USD, EUR, JPY flows: EUR staying firm despite weaker German orders, JPY strong despite Kato comments

USD mixed overnight, gaining against the commodity currencies but falling against the EUR and JPY. But it may be ripe for a correction if the employment report is solid

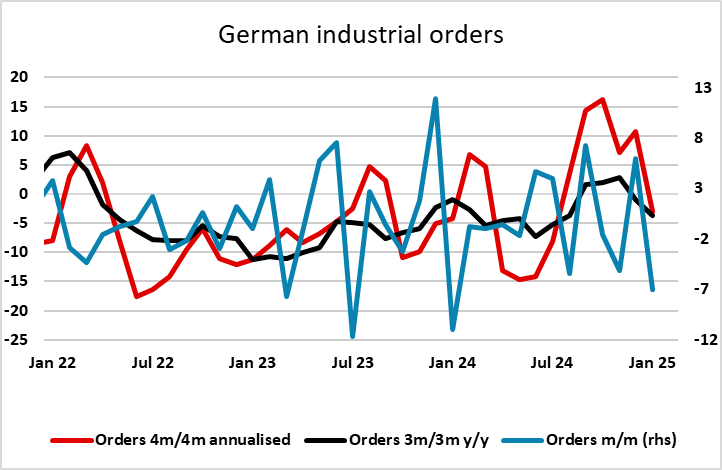

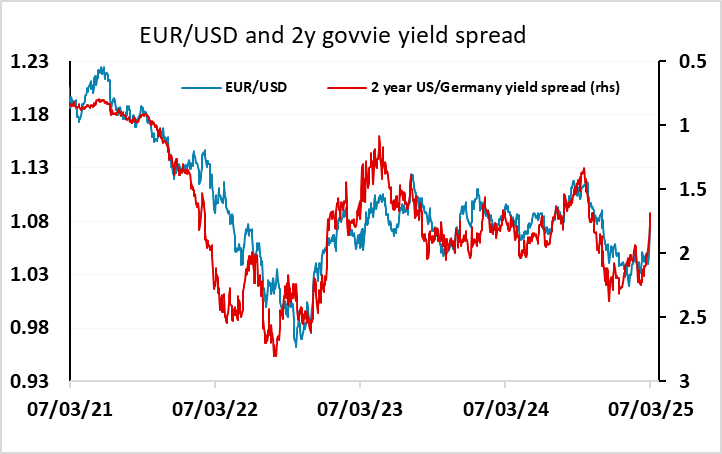

The USD was mixed overnight, gaining against the commodity currencies but losing ground to the European currencies and the JPY. The focus today will be on the US employment report but early on we have had German January industrial orders, which may moderate the current optimism around the German economy, as they show a 7% m/m decline. Admittedly, this data is very volatile, and the 7% decline follows a 5.9% gain in December, and the underlying trend is fairly flat. But it is a reminder that any German stimulus is sorely needed. EUR/USD has been unaffected by the data and continues to edge higher in early trade, but may stall soon as German yields are dipping lower.

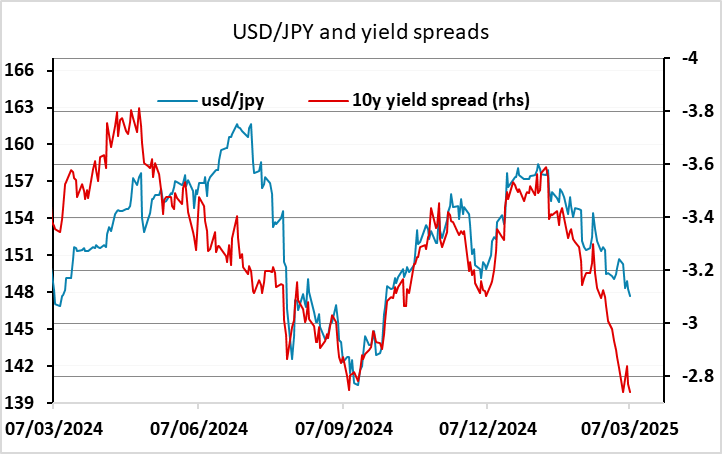

The overnight strength of the JPY may have been moderated by the comments from Japanese finance minister Kato who said the JPY moves since December have been one sided and rapid. This seems a bit of an overreaction to the JPY recovery we have seen, especially since most of the USD/JPY decline since December is a USD story rather than a JPY story, and the JPY is starting from extremely weak levels (and is still extremely weak from a fundamental perspective). EUR/JPY is currently mid-range for the year having recovered in the last week. Kato’s comments may be intended to slow things down rather than stop them, but there should be no prospect of intervention to prevent JPY gains at these levels. Yield spreads continue to suggest further substantial USD/JPY declines, and we would expect the trend to continue, but a stronger than expected US employment report could trigger a correction on the day.