FX Daily Strategy: N America, April 30th

Eurozone GDP outperforms consensus...

...with CPI also marginally firm

EUR/USD only modestly bid for now

USD/JPY still has a lot of potential downside, but patience needed

Eurozone GDP outperforms consensus...

...with CPI also marginally firm

EUR/USD only modestly bid for now

USD/JPY still has a lot of potential downside, but patience needed

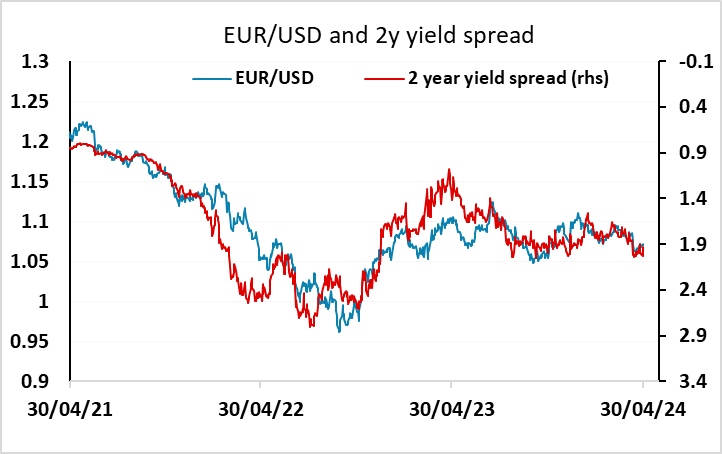

Eurozone GDP came in clearly stronger than expected at 0.3% q/q, but EUR/USD is only slightly higher above 1.07. The Eurozone CPI data has also been on the firm side, with core slightly above expectations at 2.7% y/y even though te healdine number was in line with consensus at 2.4%. But short end EUR yields have risen very modestly, with the ECB still priced as around a 70% chance to ease in June. As long as 2 year yields remain little changed, EUR/USD is likely to be similarly stable.

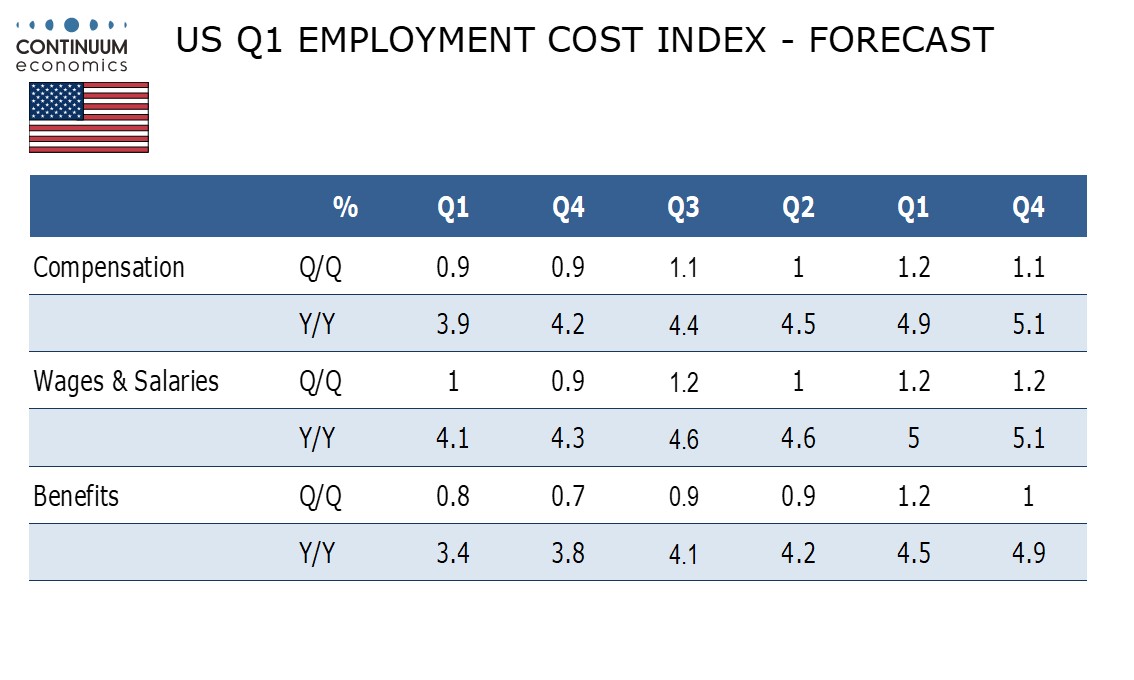

In the US, the employment cost index is the most important data for the Fed coming into Wednesday’s FOMC meeting. We look for the Q1 employment cost index (ECI) to increase by 0.9%, matching the Q4 increase that was the slowest since Q1 2021. Yr/yr growth will continue to slow, to 3.9% from 4.2%, reaching its slowest since Q3 2021, but will remain well above the pre-pandemic trend. Our view is slightly on the soft side of market expectations, so may see the USD edge a little lower.

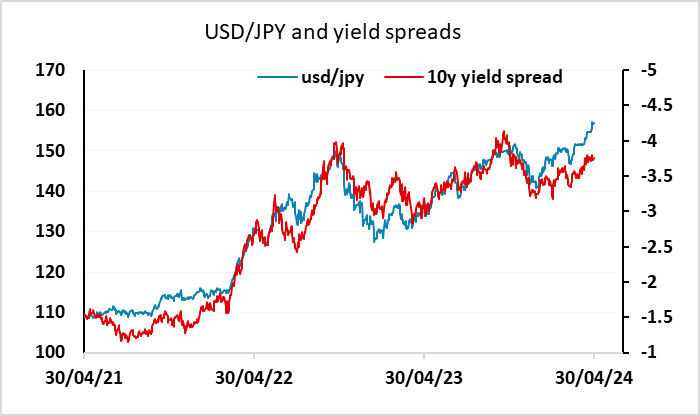

USD/JPY continues to offer the greatest chance of volatility following the sharp move up after the BoJ meeting on Friday and the even sharper move down in response to what looks likely to have been BoJ intervention on Monday. We continue to see a stronger JPY over the longer run, and experience teaches that opposing BoJ intervention isn’t typically profitable. However, JPY weakness has been highly correlated with the strong decline in US equity risk premia in the last few years, and with the rise in US yields. While the US/Japan yield spread suggests there is more downside scope for USD/JPY, risk premia suggest EUR/JPY may hold close to current levels. We favour the JPY upside, partly because there is more fundamental justification for the yield spread to be a driver of the currency, and partly because the JPY’s weakness is even more extreme than most believe due to the relatively low Japanese inflation data in the last few years. But JPY bears will not given up easily, and periods of calm will tend to see the JPY weaken due to carry considerations.