FX Daily Strategy: N America, October 30th

US GDP may weigh on the USD after recent gains

GBP might benefit from UK budget

EUR benefiting from stronger data

AUD looks undervalued

US GDP may weigh on the USD after recent gains

GBP might benefit from UK budget

EUR benefiting from stronger data

AUD looks undervalued

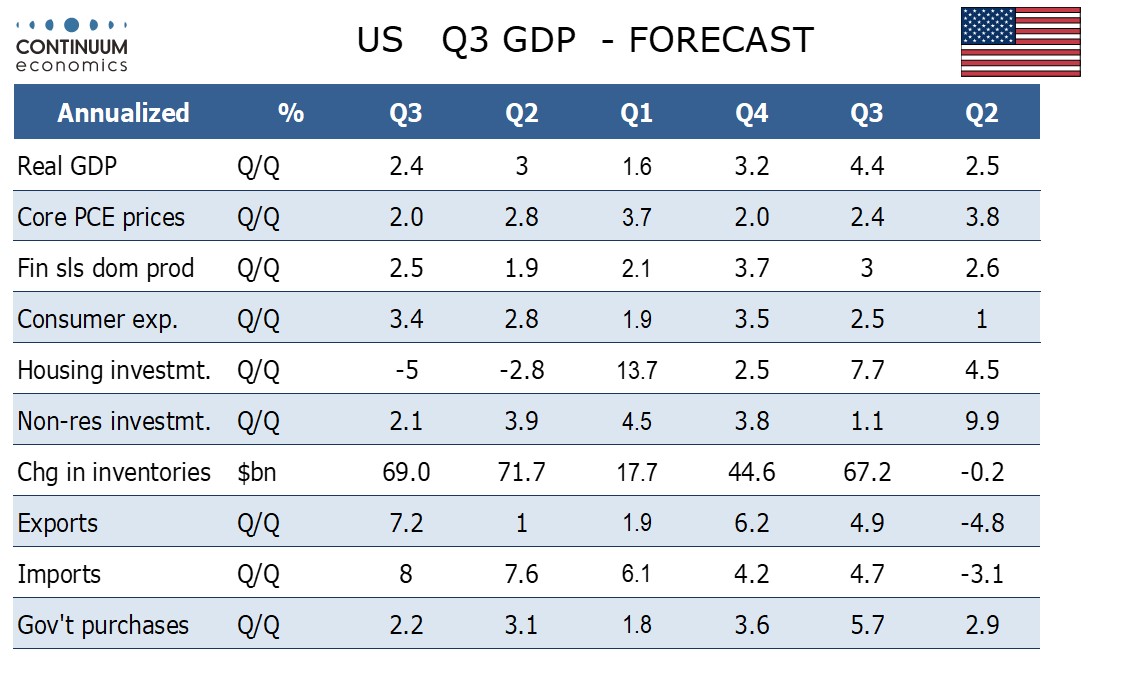

After a quiet start to the week, Wednesday has a plethora of data releases, with then highlight being the US Q3 GDP data, as well as the UK budget statement. We expect a 2.4% annualized increase in US Q3 GDP, slower than Q2’s 3.0% but still maintaining solid momentum. Q3’s gain will be led by consumer spending, with a slowing in core PCE prices to an on-target 2.0% annualized after gains of 2.8% in Q2 and 3.7% in Q1. Our forecast is on the soft side of market expectations, with consensus at 3.0%b annualised, so there might be some USD negative impact, especially since the short term market is long USD after the gains of the last few weeks. USD/JPY positioning is likely to be the most vulnerable given the JPY’s recent weakness.

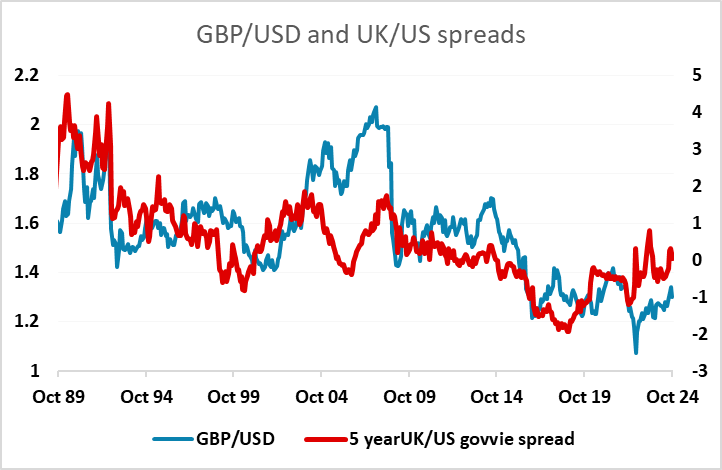

For the UK the key event is the Budget and Spending Review. With speculation that the Chancellor faces a £ 40 bln funding gap which will be addressed largely through tax rises, it seems as if the UK economy faces a larger fiscal tightening than was planned under the previous government. However, it seems likely that the Budget measures will actually be less restrictive as the government looks set to change the fiscal rules to allow more investment. This should therefore reinforce the Office for Budget Responsibility’s already relatively upbeat growth outlook. However, the impact on GBP is hard to predict. We tend to favour the upside because GBP retain some risk premium from the 2022 Truss budget, with GBP trading lower than the historic correlation with yield spreads would suggest ever since (despite some recovery). If the budget is seen as responsible but also offering the chance of growth recovery in the longer run, the pound might react positively.

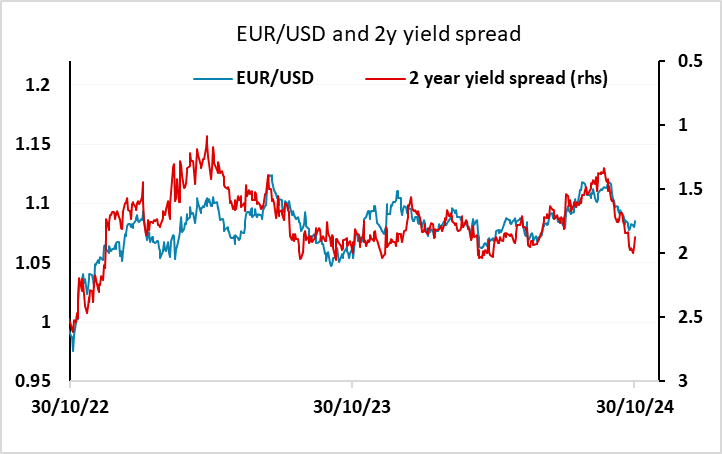

Before the US data there has been provisional CPI data in Europe from Spain and Germany, and also provisional Q3 GDP data from the Eurozone. We have seen much stronger than expected German GDP at 0.2% q/q in Q3, to go with the stronger Spanish and French numbers earlier. Although the Italian numbers were weaker than expected, this ensures that the Eurozone number will be above the 0.2% consensus. The German state CPI data is also well above expectations, with y/y rate rising 0.5% or more. This data has triggered some more EUR/USD gains, with EUR 2 year yields up 6bps in response as the market prices out the risk of more aggressive ECB easing. However, short term spreads still don’t suggest scope for significant EUR strength, so we wouldn’t anticipate a move up to 1.09. But EUR/USD now looks better bid short term and 1.08 is likely to provide good support.

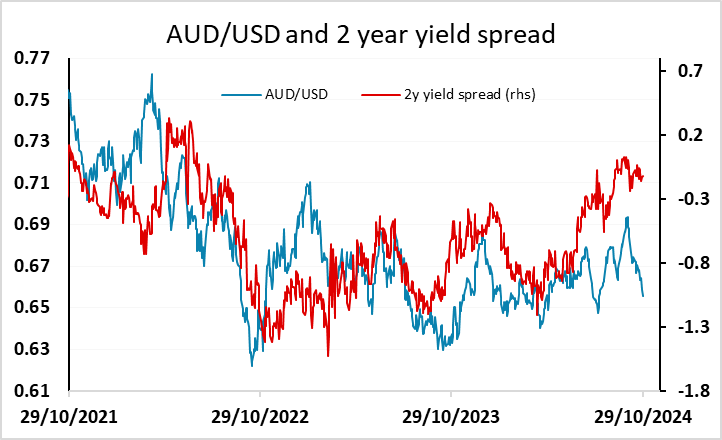

Elsewhere, the AUD continued to weaken overnight, falling back after the Q3 CPI data, though it recovered somewhat in late Asia. The CPI data wasn’t particularly remarkable, since despite a slightly weaker than expected headline, the core measures were if anything above consensus. Yield spreads remain very favourable, but the AUD continues to be dragged lower by the correction lower in Chinese equities after the stimulus inspired surge. Even so, there is strong technical support on the 0.65 handle and we see upside risks.