FX Daily Strategy: Europe, October 23rd

CAD risks two way on BoC decision

JPY weakness approaching big levels

CHF strength may be overdone

CAD risks two way on BoC decision

JPY weakness approaching big levels

CHF strength may be overdone

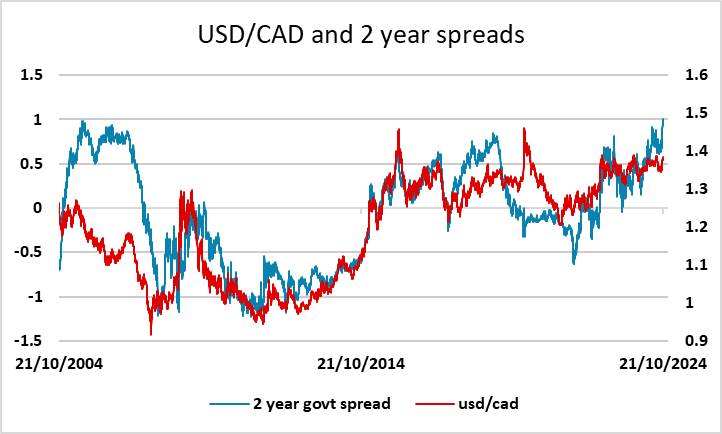

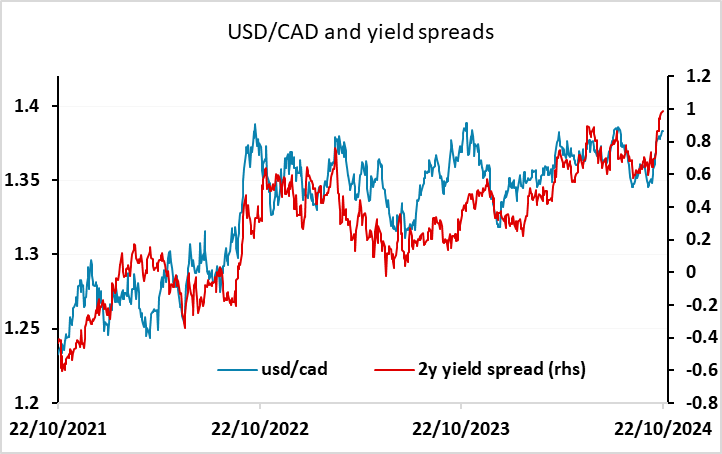

Wednesday looks like another generally quiet day, with the main event being the BoC monetary policy decision. We see it as a close call between a fourth straight 25bps easing to 4.0%, which is our expectation, or a 50bps move to 3.75%. This suggests risk/reward is biased strongly in the CAD’s favour, as the market is close to being fully priced for a 50bp move (currently seen as a 93% chance). However, we are starting from a position where 2 year yield spreads have moved very much in the USD’s favour in recent weeks, with the current 1% spread the highest since the late 1990s, so if we see a 50bp rate cut as the market expects, the recent rise in USD/CAD may extend towards 1.40. The reaction may also depend on what is suggested for December. With the market currently pricing 80bps of easing for the two months, any suggestion that a 50bp cut was possible in December on top of a 50bp move this time could eb expected to spike USD/CAD sharply higher.

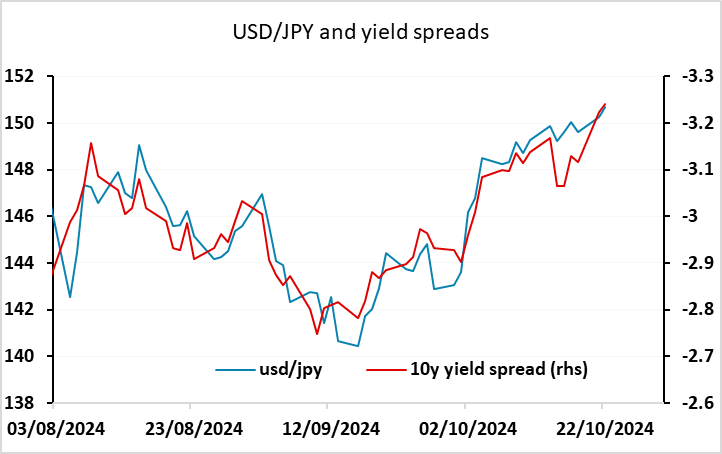

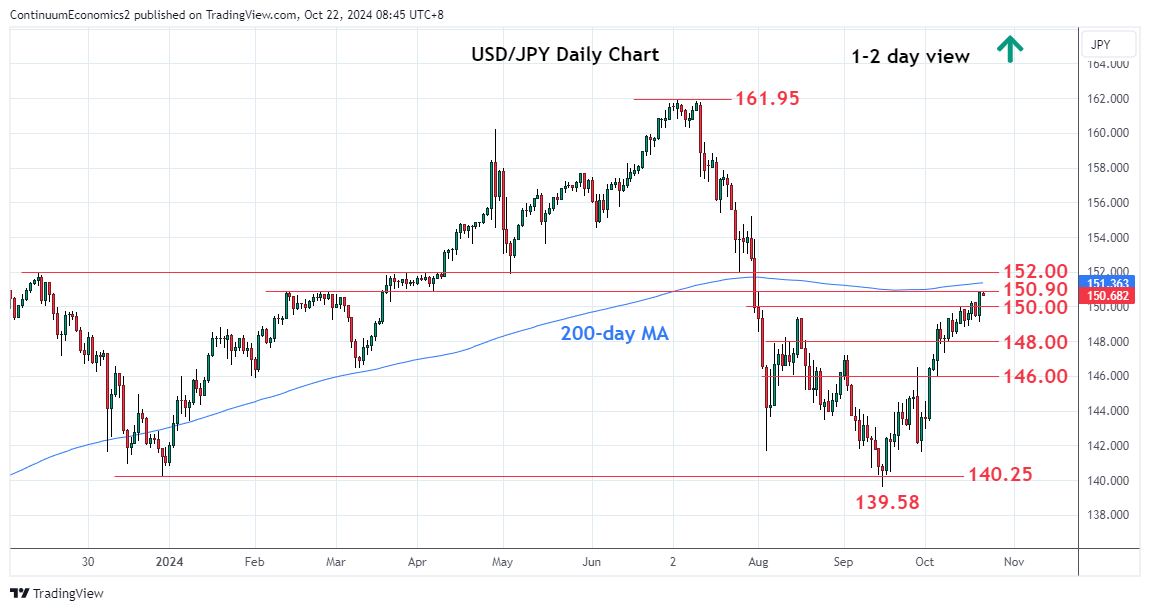

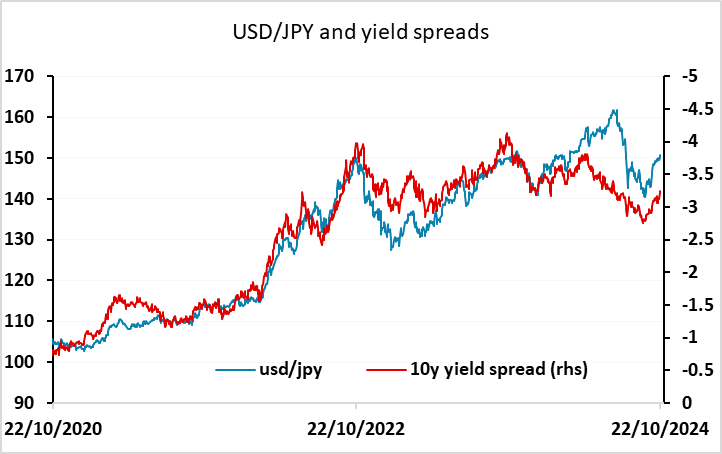

There is very little else on the calendar, so it seems likely that the trends of recent days may extend. This would mean general USD strength and some JPY weakness, even though we are getting to levels that are starting to attract the attention of the Japanese authorities. As we have noted ad nauseam, the JPY is very cheap relative to long term fair value and also cheap relative to yield spread metrics, but USD/JPY has nevertheless broadly followed yield spreads since the recovery from the summer drop started in August. This suggests we may need more gains in US yields to trigger any break of the 200 day moving average above 151 which looks like the next target for USD bulls.

The recent rise in US yields looks a little overdone in our view. It likely reflects rising expectations of a Trump victory, and possibly also the rising potential of a Republican clean sweep. But if Congress is split we doubt that there will be sufficient policy changes to justify the recent rise in yields. In any case, we see USD/JPY as vulnerable at these levels on anything other than a short term basis.

While the JPY has been weak, the CHF has been strong in recent days, gaining ground against the EUR. This suggests safe haven demand, which is also reflected in the strength of the gold price. However, this hasn’t shown up in any general weakness in riskier currencies or equities. If it does, the JPY is likely to benefit from safe haven demand as well. As it stands, we would tend to see the recent strength of the CHF as likely to reverse.