FX Daily Strategy: APAC, May 31st

Japanese CPI could impact the JPY, which looks close to a bottom

US PCE data needs to be weaker to extend USD decline

EUR data looks unlikely to have a big impact

EUR/CHF decline hard to oppose but CHF/JPY looks too high

Japanese CPI could impact the JPY, which looks close to a bottom

US PCE data needs to be weaker to extend USD decline

EUR data looks unlikely to have a big impact

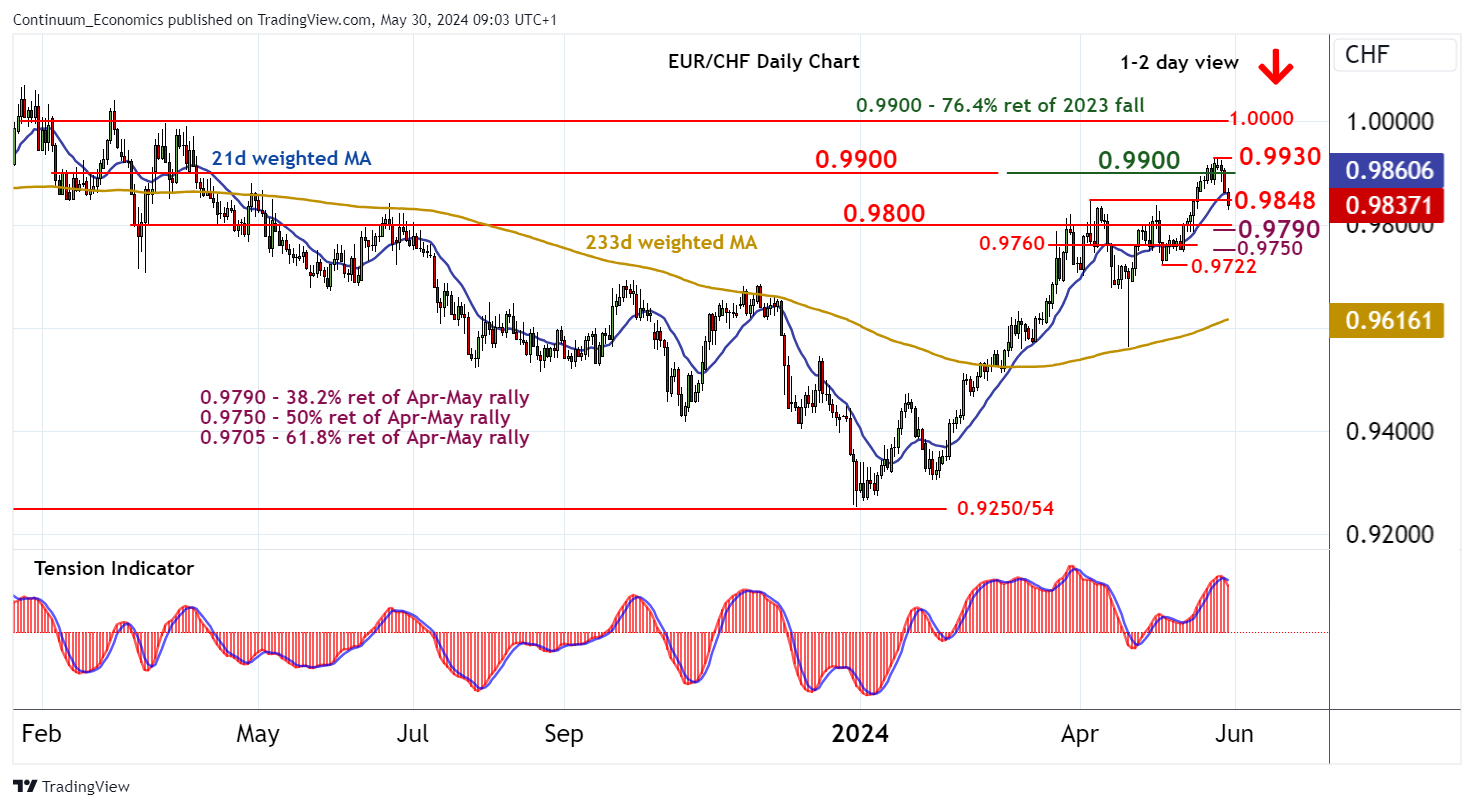

EUR/CHF decline hard to oppose but CHF/JPY looks too high

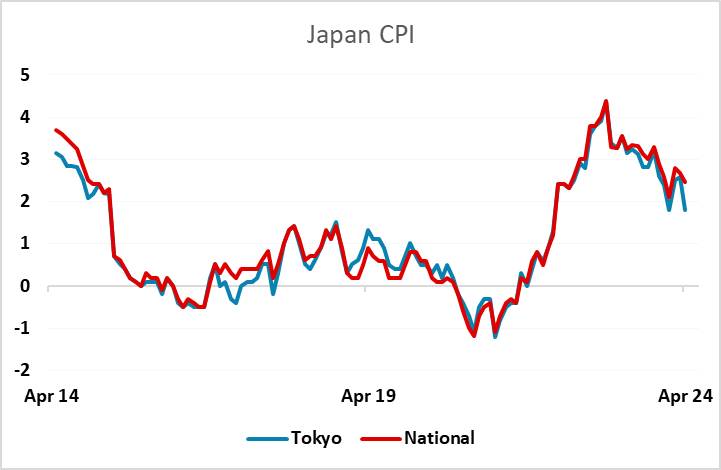

Friday sees a lot of price data from around the world, with the Japanese Tokyo CPI data probably the most likely to have an impact. This showed a sharp drop in April relating to a change in the calculation of education prices, but this was not fully reflected in the national numbers. The consensus expects a bounce this month, but after the sharp drop in April it seems unlikely to have much impact unless it is substantially away from expectations.

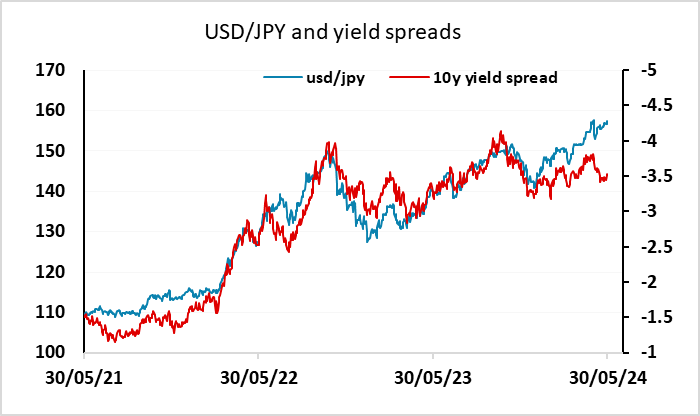

The JPY has a better day on Thursday, but USD/JPY still only moved modestly lower despite the general drop in yields in the US and Europe. We suspect that the Wednesday/Thursday highs are going to be hard to break given the spread narrowing new have seen in favour of the JPY and the threat of BoJ intervention in the 158 area, but that doesn’t mean that USDJPY will gains significant downside momentum without some news. The US data on Thursday was only modestly on the weak side, with the larger than expected April trade deficit perhaps the most significant release, as it suggests weak Q1 GDP growth could extend into Q2. There is of course also a direct negative implication for the USD of a larger trade deficit, but this is generally not seen as a significant factor in the short run.

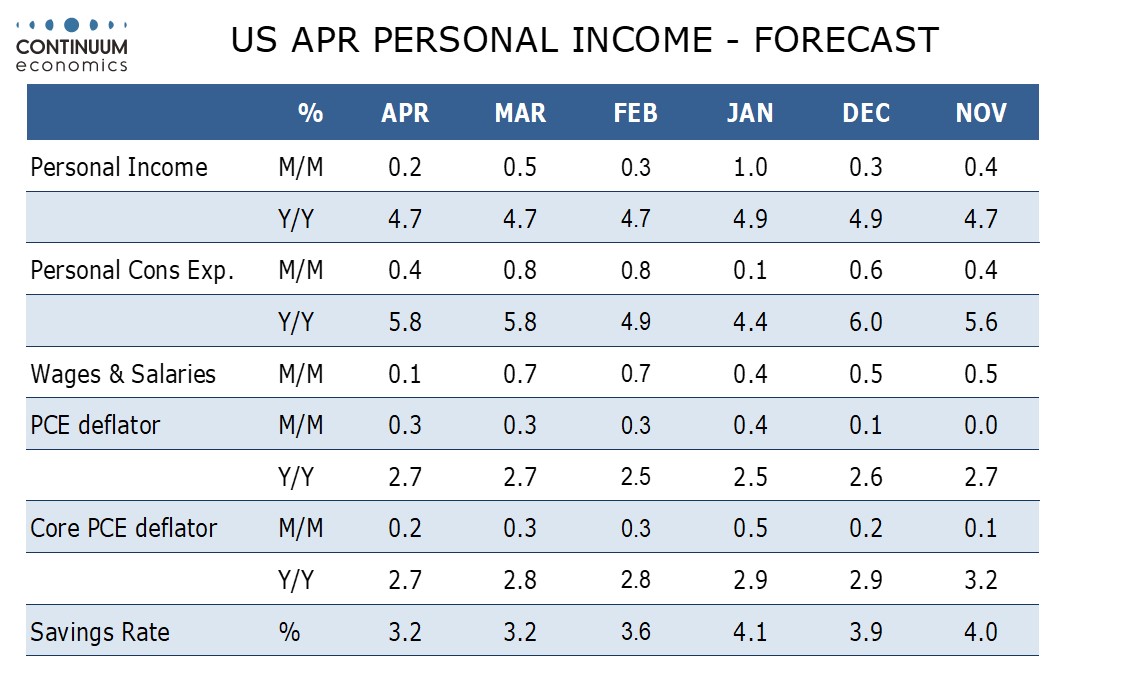

The PCE data on Friday will need to be on the weak side of expectations if USD weakness is to extend. April’s core PCE price index looks set to come in close to 0.25% before rounding, though we expect the index to be rounded down to 0.2%, while overall PCE prices are rounded up to 0.3%. Our forecast for core is on the low side of market consensus, so could be enough to extend the USD decline, but it’s a close call and we wouldn’t expect a large impact.

Otherwise there is an array of European data, but nothing that looks likely to have a big impact. Most potential comes from the Eurozone CPI data, but with the German and Spanish numbers already released this week, and broadly in line with consensus, it will require French and Italian data to be well away from expectations if he data is to have any notable impact. We continue to see current EUR yields as pricing in too little ECB easing this year, which suggests some downside risks for the EUR, but ahead of next week’s ECB meeting (where a rate cut is essentially fully priced in) we wouldn’t expect much change in market pricing unless the CPI data springs a big surprise.

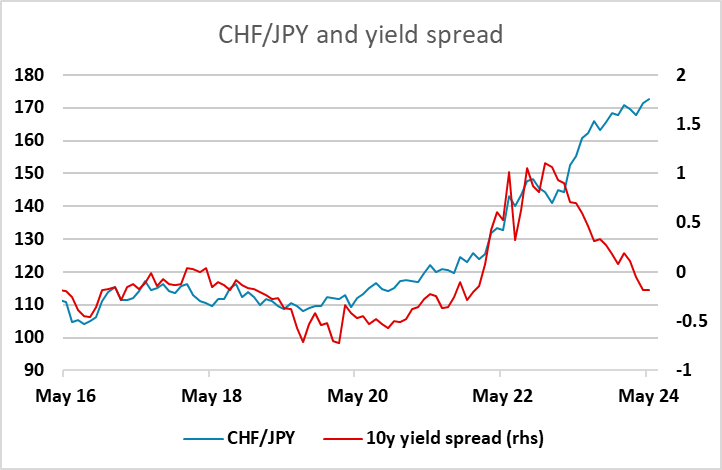

While the JPY performed a little better on Thursday, the best performer was the CHF, with EUR/CHF dipping below 0.98 after better than expected Swiss Q1 GDP data. The retreat from parity in EUR/CHF may mark the short term end of the rally seen this year, with the coming months more likely to see rate cuts from the ECB than the SNB. Nevertheless, the CHF looks a more attractive funding currency than the JPY given the huge valuation move in the last few years, and with CHF/JPY hitting its highest since the BoJ intervention at end April/beginning of May, it looks ripe for a reversal lower.