FX Weekly Strategy: Europe, August 4th-8th

GBP under pressure but may manage recovery

JPY to benefit as risk sentiment continues to decline

CHF may see delayed reaction to tariff announcement

EUR/USD picture unclear

Strategy for the week ahead

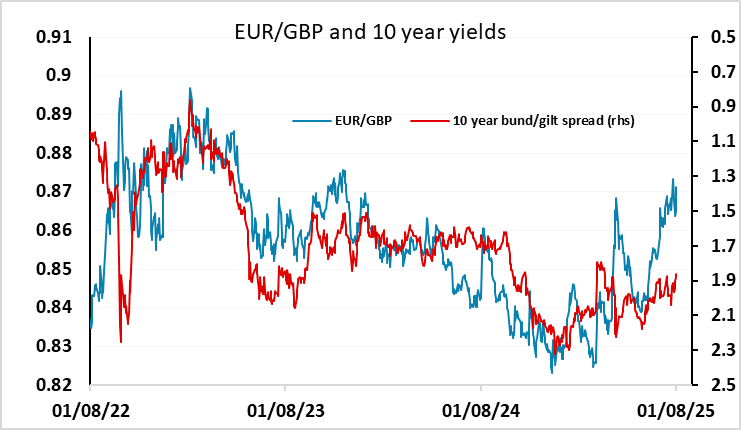

The BoE meeting looks like the main event of a generally quiet week for events and data. GBP came under pressure against the EUR at the end of last week as a result of the decline in risk appetite and the USD after the weak US employment report. GBP was still above its lows against the EUR, and has somewhat underperformed yield spreads in the last few weeks, as concerns about the UK fiscal position have increased. A BoE rate cut this week is around 80% priced in, and we would expect the BoE to cut in line with the market consensus. There is one more cut priced in by the end of the year, and the market reaction may depend on what signal the BoE give for future policy. Projections are likely still to show inflation below target perhaps only from 2027 so the Monetary Policy Statement will still repeat the need for policy to be framed carefully as well as gradually. This may mean that there is potential for GBP to recover a little if there is any recovery in risk sentiment, but this is far from certain.

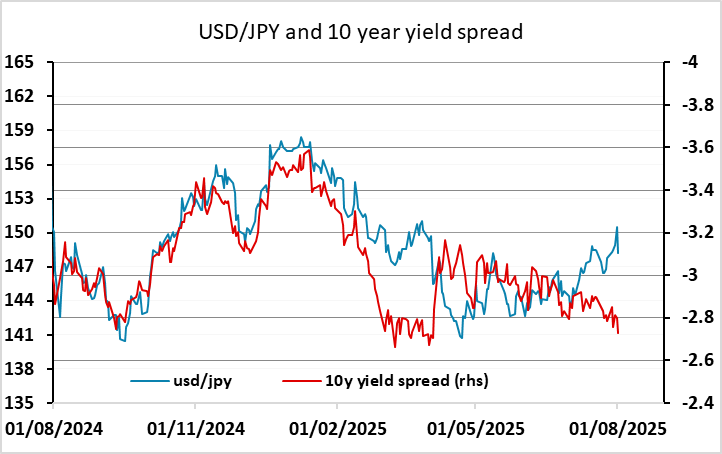

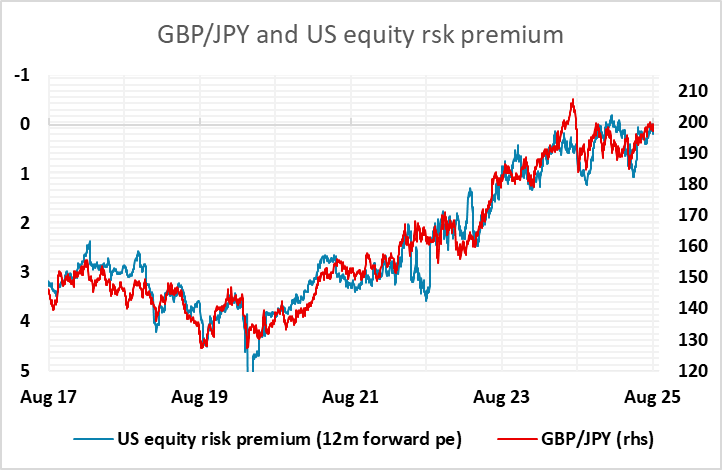

Tariffs will still be a major focus this week after the announcement of 35% and 39% tariffs on Canada and Switzerland last week. The market will want to see if these are negotiated down, as the combination of this and the weaker employment report were behind the weaker risk tone at the end of the week. While we may see some initial stabilization, we would now see a major danger of a weakness in risk sentiment extending in the coming months. We have been saying for some time that the low level of US equity risk premia simply isn’t justified by the prospects for the US economy, and last week’s employment data and US GDP data underline this. While the Q2 GDP number was a little stronger than expected, H1 GDP growth of 1.2% annualized is hardly consistent with the pricing of substantially above average corporate earnings growth, especially starting from near enough full employment. From an FX perspective this suggests there is upside scope for the JPY in general. USD/JPY is already well above the level suggested by yield spreads, while JPY crosses look vulnerable to any rise in risk premia.

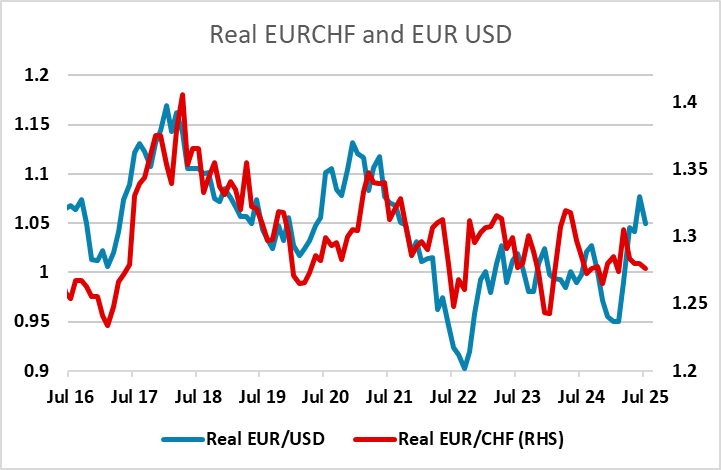

The CHF may be something of a focus as well, as there was little reaction to the unfavourable tariff news last week. It isn’t unusual for the CHF to ignore Swiss specific news in favour of more global stories, but EUR/CHF has made several attempts to break below 0.93 of late without success. In a risk negative world the CHF would normally be expected to perform well, but the fact that EUR/CHF has been pressing the lows in a risk positive environment makes this more questionable. EUR/CHF does appear to be lagging behind the normal relationship with EUR/USD, and it may be the case that the support at 0.93 is partly due to the SNB (although there is no evidence of intervention as yet).

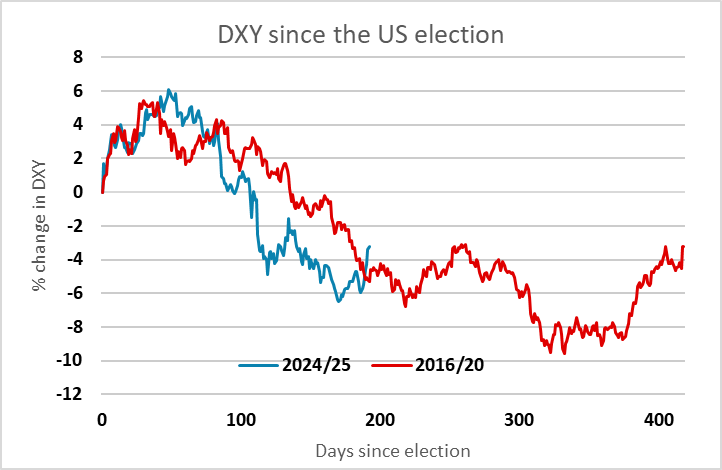

For EUR/USD, the picture remains very unclear. Traditionally, the EUR has tended to fall against the USD on dips in risk sentiment, and in recent years has been sensitive to moves in short term yield spreads. But there was a big break in the relationship when the tariffs were announced in early April, and reports that investors were shifting away from the US because of uncertainty about whether US exceptionalism would be sustained going forward. While the USD managed a modest recovery when some of the tariff uncertainty was resolved, EUR/USD remains well above the level suggested by yield spreads. Evidence of US economic weakness will tend to support the EUR via yield spreads, but the EUR is already well above the levels suggested by yield spreads, so the support may not be large, especially if we see weakness in equity markets. We consequently expect EUR/USD to be fairly neutral, buffeted by cross winds, and for the USD index to continue to broadly follow the path seen in the first Trump presidency.

Data and events for the week ahead

USA

It is a fairly quiet week for US data. Monday sees June factory orders. On Tuesday we expect June’s trade deficit to narrow to $61.3bn from $71.5bn and July’s ISM services index to increase to 51.5 from 50.8. Thursday sees weekly jobless claims, Q2 productivity and costs, June wholesale sales and June consumer credit.

Canada

In Canada Tuesday sees June’s trade balance and Wednesday sees July’s S and P services PMI. July’s Ivey manufacturing PMI is due on Thursday. The most important Canadian release will be July employment on Friday, following surprisingly strong data seen for June.

UK

After what was widely considered to be a dovish hold at the last (June) MPC meeting (Bank Rate staying at 4.25%) which saw three dissents in favor of easing at that juncture, a 25 bp reduction is very much on the cards for the August decision next Thursday. One problem is that neither concerns about fiscal policy on consumer savings, because of a lack of detail, can be incorporated into the updated BoE projections. Thus, the message from those projections, likely still to show inflation below target perhaps only from 2027 may be misleading although likely to mean that ostensibly the Monetary Policy Statement will still repeat the need for policy to be framed carefully as well as gradually. Alongside the decision, an update on various issues will be available to the MPC from its fresh Decision Makers Survey and Friday sees more labor market insights from the REC survey numbers. Final PMI figures (Tue) may attract little attention, but the construction counterpart may be of more interest.

Eurozone

There are few individual ECB Council speakers, with Finland’s Rehn chairing a seminar on Tuesday but with more insight from the fresh ECB Bulletin (Thu). Otherwise, a far from busy week data-wise sees retail sales data (Wed), important to assess to what extent the consumer may be helping shore up recent solid EZ GDP numbers. But cracks remain as may be seen in Construction PMI data (Wed) they coming a day after the final composite figures. Germany sees June industrial data where production figures (Thu) which may see a fresh reversal after a surge in energy output in the previous month as may orders data due on Wednesday.

Rest of Western Europe

There are a few key events in Sweden, most notably flash CPI data for July (Thu) notable as at least prior to the June rise, April and May figures added to signs that the inflation pick-up early in the year may have been a blip. We see the June upside surprise being partly reversed with CPIF inflation down 0.2-0.3 ppt from 2.8%,

Otherwise, in Switzerland, Monday sees what may still be soft CPI figures for July, likely to stay around 0.1% y/y and in line with SNB thinking.

Japan

The BoJ meeting minutes will be released on Tuesday, could provide us with more cues of BoJ coming decision. While Ueda’s post meeting remark has mostly sunken expectation of an imminent hike, we could perhaps see what is really discussed in the meeting to review the credibility of that remark. Labor cash earning will be more critical as wage growth has slowed significantly in May, potentially due to tariff complication. While we will not have a comprehensive rebound yet with the deal mostly done in July, it is imperative to see traction in wage, to support BoJ’s sustainable inflation.

Australia

We will have private inflation gauge on Monday, PMI on Tuesday and Trade Balance on Thursday. The private inflation survey would be more important as it would preview the magnitude of easing in inflation and may affect market participant’s anticipation of an imminent cut from the RBA.

NZ

Labor data will be released in early Wednesday, along with wage, followed by RBNA inflation expectation on Thursday. The labor cost index is more important than headline employment data as the market is looking towards the last cut from the RBNZ. It could be further supplemented by inflation expectation, a low 2% count could see an cut from RBNZ in the next meeting.