USD flows: USD downside risks increase after soft data

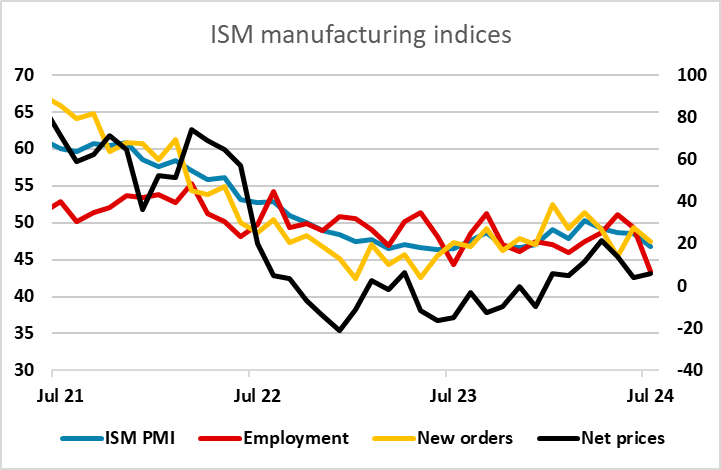

Weak ISM, notably employment, adds to downside risks on the USD after rise in jobless claims and weak unit labour cost data

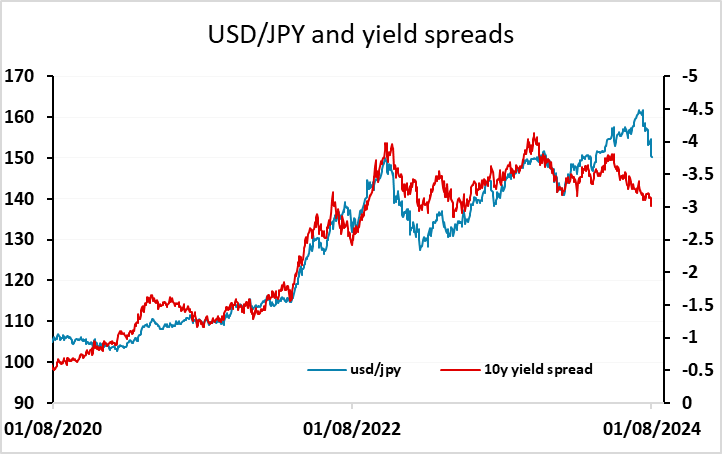

The ISM manufacturing index has come in very much on the weak side of expectations, with the employment index particularly weak, hitting its lowest since the pandemic, while the ISM manufacturing PMI index was the lowest since November 2023. This is of greater significance given the approach of the employment report tomorrow, but the manufacturing sector has been weak for some time and is not likely to be a major driver of markets short term. Even so, along with the rise in the jobless claims numbers and the weakness of the unit labour cost data for Q2 released earlier, it is maintaining the decline in US yields and suggests USD downside risks are greater ahead of tomorrow’s data, particularly against the JPY.