FX Daily Strategy: Europe, March 4th

Tariff decision to determine risk tone

CAD looks vulnerable on the crosses

JPY should gain against the USD in most scenarios

EUR may benefit from ECB meeting

Focus on US tariff announcement

Scope for CAD weakness as tariffs increase still likely to mean lower CAD yields

EUR strength on expected spending increases may be overdone

JPY still has upside potential

There’s no significant data due on Tuesday, so the market will be even more focused on the expected announcement of tariffs on Canada (and Mexico and China). After the comments at the weekend suggesting that they would not necessarily amount to the full 25% threatened, the market assumption looks to be somewhere in the region of 10%. While this would be less than had been threatened, it would still be quite damaging for the Canadian economy. The Bank of Canada estimated that a 25% tariff would reduce GDP by around 2%, so a 10% tariff would likely mean GDP at least 0.5% lower than expected. This might not be enough to push the Canadian economy into recession, especially after the stronger Q4 numbers released on Friday, but might mean slightly easier BoC policy than currently anticipated.

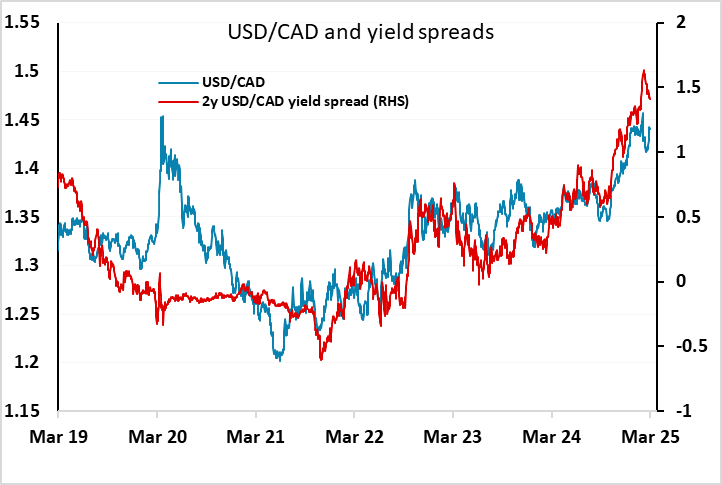

We don’t believe that there is much impact from tariffs priced into the Canadian curve, so there is a risk of lower yields if tariffs are announced, even if only at 10%. If Canada retaliates the policy impact is unclear, as higher Canadian prices would limit the BoC’s room for manoeuvre. But we would expect any retaliation to be targeted rather than across the board, so the risk for Canadian yields – and for the CAD – looks to be on the downside. This is even more the case given the starting point for USD/CAD remains some way below the level suggested by the correlation with yield spreads.

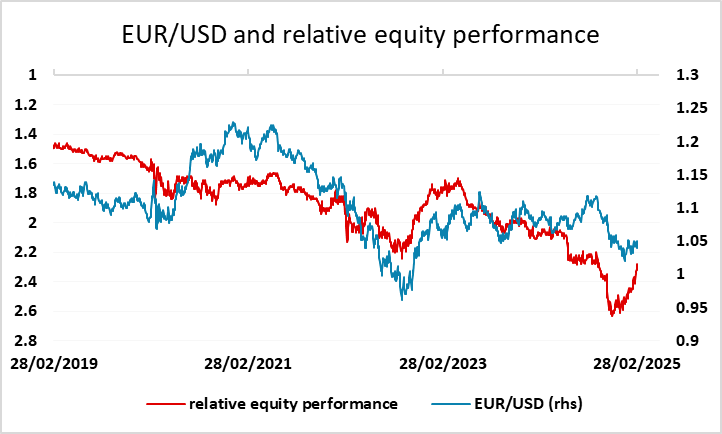

Even so, the USD is seeing some general softness driven mostly by increased expectation of rising European fiscal spending on defence as a result of the US reducing their support for Europe. This drove European equities higher on Monday, and European equities were already outperforming this year, in part because of the high valuations in the US and some concerns about the latest US data. But the market may be jumping the gun a little, as any increase in European fiscal spending could take some time, and it remains uncertain how well this can be organised. While we do slightly favour the EUR upside, helped by the prospect of equity market outperformance, it is unlikely that the EUR will manage rapid gains at least until there is better evidence of stronger European growth or clearer evidence of weakness in the US. Neither seems imminent.

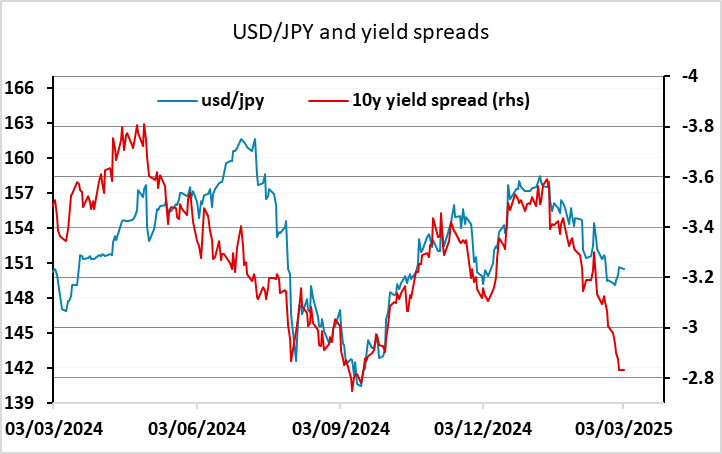

The USD was strong at the end of last week in part because of tariff expectations, but also likely in part because of end of month flows. Some of the USD decline in Monday was due to a reduction in the market’s expectation of tariff increases, and some was related to the expectation of more European fiscal spending, but there may also have been some repricing after Friday’s end of month flows. USD/JPY continues to looks the most out of line with current yield spreads, with spreads moving sharply in the JPY’s favour last week but the JPY failing to benefit. Monday saw some buying of EUR/JPY and other JPY crosses on the better European equity performance, which helped sustain the softer JPY tone, but the risks of a sharp JPY upmove are increasing, even if it is possible for the correction to extend to the 153 area.