 2024 through January 2025 having been either 0.1% or 0.2%. Goods less food and energy is where tariff effects are going to be concentrated.

Service prices fell by 0.2% after a flat February, meaning two soft months to follow two straight gains of 0.5%. Trade again led the dip, falling by 0.7% after a 1.1% decline in February.

Intermediate data gives a similar message to finished product. Processed goods were unchanged with a 0.9% rise ex food and energy, unprocessed goods fell by 4.1% with a 0.4% rise ex food and energy while services fell by 0.1%.

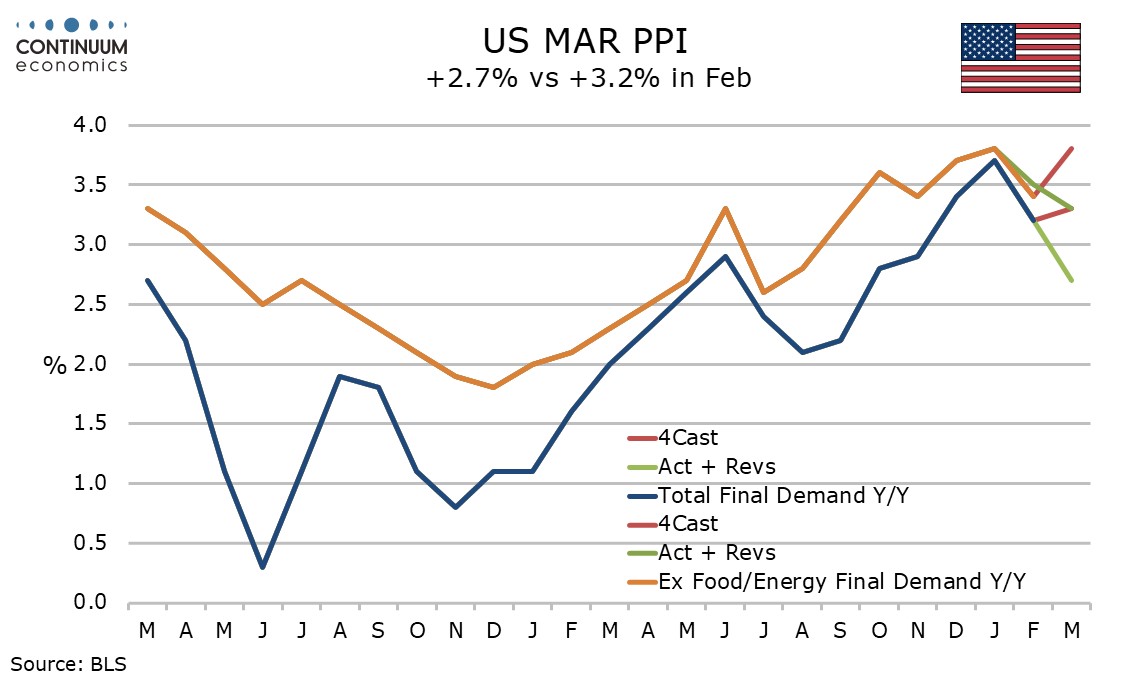

Yr/yr growth slowed significantly overall, to 2.7% from 3.2%, but only modestly ex food and energy, to 3.3% from 3.5%, and marginally ex food, energy and trade, to 3.4% from 3.5%.

While this data is pre-tariff, it is a reminder that while tariffs will lift core goods prices, in a weak economy food, energy and services may see restraint, weighing against rising core goods prices. Still, it may need a weak economy to provide a significant offset to tariff-led inflation in core goods.