FX Daily Strategy: APAC, May 30th

Risks to USD turning negative as market awaits Trump reaction to court decision

USD/JPY vulnerable to any announcement of new tariff measures

CPI data more likely to support JPY than EUR

Risks to USD turning negative as market awaits Trump reaction to court decision

USD/JPY vulnerable to any announcement of new tariff measures

CPI data more likely to support JPY than EUR

The focus for Friday and likely for the coming weeks is still going to be on tariffs and how the Trump administration react to the International trade court’s ruling that the president didn’t have the power to impose reciprocal tariffs. While the markets’ initial reaction was positive, as a removal of these tariffs would be seen as good news for the US and global economy, it s still unclear whether the court’s decision will be effective in reducing tariffs. First of all, the White House is appealing, and the court’s decision could be overturned. However, this may take some time, and there is only a 10 day grace period before the reciprocal tariffs need to be unwound. More concerning for those expecting tariffs to be removed is the potential for the administration to raise tariffs by other means. Product tariffs are seen to be legal, and there are also other legal avenues whereby surplus countries can have a 15% tariff imposed. We would expect more product tariffs to be announced fairly shortly, with pharma the most obvious target, and that could trigger a negative market reaction, more than reversing the positive impact of the initial court decision.

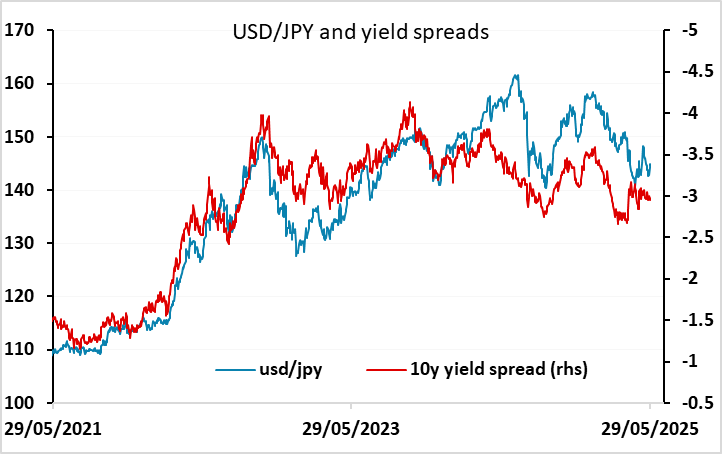

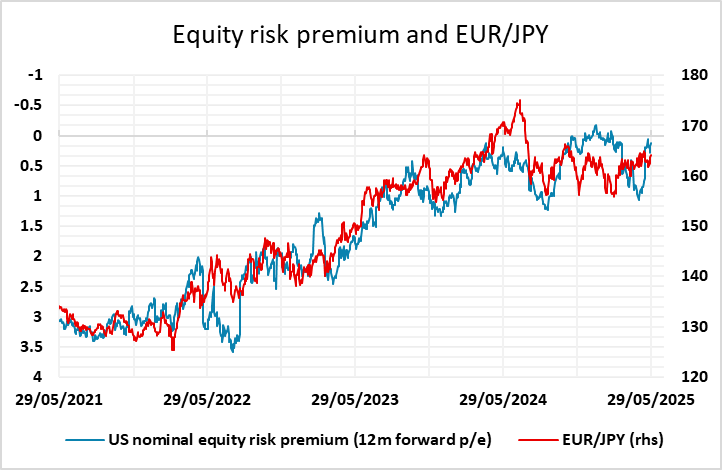

This suggests to us that the risks have shifted towards a danger of risk negative news. This is also against a background of a less positive economic picture after the Q1 GDP revision revealed a weaker than expected rise of 1.2% in consumer spending in Q1. So although there is limited US data on Friday, with the trade data and the University of Michigan survey the only notable releases, we would see downside risks for the USD, both because of the danger of a Trump reaction to the court decision and because the market may anticipate some reaction next week, leading to some position unwinds after the strong equity run seen in recent weeks. USD/JPY continues to looks the most vulnerable, as the JPY will tend to benefit on the crosses from any rise in equity risk premia.

Friday also sees the latest Tokyo CPI data, which act as preliminary CPI for Japan. The latest data saw Tokyo, national, headline and core all converge near 3.5%. This month the consensus is for a small rise in core Tokyo CPI, and this should provide some more support for Japanese yields. There still isn’t much risk of BoJ tightening priced into the curve, with less than 20bps priced in by the end of the year, and tightening is unlikely if we see a negative impact on the world economy from US tariffs. But in that circumstance, the JPY is likely to gain in any case. If the world economy proves resilient, as current equity market pricing suggests, the market is underpricing the risks of BoJ tightening. So the JPY looks likely to perform solidly even in a more risk positive scenario.

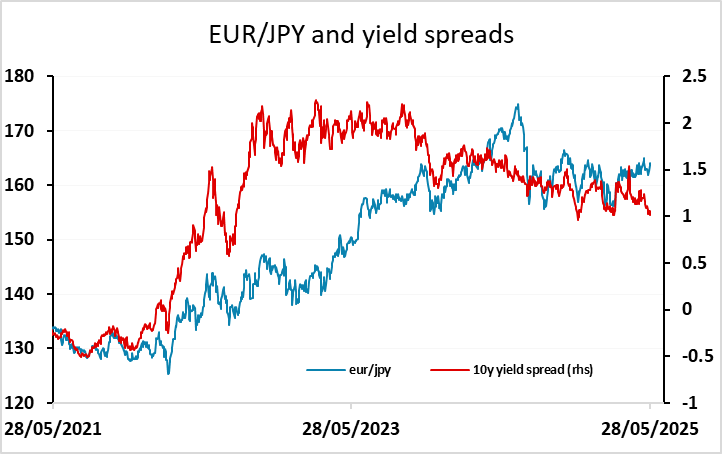

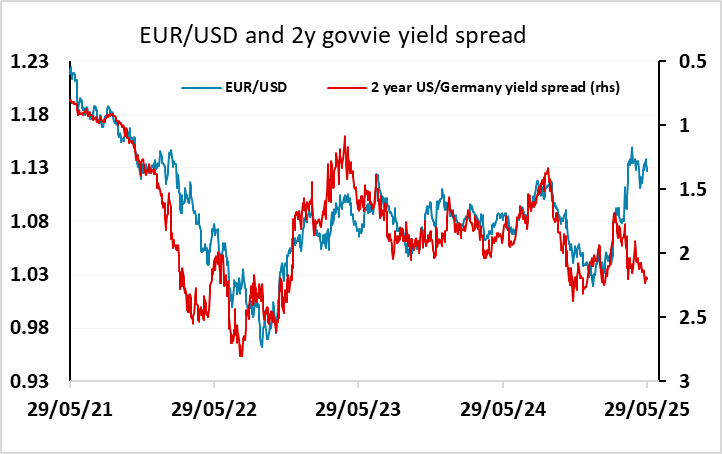

We also have provisional German, Spanish and Italian CPI data for May. The French data released earlier this week was soft, and similar softness elsewhere would suggest there is more scope for ECB easing than the 56bps priced into the curve for the rest of the year. While EUR/USD has disconnected from moves in yield spreads, this may keep the EUR on the back foot on the crosses.