FX Daily Strategy: N America, December 5th

Canadian employment may be slightly CAD positive

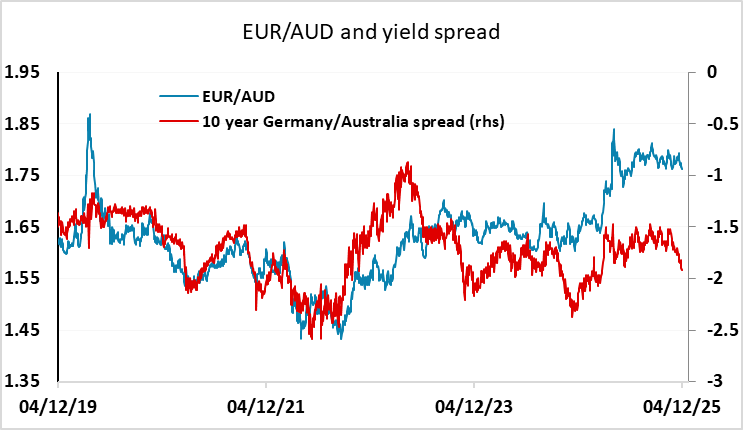

EUR looks a little extended on the crosses

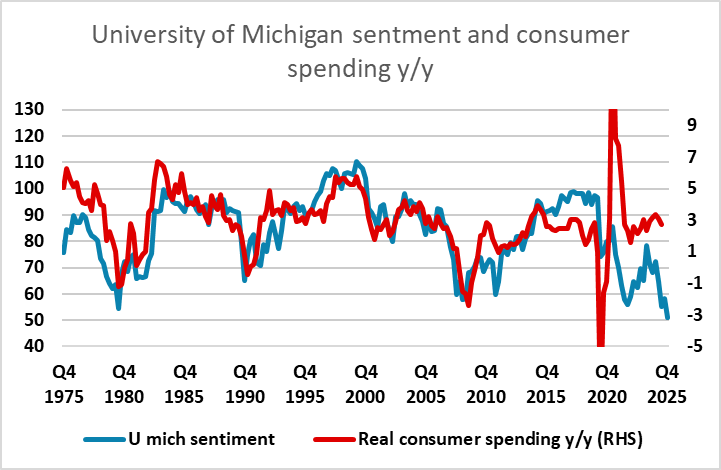

University of Michigan survey of some interest given extreme weakness

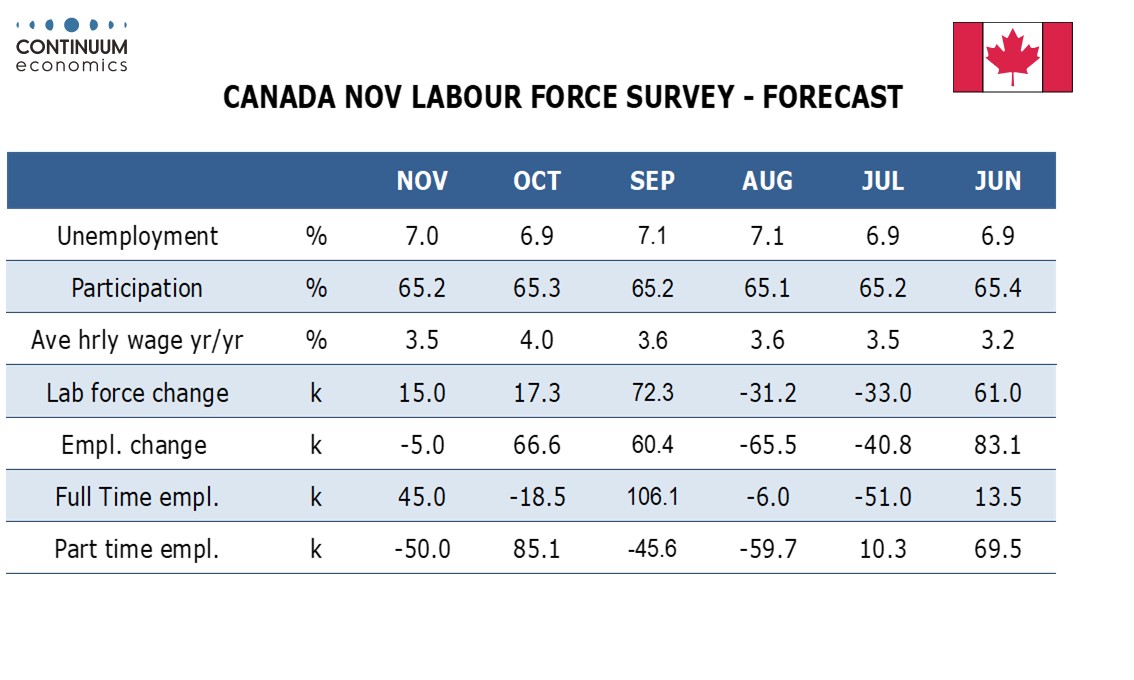

Canadian employment may be slightly CAD positive

EUR looks a little extended on the crosses

University of Michigan survey of some interest given extreme weakness

We won’t get the November US employment report until December 16 when it will be released together with the October data, but we do get the Canadian November report on Friday. Canadian employment data has been volatile in recent months. The underlying trend still seems modestly positive, but after two strong gains in excess of 60k we expect a modest decline of 5k in November. This would lift unemployment to 7.0% from 6.9% in October, still below the 7.1% seen in August and September.

Our forecast is slightly stronger than the surveyed consensus of a 7.6k decline in employment, but the difference is small compared to the volatility of the data in recent months. USD/CAD is broadly back in line with the yield spread relationship that has been in place since the pandemic, after a period of USD weakness following the announcement of reciprocal tariffs in April, so we don’t expect much CAD reaction to the numbers. However, even the market expectation of a small decline would suggest that the employment picture is starting to improve a little after the weakness seen over the summer, so we would continue to favour the USD/CAD downside.

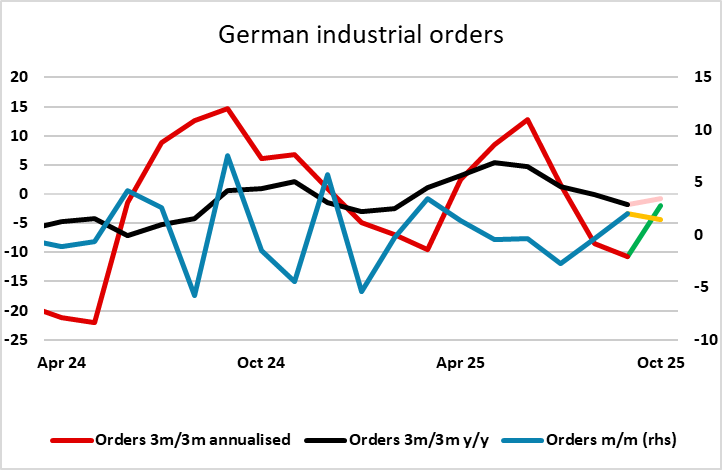

German factory orders have come in stronger than expected in October, rising 1.5% m/m. This follows on from the strong 2.0% rise in September and stabilises the underlying trend after a couple of weaker months in July and August. French production and trade data are also slightly better than expected this morning, and EUR/USD has edged up this morning helped by these data releases. However, EUR/USD remains fairly stable in the mid-1.16s and the EUR has slipped a little on the crosses overnight against the JPY and AUD, both of which look undervalued relative to yield spread moves in the last 6 months. Todays data should help stabilise the EUR on the crosses, but we still see downside risks medium term.

Most of the US data is still quite old and consequently of limited significance, and the PCE deflator from September is in that category. However, the December University of Michigan sentiment survey is bang up to date, so could have some impact, especially given the extreme weakness seen in November. The current conditions index is at an all time low, and the general sentiment index very close to the low seen in 2022. Historically, these indices had a good correlation with consumer spending, but this has broken down a little since the pandemic. Even so, persistent weakness on the current scale would be something of a concern. The consensus expects a small bounce from current levels, but even this would suggest risks of weakness going forward, so the USD risks on the data are on the downside.