FX Daily Strategy: Asia, April 9th

US CPI and ECB meeting may conform to expectations

Ranges may therefore remain intact in EUR/USD and USD/JPY

CHF may see renewed weakness if there is no significant risk negative event on the weekend

Risk positive tone remains, but could be challenged in the second half of the week

CHF likely to remain the preferred funding currency

Tension between EUR/JPY and USD/JPY

AUD/CAD upside potential

The FX market retains a risk positive tone and there is nothing on the Tuesday calendar that looks likely to disturb it. However, Wednesday’s US CPI data and Thursday’s ECB meeting are the main potential stumbling blocks this week, and there may be some inclination to pare back long risk positions ahead of these events.

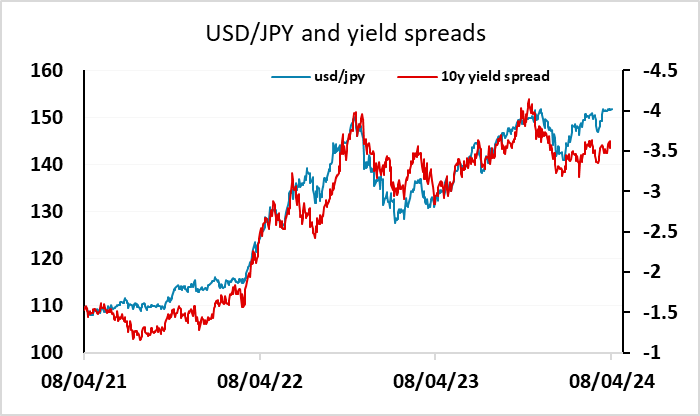

Monday saw a continuation of Friday’s risk recovery after the brief risk negative move on Thursday. EUR/CHF was back testing up towards last week’s high of 0.9850, while EUR/JPY was once again pushing up towards 165. However, it is clear that the 151.97 high in USD/JPY is proving a restrictive factor on JPY weakness, with concerns that the Japanese authorities may act if there is a significant break of that level. USD/JPY reached 151.94 on Monday, but edged lower from there, and as long as the 151.97 high holds, the CHF is likely to be the preferred funding currency.

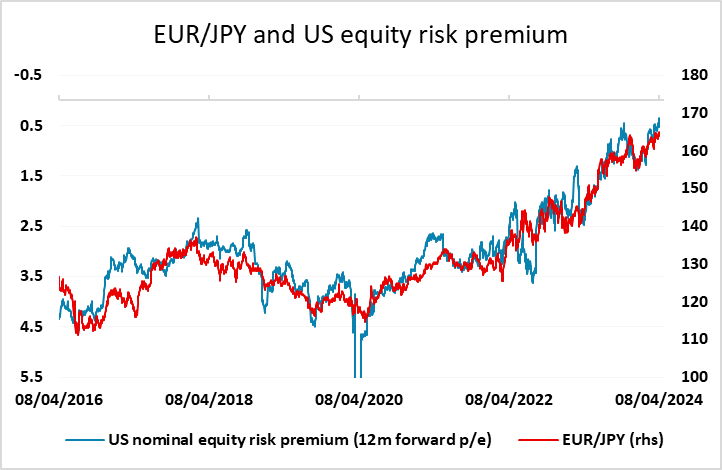

There is a tension building between the upside bias in EUR/JPY built on the correlation with declining US equity risk premia, the upside limits to USD/JPY due to the lack of significant yield spread widening and the opposition of the Japanese authorities, and the upside limits to EUR/USD due to the relatively strong US economic picture and the recent less dovish Fed tone. If EUR/JPY continues to rise, either USD/JPY or EUR/USD will also have to rise, but it’s hard to find justification for such gains based on current or expected yield spread moves. So it may be that the EUR/JPY relationship with equity risk premia has to break soon, either due to further BoJ policy tightening or FX intervention. The market might force the hand of the Japanese authorities with a more serious upside test in USD/JPY, especially if the US CPI data come out on the strong side of expectations. But for now expect USD/JPY to hold below 152 and EUR/JPY below 165.

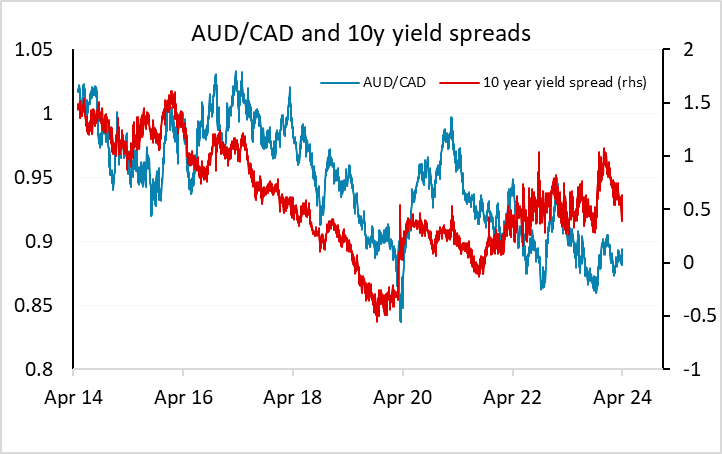

Tuesday’s calendar does include the Australian NAB business survey, which saw a modest recovery in February, and further gains might push the AUD to a renewed test of the recent highs. After Friday’s US and Canadian employment data. AUD/CAD may be a more attractive play than AUD/USD, with the Canadian economy seemingly underperforming. AUD/CAD also looks more out of lie with the historic correlation with yield spreads.