USD, EUR, JPY flows: USD surges on Fed, JPY suffers as BoJ stands pat

USD generally stronger as US yields rise after FOMC. JPY sees most weakness as BoJ leaves rates unchanged

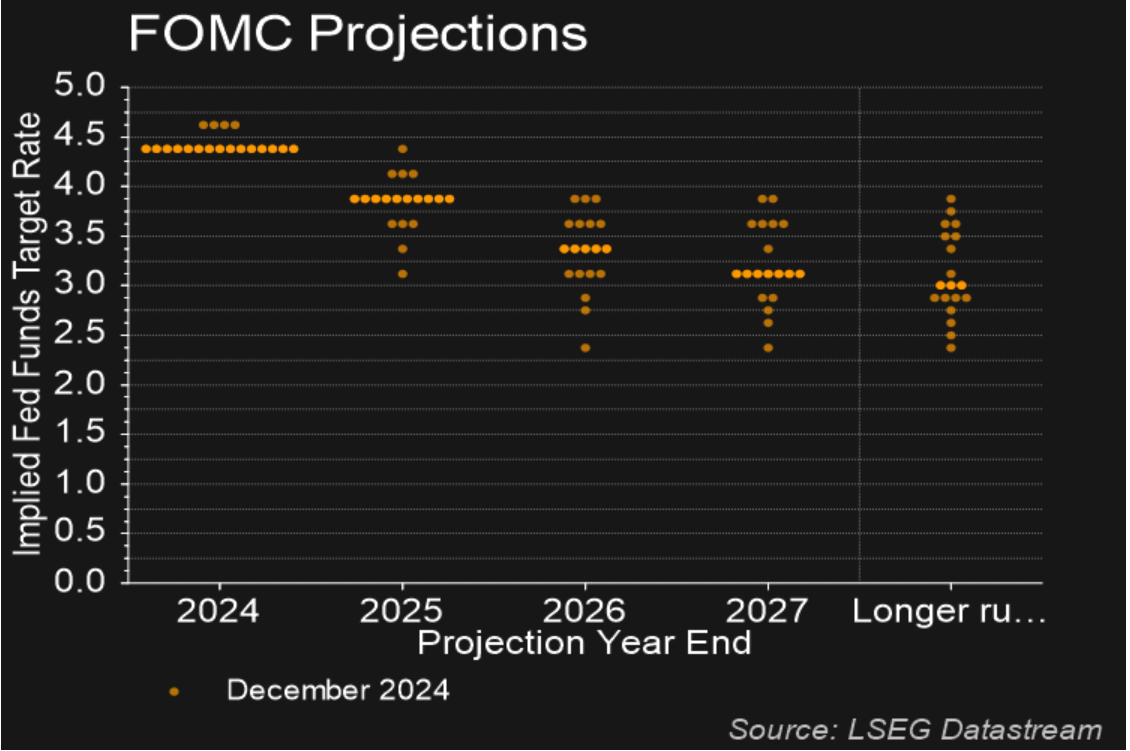

The USD has surged following the FOMC meeting, which triggered a general rise in US yields as the Fed reduced their expectations of easing and increased inflation forecasts for 2025 and 2026. The Fed “dots” now indicate a median of 50bps of easing in 2025, with a mild skew towards more cuts, from 100bps back in September. Although 50bps of 2025 cuts were already priced into the market going into the meeting, the market has further reduced their expectation of cuts to 35bps in the wake of the meeting, triggering general USD gains.

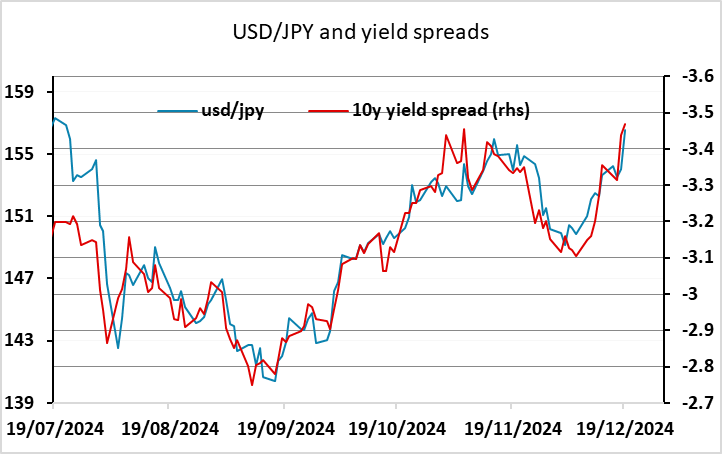

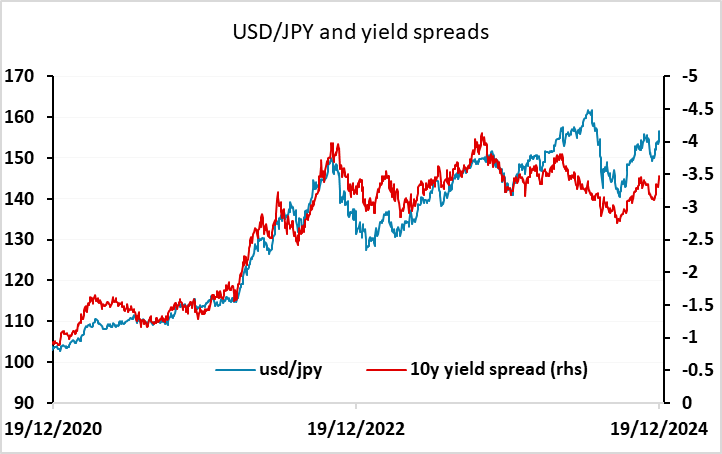

USD/JPY has been the biggest mover, helped also by the BoJ’s decision to leave rates unchanged at the December meeting. This was largely priced in ahead of the meeting after last week’s less hawkish BoJ comments, so there was little immediate reaction to the BoJ decision. USD/JPY has moved sharply higher in late Asia/early Europe, gaining another big figure, but this looks like a realignment with the higher US yields seen after the Fed. USD/JPY continues to map moves in the 10 year spread since August, and with JGB yields failing to follow the rise in US yields, USD/JPY at 156.50 is in line with the current spread. However, a bigger picture view still suggests this is too high based on the historic relationship with spreads.

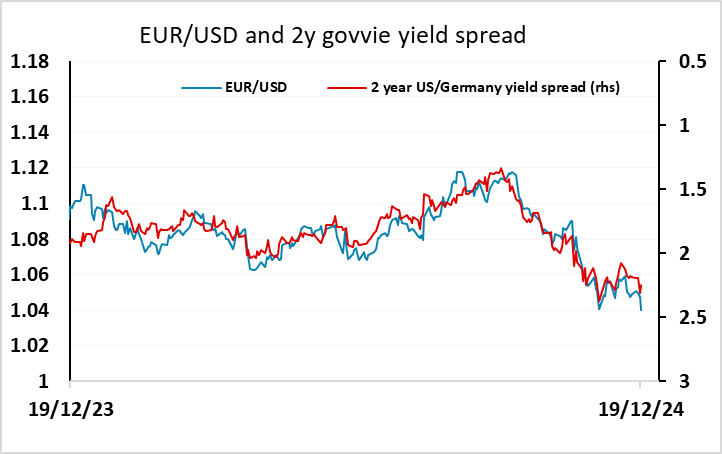

The EUR has held up slightly better than the JPY. EUR/USD has tended to follow the 2 year USD/EUR spread of late, and this hasn’t moved as much as the 10 year US/Japan spread, partly because the US curve has steepened slightly, with the 10 year yield rising more than the 2 year, partly because EUR 2 year yields have been pulled higher by US 2 year yields. 1.04 looks to be on the low side based on this correlation, but the rise in EUR 2 year yields may prove temporary, so we wouldn’t expect a significant EUR recovery at this stage.