USD, EUR, JPY flows: Neutral picture, risk premia remain very low

USD steady, Japanese equities firmer, FX becalmed ahead of PMIs

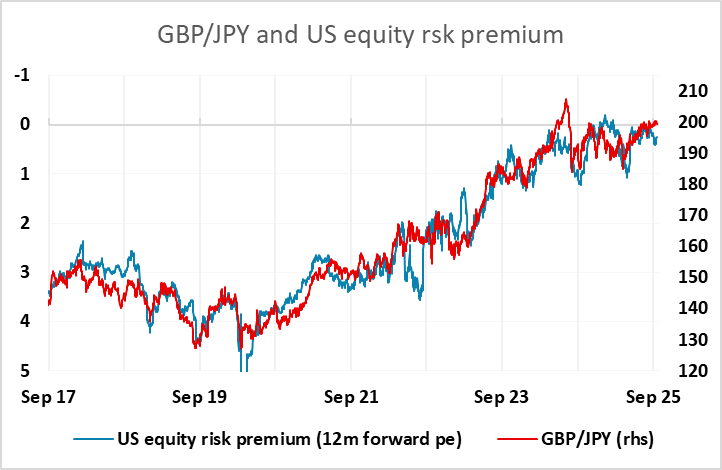

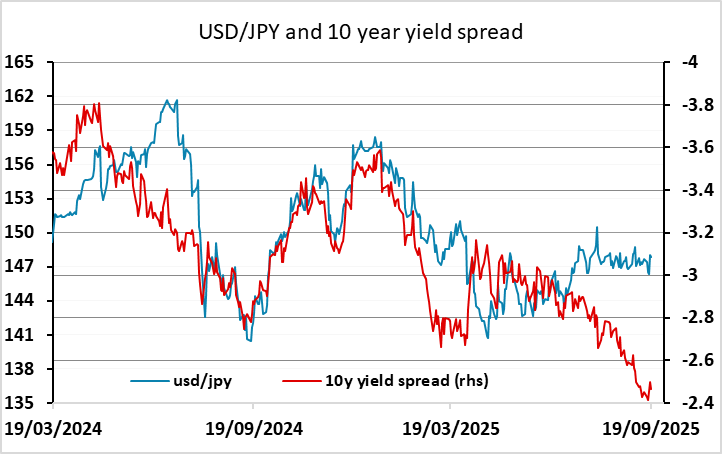

A quiet start to Monday with little to focus on ahead of tomorrow’s PMIs. The main news overnight is the outperformance of Japanese equities, after a slump last Friday after BoJ announced their plan to shrink their balance sheet on ETFs and J-REITS. Market participants are unfazed as the current magnitude and pace of BoJ selling schedule indicates it will be spread out through a century. But there has been little FX volatility. The USD has slipped a little lower against the EUR and JPY through the Asian session, but is not much changed against the commodity currencies. The focus is likely to remain on the equity market, after the new all time highs seen in the S&P 500 on Friday, despite the rise in US yields. While this suggests a risk positive tone, valuations are very stretched and JPY weakness is already extreme, so the biggest risks are to the JPY upside. But there is nothing on the calendar to trigger a big move today, and we would expect a neutral session.