FX Daily Strategy: N America, November 20th

GBP firmer after CPI

JPY remains the favoured safe haven as risk appetite wanes on Russia concerns

GBP firmer after CPI

JPY remains the favoured safe haven as risk appetite wanes on Russia concerns

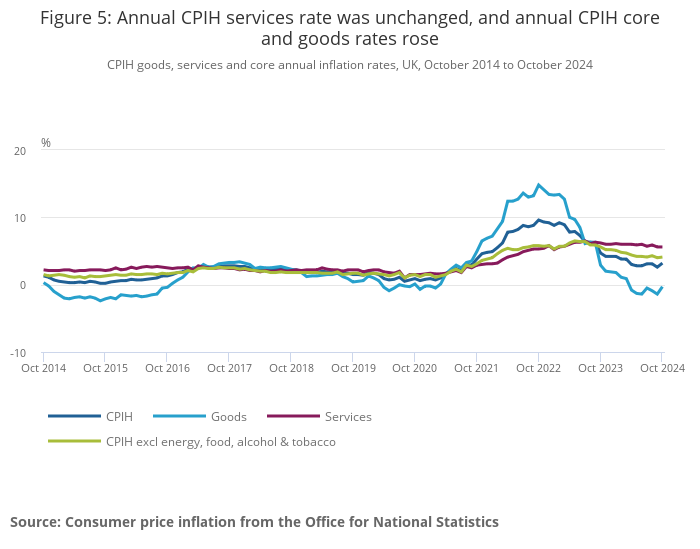

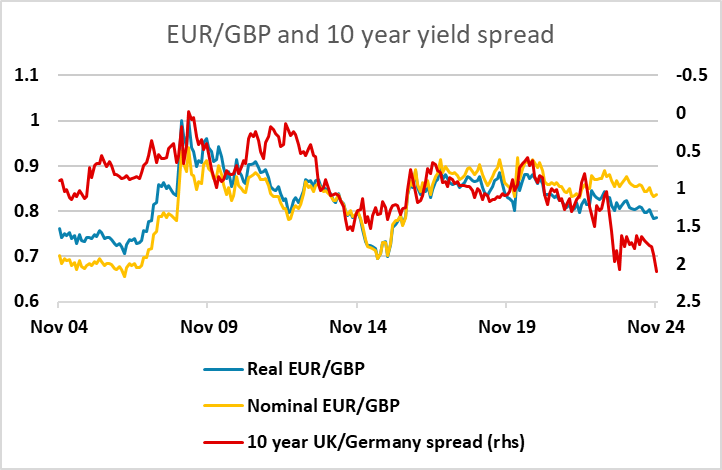

Stronger than expected UK October CPI effectively rules out the chances of a December UK rate cut and has triggered a 20 pip decline in EUR/GBP to 0.8330. All CPI measures were above expectations, with core at 3.3% well above the 3.1% consensus while headline at 2.3% was also above the 2.2% consensus. However, most of the rise was due to a rise in electricity and gas prices, and services inflation was steady at 5.6%, albeit too high for comfort.

GBP is likely to hold and possibly extend gains slightly in the short term, having slipped back a little in recent sessions. A generally better risk tone is supportive as well, but it will still be a significant challenge for EUR/GBP to dip back below 0.83. While yield spreads point lower, the rise in UK yields since the Budget has failed to provide much of a boost to GBP, suggesting that the implications of the Budget for the UK economy and government debt profile are seen as justifying an increase in the risk premium attached to the pound.

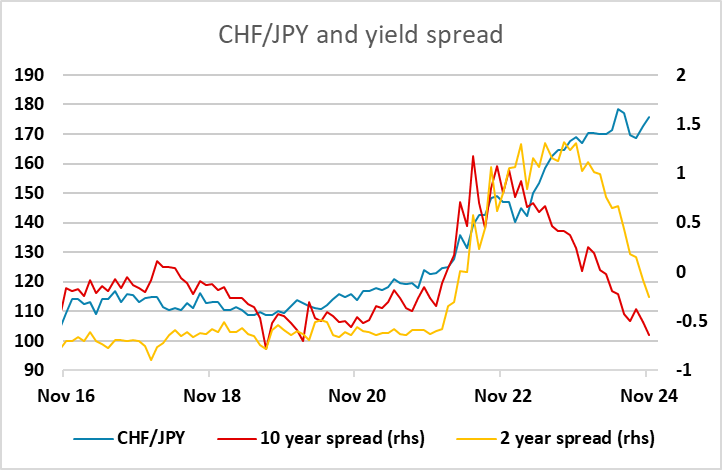

The Russia/Ukraine developments have lent a generally more risk negative tone to the FX market, with the JPY and CHF the best performers on Tuesday. In practice, Putin’s comments about the Russian nuclear threat are intended to discourage aggressive Ukrainian attacks and we doubt he will follow through with action. But his comments do introduce further uncertainty heading into the new Trump presidency and it’s hard to take too positive a risk view given the already very low market risk premia. The JPY should remain the preferred safe haven here given its low valuation and the possibility of a BoJ rate hike in December, while the Fed and the SNB are likely to cut, possibly by 50bps in the SNB’s case. The sharp decline in the JPY overnight consequently looks overdone.