CHF flows: CHF falls back on SNB rate cut

SNB cuts rates 25bps as most expected. CHF weaker and some scope for further losses

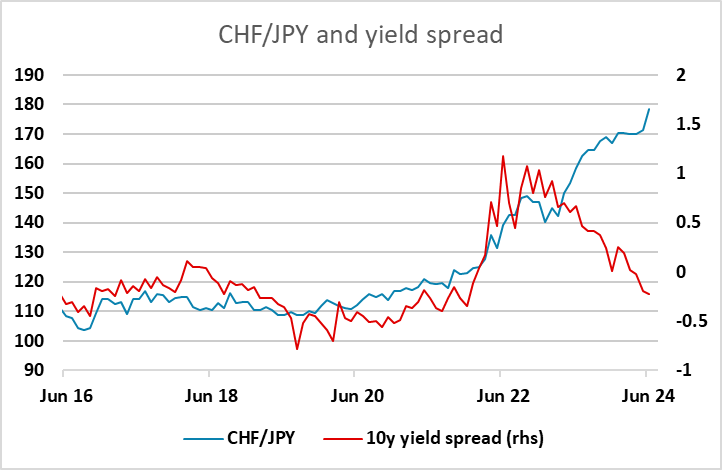

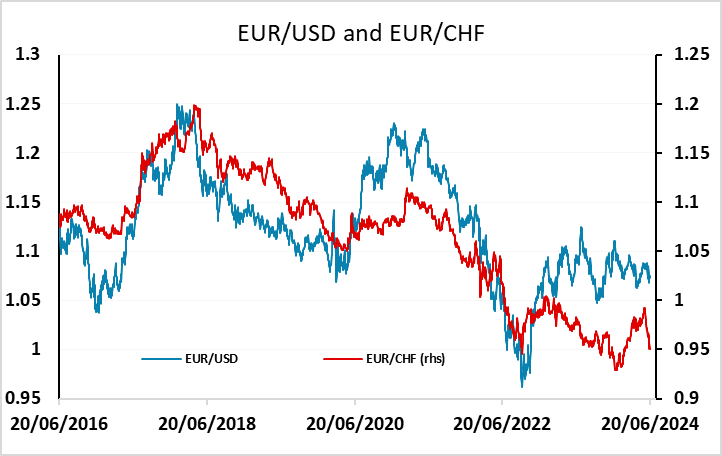

The SNB have cut rates a further 25bps as most forecasters expected (although some platforms have been indicating that no cut was expected). The market was 65% priced for a cut, so EUR/CHF has risen half a figure on the decision. The bounce has come from a significant retracement level near 0.9480 and we should now see a period of consolidation above 0.95. The SNB also indicate that they are prepared to be active in the FX market where necessary, suggesting the may move to shut off any further CHF appreciation. Their inflation forecast going forward is little changed after the rate cut (but would have been lower without the cut) and leaves the possibility of a further cut in September. This is now priced as around a 70% chance. All in all, we would favour some further CHF downside provided that the risk tone elsewhere remains reasonably positive. If geopolitical factors undermine growth and risk appetite, which the SNB highlights as a risk, the CHF may see some upside pressure, but the SNB may act to prevent gains, and we would still see the JPY as representing the better value as a safe haven.