FX Daily Strategy: Asia, June 3rd

Tariff issues still the main focus

EUR may suffer from any new US tariff measures

ECB rate cut and lower inflation forecast may also be EUR negative

CAD to gain modest support from BoC

JPY can gain in risk negative secanrio but should in any case be well supported

Some downside risk on Eurozone CPI

FX impact unlikely to be significant, but USD to remain soft

Some focus on US JOLTS data

CAD may suffer on the crosses

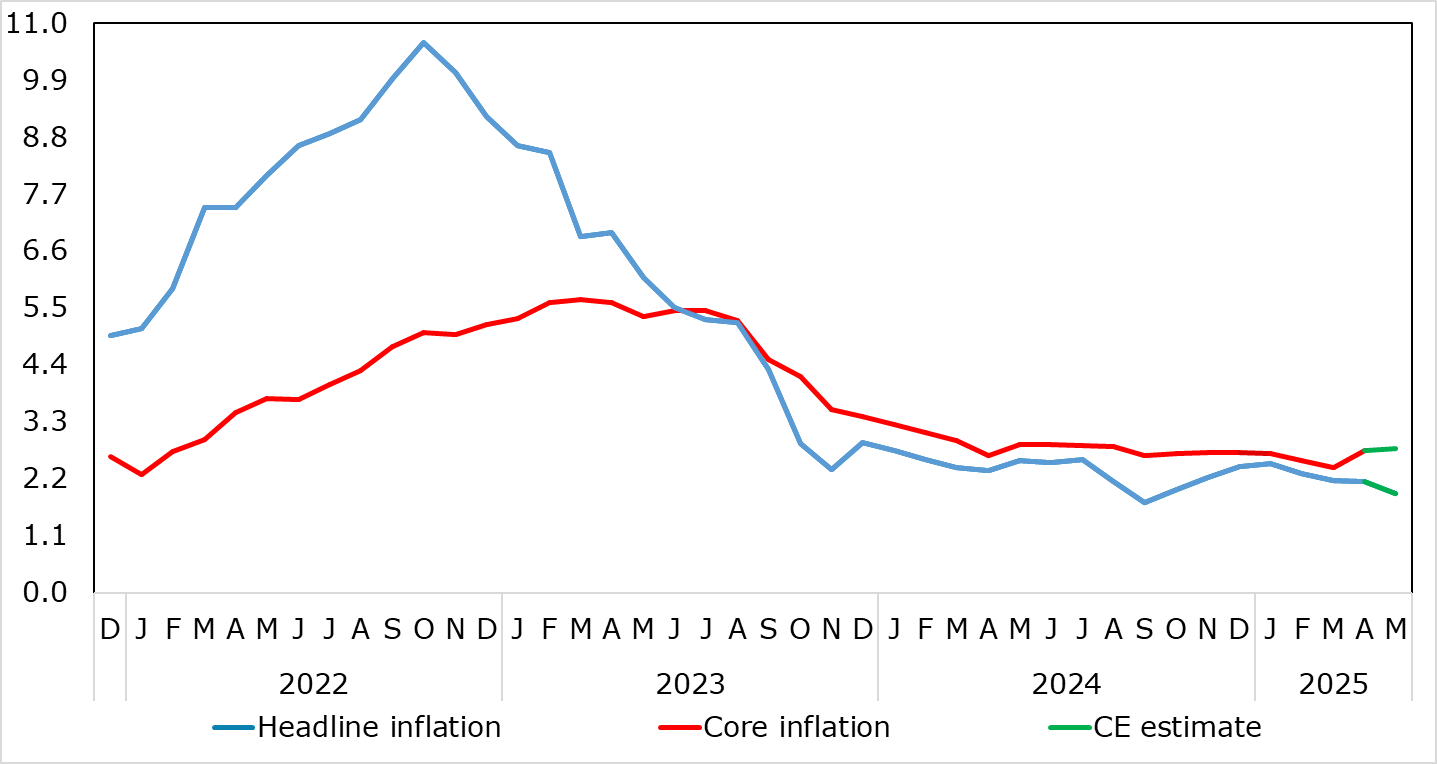

Eurozone Headline CPI to Fall Below Target as Services Rise Reverses?

Source: Eurostat, CE, ECB

Tuesday sees the release of Eurozone CPI data. Exceeding expectations, EZ HICP inflation failed to fall in April, instead staying at 2.2%. More notably, services inflation jumped 0.5 ppt to 4.0%, very probably due to the impact of the timing of Easter affecting airfares and holiday costs. Services inflation is very likely to at least reverse that rise in May, this also likely to unwind the higher April flash core reading of 2.7%, which was up from 2.4%. Indeed, as a result, we see the headline rate dropping to a below-target and eight-month low of 1.9% helped by rounding and a further m/m fall in fuel prices. The preliminary national data has generally been on the soft side, Germany excluded, but our forecast is slightly below the market consensus of 2.0%. The numbers won’t do anything to change market expectations of a 25bp rate cut from the ECB on Thursday, but could influence expectations of the prospects for further cuts this year. As it stands, the market is pricing one more cut this year, most likely in October or December, but could be influenced in that view by this week’s data as well as the ECB comments on Thursday. As far as the CPI data is concerned, it might encourage expectations of an earlier rather than later cut.

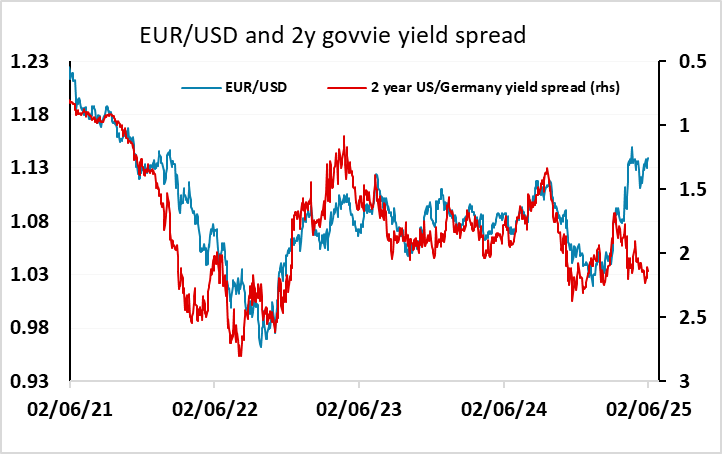

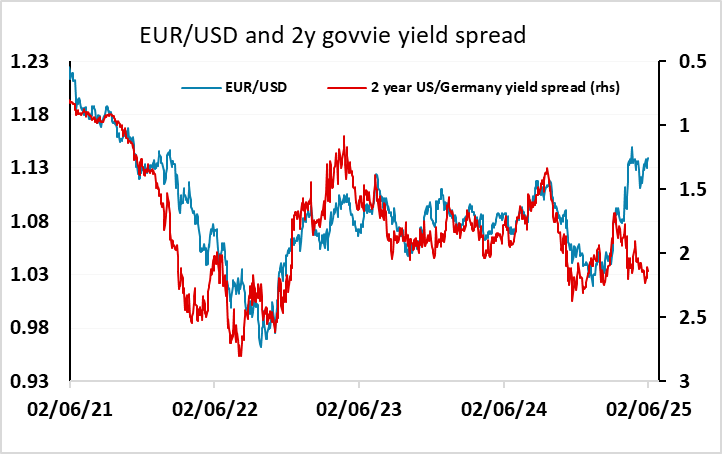

However, there is likely to be minimal market impact. The USD continues to trade softly, due to concerns both about the potential impact of existing tariff increases and about the potential for further tariff increases being announced. Even if EUR yields fall, the correlation of EUR/USD with yield spreads has largely disappeared in the last few months, much as it did in Trump’s first term. The focus is very much more on confidence in the US economy than on moves in yield differentials. Even if the tariff concerns fade a little, there is still a bias among international investors to lighten exposure to the USD, so the downtrend is unlikely to disappear. But one concern for the EUR would be any targeted increase in tariffs, either on products or on areas with significant trade surpluses with the US. While the tendency has been for such tariffs to be USD negative, they might also hurt the target area currency on the crosses. So the EUR and CHF could be vulnerable on the crosses to any announcement of pharma tariffs in particular.

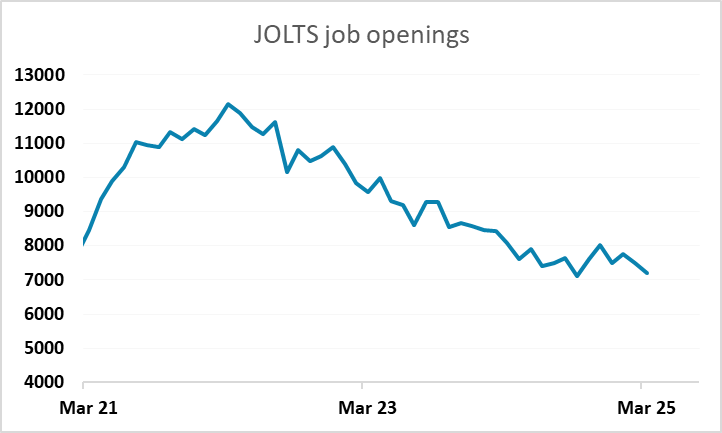

There is only second tier data in the US, with the greatest focus likely to be on the JOLTS data given the employment report later in the week. This has shown a steady downtrend in the last few years, but has been fairly steady in recent months. Indeed, neither the JOLTS data not the claims data shows any strong evidence of significant labour market weakening of late, although continuing claims have been edging up. We consequently don’t expect to see convincing evidence of a weaker US labour market in this week’s employment report, and that may help prevent a major USD breakout to the downside, although the underlying soft tone looks likely to persist.

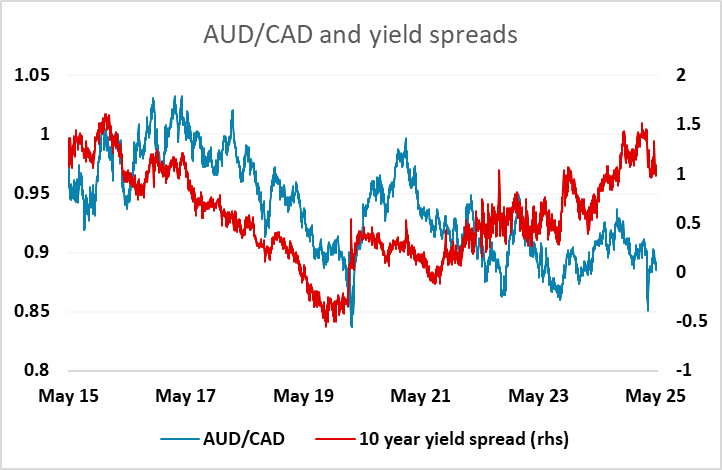

Cross currency activity remains quite limited, but we continue to see potential for the CAD to fall back on the crosses, particularly against the AUD. The CAD will generally underperform in a USD negative environment, and may also suffer form the threat of increased steel tariffs. While the AUD will tend to suffer from any general weakness in risk sentiment, it is less at risk from specific product tariffs. Yield spreads also argue for AUD gains.