GBP, SEK flows: GBP firmer, SEK weaker after data

GBP gaining on better than expected GDP data, while soft Swedish CPI is pushing SEK lower. But neither move is likely to extend far.

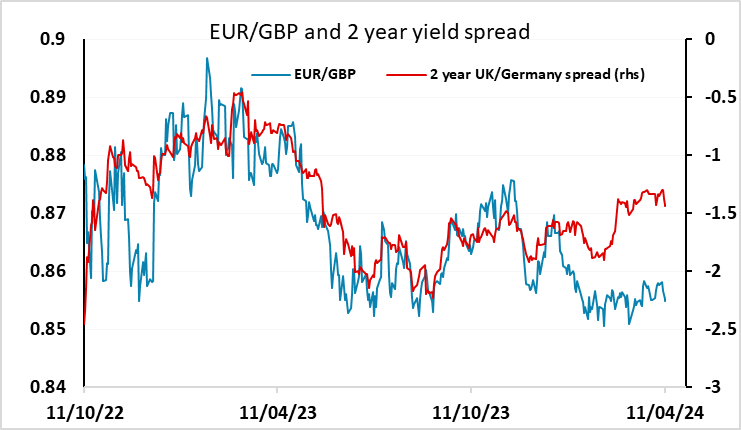

GBP has risen modestly after the UK February GDP data. February was in line with expectations at 0.1% m/m, but an upward revision to January has pushed the 3m/3m trend up to 0.2% - the highest since October last year. In truth it’s much too early to say that the UK economy is doing anything other than bumping along close to zero growth, and the Bank of England is in any case much more focused on wage and price developments than real output, but at the margin this makes an early rate cut slightly less likely. EUR/GBP has dipped below 0.8550 to its lowest this month, and has scope to around 0.8530. However, this is significant short term support, and next week’s labour market and CPI data is more likely to determine the next significant move.

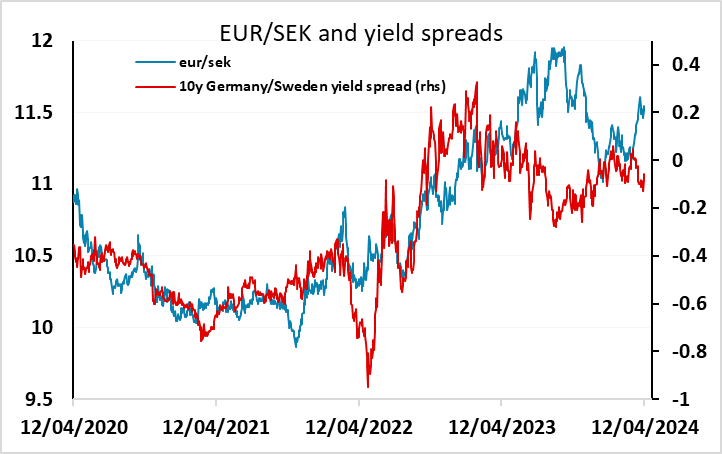

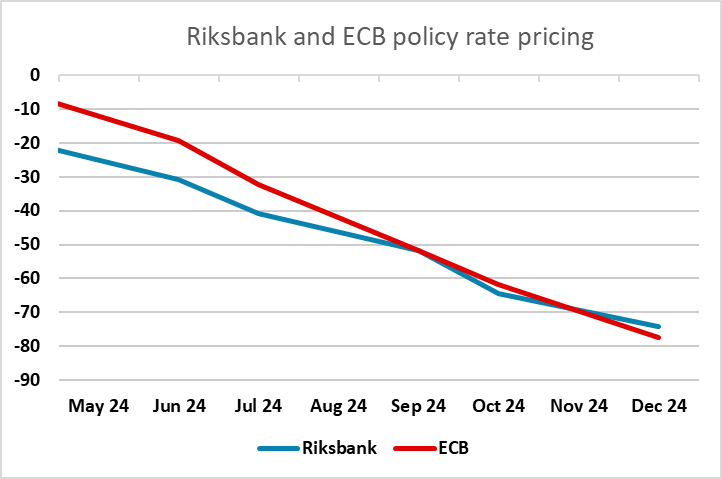

Swedish CPI data has come out significantly below market expectations, with the core rate falling to 2.2% from 2.5%, against market expectations of a rise to 2.6%. This will increase the market expectations of a Riksbank rate cut in May, and a cut is now fully priced for June, while the market pricing of the probability of an ECB June cut has been pared back after yesterday’s ECB meeting. We still doubt that he Riksbank will be cutting rates before the ECB, particularly if the SEK continues to trade soft, and this limits the potential upside for EUR/SEK. EUR/SEK has gained a few figures on the data, but should come up against significant resistance in the 11.55-58 area.